Gold on the Rise, Will It Go for USD 2,000 Again?【July 12, 2023】

Fundamental Analysis

- U.S. CPI to be released today; dollar-yen may fall further depending on results

- U.S. stock indexes rise; Microsoft acquisition plan moves forward

- Oil price rises to $74 level, upside target is $77.2

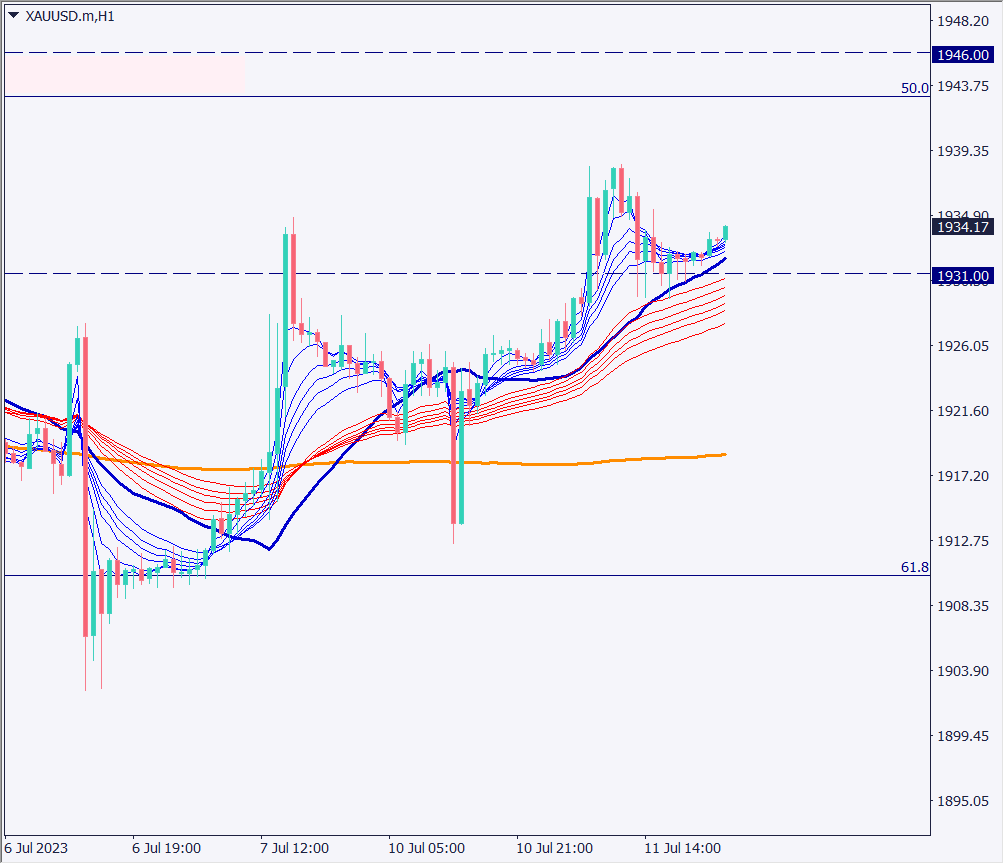

XAUUSD Technical Analysis

The overall market continues to trend lower against the dollar. Lower interest rates and a weaker dollar have helped gold to gain ground again. Although the price tested lower than USD 1900, the buying interest was strong and considered quite firm. The upward trend has strengthened from USD 1900, and the price has continued to move higher.

The near-term resistance zone is expected to be between USD 1951 and USD 1954.

Day Trade Strategy (Hourly)

Day trading policy is to buy on the push. Since the dollar selling trend is expected to continue, the day trade will have an upside view. Today’s pivot point is at $1931, which is one of the major support bands. At the end of yesterday’s New York session, the market was in a range around $1929-$1931, and there is a history of an upward breakout today morning.

Considering the above, buy on a push if the price falls to the USD 1931 area; stop loss if the price falls below $1929. Our price targets are USD 1938 for the short term and USD 1948 for the medium to long term.

Today there is the U.S. CPI, and volatility is likely to increase, so the plan is to close before that.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1948 USD – Major resistance level

1938 USD – The previous day’s high

1931 USD – Pivot Point

Market Sentiment

XAUUSD Sell: 74.1% Buy: 25.9%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| New Zealand Policy Rate | 11:00 |

| U.S. Consumer Price Index (CPI) | 21:30 |

| Canada Policy Rate | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.