USDJPY recovers to 146 JPY level, steady downside due to Japan-U.S. interest rate differential【August 22, 2023】

Fundamental Analysis

- U.S. stock indexes rebound for the first time in three days as tech stocks rise

- Markets Focus on Speech by Chairman Powell in Jackson Hole, U.S.

- Volatility may increase in the second half of the week; USD/JPY wary of upside risks

USDJPY Technical Analysis

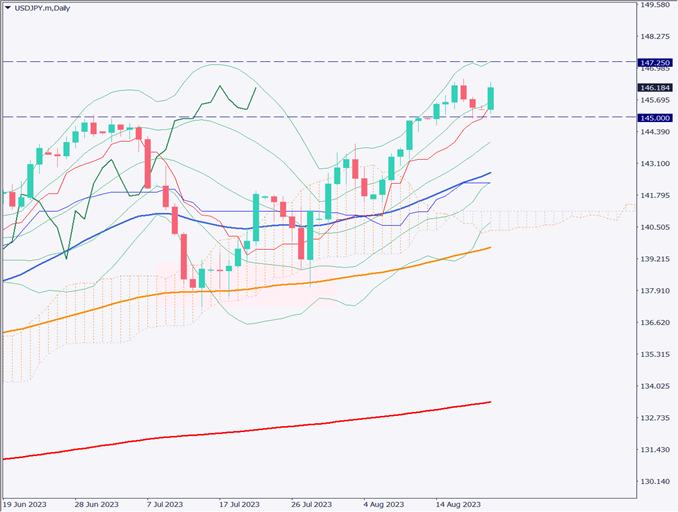

Analyzing the daily chart of the USDJPY, the Ichimoku Kinko Chart’s conversion line is functioning as a support line and has recovered to the 146-JPY level. In particular, if the pair is able to break above 146.550 JPY, it will renew the recent highs and increase the likelihood of further continuation of the uptrend.

A closer look at market sentiment shows an increase in sell positions compared to yesterday. There is a possibility that an upward test of the price may occur in order to target stop-losses. Meanwhile, the possibility of currency intervention by the BOJ continues to warrant caution.

Day Trading Strategy (Hourly)

Analysis of the hourly chart of the USDJPY confirms that the gradual uptrend is continuing. Although some profit-taking selling can be seen at times, the overall downward trend is firm and difficult to fall. The ongoing interest rate differential between Japan and the U.S. is having an impact, and this interest rate differential is supporting the USDJPY.

Whether the moving average and the uptrend line can be maintained will be important in determining the direction of the USDJPY on the hourly time frame.

The day-trade strategy is to buy on the push. The entry price is set at 145.80 JPY with a profit target at 146.80 JPY. Meanwhile, the stop loss is set at 145.50 JPY. The strategy is to use a short-term decline as a buying opportunity against the backdrop of the continuing uptrend.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

146.80 JPY – Resistance line

145.00 JPY – Round number

Market Sentiment

USDJPY Sell: 74% Buy: 26%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Number of existing home sales in the U.S. | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.