USD/JPY falls as BOJ tripartite meeting takes place, falls below uptrend line【May 31, 2023】

Fundamental Analysis

- Tripartite Meeting (Ministry of Finance, Financial Services Agency, and Bank of Japan) to Discuss Yen Weakness

- USD/JPY declines on the alert of another currency intervention, with the first intervention level at 145 yen

- Uptrend line breaks out to the downside and the equilibrium cloud is broken below

- Next materials are the FOMC meeting on June 13-14 and the BOJ policy meeting on June 15-16

USDJPY Technical Analysis

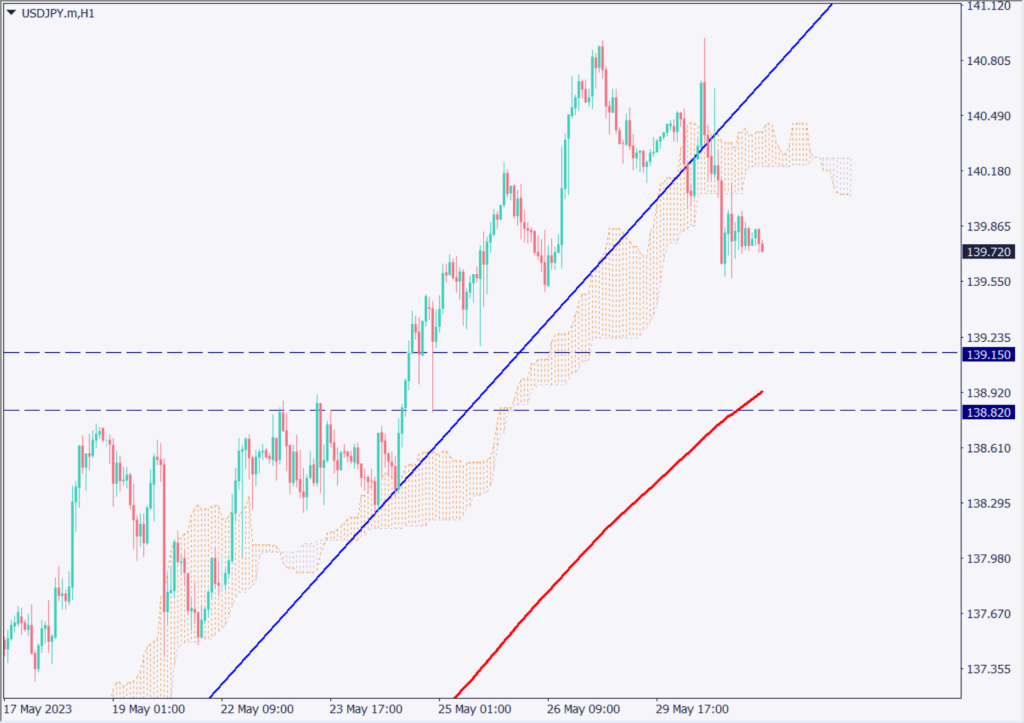

The dollar rebounded above the uptrend line and rose to 140.90 yen, but the news that a tripartite meeting was being held raised fears of currency intervention, and the yen fell all the way to 139.70 yen. The yen’s strength has been prevailing in the foreign exchange market, making the market vulnerable to a decline.

Day Trade Strategy (Hourly)

Day trade policy is to sell short term. The uptrend line has clearly broken below the uptrend line and a mid-trend triangle has been completed with lower volatility in the NY session. The area around 139.70 yen is consolidating, but a decline to 139.150 yen is possible if the yen strengthens more.

On the other hand, there are few factors to buy the yen, so a buyback is likely. We would like to trade cautiously, focusing on short-term trades.

Uptrend Line

Although the dollar had been rising steadily since May 11 and continued to move higher without breaking the uptrend line, it is understood that yesterday’s move ended the hourly uptrend. At least in the short term, the uptrend is over.

A short-term firmer market that occurs in the middle of the trend has formed, and stop losses are likely to be in place below 139.70 yen. We would like to consider the development of a decline toward the moving average.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

JPY 139.150 – Major monthly support zone

JPY 138.820 – Target by N-shaped pattern

Market Sentiment

USDJPY Sell: 73% Buy: 27%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Consumer Price Index | 10:30 |

| Canada Gross Domestic Product (GDP) | 21:30 |

| FOMC Member Speech | The next day at 1:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.