USDJPY is on an upward trend and continues to rise to new highs【August 28, 2023】

Fundamental Analysis

- Fed Chair Jerome Powell Cautious About Additional Rate Hikes; U.S. Stock Indexes Rise

- USD/JPY hits highs, moves into the upper ¥146 range

- ECB President Lagarde stresses continuation of high interest rate policy

USDJPY Technical Analysis

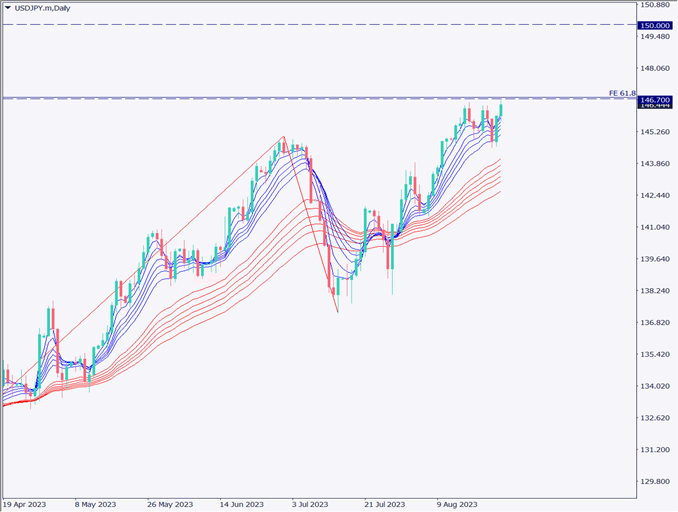

Analyze the daily chart of the USD/JPY exchange rate. RFB Chairman Jerome Powell emphasized the “data-dependent” stance on additional rate hikes. There was no mention of the timing of a rate cut, indicating that the risk of events in the direction of a stronger yen has passed once and for all. On the technical front, the uptrend is likely to continue as the GMMA is forming a shape indicating trend strength.

Also, on the daily chart, 146.80 yen corresponds to 61.8% of the Fibonacci retracement. USD/JPY is likely to continue its uptrend, and a break above 146.80 yen is expected for further upside.

Day Trading Strategy (Hourly)

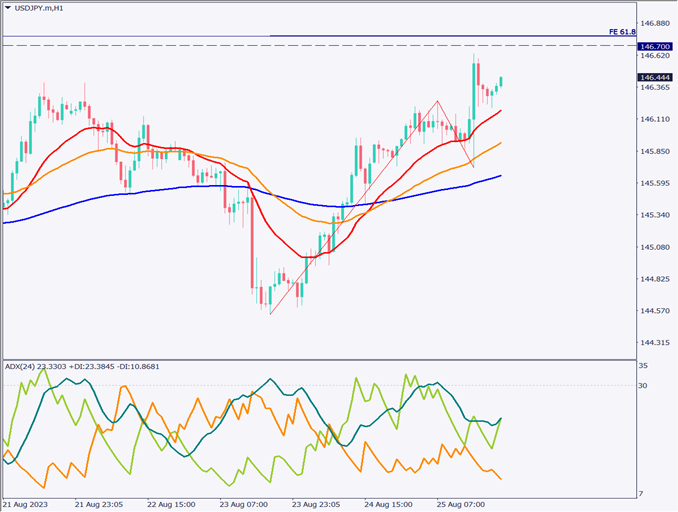

Analysis of the hourly chart of the dollar-yen market shows that the 10, 24, and 72 moving averages are in perfect order positions, all pointing upward. This suggests a stable uptrend. Furthermore, the +DI of ADX is also upward, with ADX itself at 23.

The strategy is to “buy on the push”. Entry point is targeted at 146.20 yen (10 moving averages) and settlement at 147.45 yen (100% of Fibonacci Expansion). The stop loss is to be set at 145.70 yen (the point where the recent low was broken).

Support and Resistance Lines

The resistance line to be considered in the future is as follows

146.56 JPY – Major resistance line

145.50 JPY – Pivot point

Market Sentiment

USDJPY Sell: 75% Buy: 25%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Retail Sales | 10:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.