The US Federal Reserve announces no change in interest rates but suggests additional hikes; USD/JPY updates its high for the year【September 21, 2023】

Fundamental Analysis

- The US Federal Reserve announced no change in interest rates; Chairman Powell hints at the possibility of additional hikes within the year.

- Expectations of a rate cut next year recede in view of future interest rate outlooks; “higher for longer” interest rate policy.

- UK Consumer Price Index unexpectedly drops; focus on today’s UK interest rate announcement.

USDJPY Technical Analysis

Analysis of the daily chart of the USD/JPY. Hints of additional rate hikes are given, and the upward trend continues. Currently aiming for the upper limit line of the rising wedge, with 148.75 yen as the short-term upside target.

The 24-day, 90-day, and 240-day moving averages are all pointing upward, indicating a strong upward trend. In the medium to long term, there’s an aim to surpass the 2022 high of 151.95 yen. In the current market environment, it seems good to skillfully utilize the upward trend.

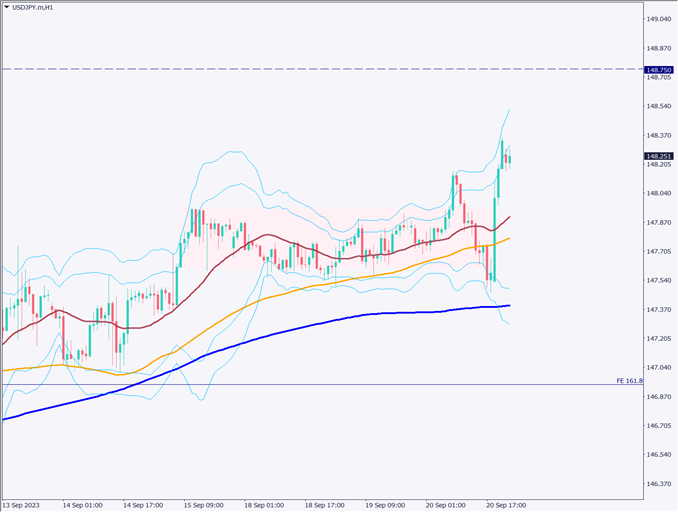

Day Trading Strategy (Hourly)

Analysis of the 1-hour chart of the USD/JPY. After the FOMC’s decision to hold interest rates steady, it temporarily broke below 147.50 yen. However, with hints of additional rate hikes and fading rate cut speculation, buying of the dollar has strengthened again. The anticipated long-term interest rate gap between Japan and the US is a major fundamental factor boosting the rise of the USD/JPY. In the short term, a move towards 148.75 yen is expected.

Trading policy is to buy. Entry is at market price, with a stop at 147.85 yen and a target price of 148.75 yen.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

148.75 yen – Main resistance line

147.95 yen – Range upper limit

Market Sentiment

USDJPY Sell: 68% Buy: 32%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK Interest Rate Announcement | 20:00 |

| Philadelphia Fed Manufacturing Index | 21:30 |

| Number of Used House Sales | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.