USD/JPY down for 3 days, wary of Fed director’s comments on rate hike halt and currency intervention?【June 1, 2023】

Fundamental Analysis

- U.S. Job Openings Beat Market Estimates, Dollar Strengthens Sharply for a Time

- After the release of the U.S. jobs report, Fed Governor comments on the suspension of interest rate hikes, causing a change in direction and a weakening of the dollar

- China’s economic indicators worsen, causing concern about the global economic outlook

- German CPI declines, signs of slowing inflation in the EU

- Dollar/Yen moves lower due to the upcoming trilateral meeting and the previous intervention level

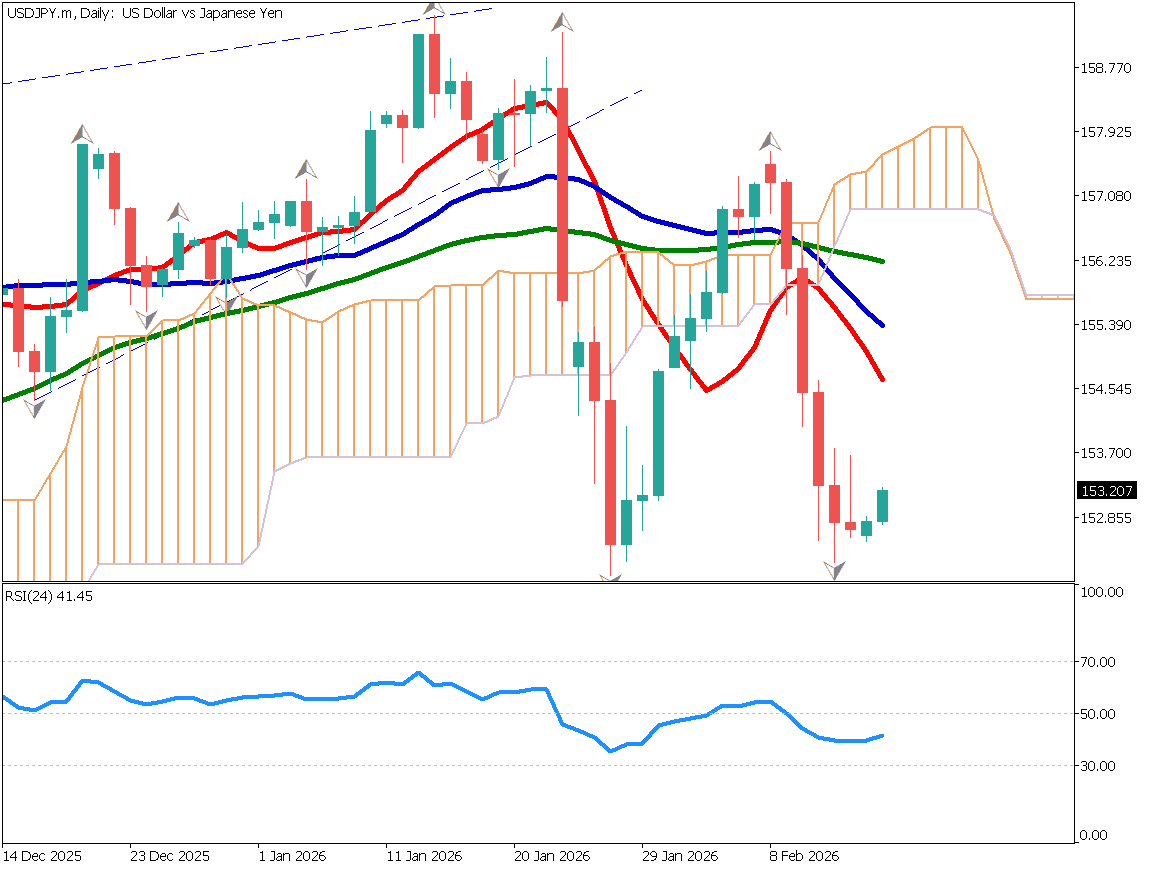

USDJPY Technical Analysis

The dollar dropped to the low 139.00s. On the hourly chart, the pair was forming a short-term range, but once fell to around 139.30 before Londoners entered the market. The pair was then bought back and surged to JPY 140.40 yen due to an economic indicator of an increase in the number of job openings in the U.S. However, the pair was back on a downtrend during the New York session due to the Fed member’s comment about suspending interest rate hikes.

The pair fell to around the 240 moving average at JPY 139.150.

Day Trade Strategy (Hourly)

Day trade policy is to return to the market. There is a major support zone around 138.90 yen, and short-covering could take the pair up to 139.50 yen. Also, the possibility of a rebound at the 240 moving average should be considered.

Fibonacci Levels

Drawing the Fibonacci Expansion with the May 30, 2023 high at JPY 140.930 yen as the starting point, we can confirm that the price corresponding to 61.8% is at JPY 139.40 and the price range corresponding to 100% is around JPY 138.80.

The Fibonacci Expansion is functioning at JPY 139.40, which is highly reliable. The next lower price target can be expected to be around JPY 138.80-138.82.

Moving Averages

The hourly moving average of 240 indicates a two-week moving average and is a moving average that is easily recognized in the medium to long term. It has been used in many rebounds and declines in the past and is reliable. Although the price temporarily plunged into the JPY 138 level due to the weak dollar, there are few materials to buy the JPY, so the price may rebound at the moving average line.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

JPY136.270: Major support zone (price range analysis by ATR)

JPY137.880: Pivot point on a monthly basis

Market Sentiment

USDJPY Sell: 65% Buy: 35%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Retail Sales | 10:30 |

| EU Consumer Price Index | 18:00 |

| US ADP Employment Report | 21:15 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.