U.S. Debt Ceiling Negotiations Reach Basic Agreement; Will Dollar-Yen Uptrend Strengthen?【May 29, 2023】

Fundamental Analysis

- Nasdaq Market Sharply Higher; AI in the Spotlight; NVIDIA Surges

- US Debt Ceiling Negotiations Reach Basic Agreement, Risk-On Market as US Default is Averted

- The yen was down across the board in the forex markets, with the safe-haven yen selling off easily in the risk-on market.

- USD/JPY continues to rise for 3 days, aiming for JPY 142.25, a key resistance level in the past

- Eurodollar is in a downtrend and a band walk is in progress

USDJPY Technical Analysis

Weekend Analysis and Outlook for the Week (Daily)

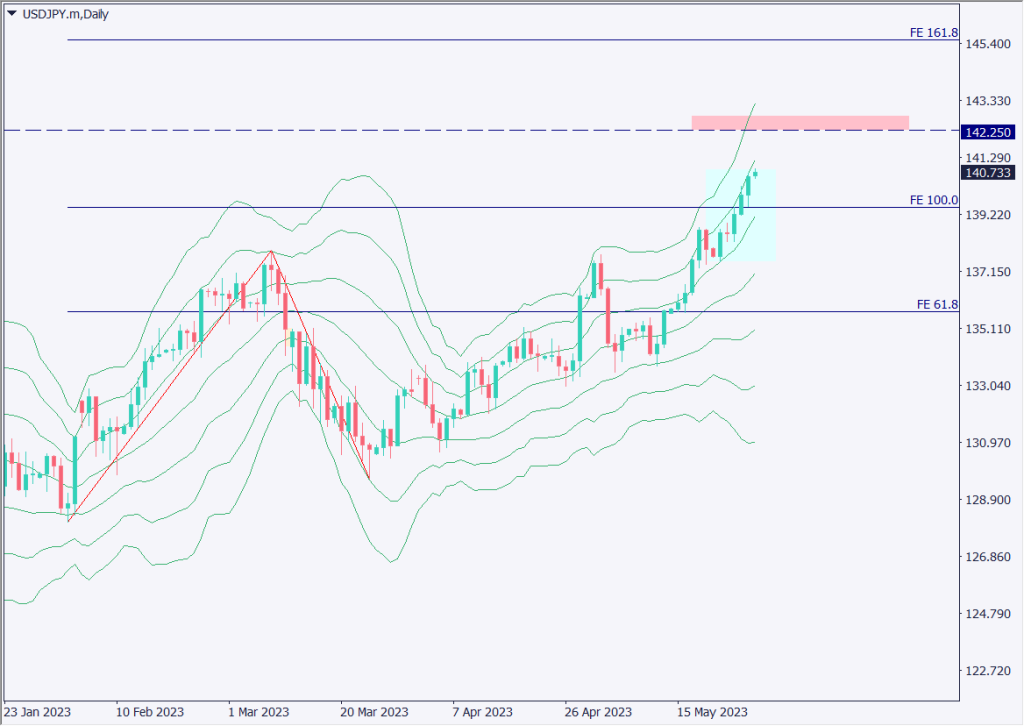

The dollar has been rising for three consecutive days and did not lose its upward momentum last Friday, with a push around JPY 139.50 and a quick close above JPY 140. A strong band walk is occurring on the daily basis.

The price area to be aware of this week is expected to be around JPY 142.250, as JPY 142.250 corresponds to the return high of last November. In addition, a large resistance zone exists in the vicinity of JPY 142.180 to JPY 142.30. We believe that an adjustment move this week could occur around the JPY 142.00 area.

| Weekly Range Forecast | JPY 138.90- JPY 143.88 |

| Main Resistance Zone | JPY 142.18 – JPY 142.30 |

| Daily Trend | Rising trend |

Day Trade Strategy (Hourly)

The day trading policy is to continue to push the market. Volatility is likely to be low today as the U.S. market is closed. Since the price surged from JPY 137 to JPY 140 last week, we need to be careful of an adjustment today.

Channel

An ascending channel can be drawn on the hourly time frame. Since the price is currently touching the upper limit of the channel band, it is possible that the price may fall back. However, the +1σ of the Bollinger Band is functioning as a support line.

RSI

The RSI value has reached 70 and is currently at 68. Since it has reached the general overbought level, it would not be surprising to see an adjustment.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

JPY 141.48 – Fibonacci Expansion (100%)

JPY 140.70 – Pivot point

Market Sentiment

USDJPY Sell: 76% Buy: 24%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. National Holiday – Stock Markets Closed | – |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.