Gold faces downward pressure as the impact of the Federal Reserve’s high-interest-rate policy spreads【September 22, 2023】

Fundamental Analysis

- The Bank of England decides to keep its policy rate unchanged; GBP/USD falls below the 240-day moving average.

- Ahead of the Bank of Japan’s policy decision, USD/JPY declines. Will USD/JPY break the rising wedge?

- The Bank of Japan’s policy decision meeting is scheduled; be cautious of volatility in USD/JPY and cross-yen pairs.

XAUUSD Technical Analysis

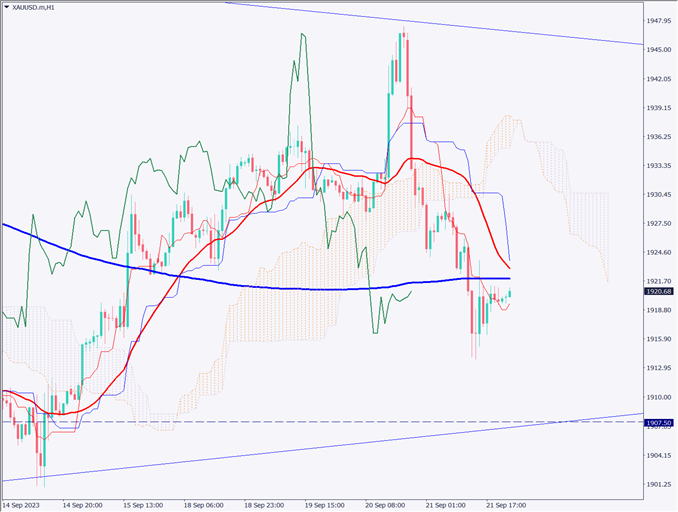

Analysis of the daily chart for gold. The continuation of the Federal Reserve’s high-interest-rate policy impacts, putting downward pressure on gold. It can’t break through the Ichimoku cloud, with the 24-day, 240-day moving averages, base line, and conversion line all hovering around the USD 1925 level. This level is acting as a strong resistance.

If it breaks below the cloud, a drop to around USD 1906 is conceivable. In the recent market, the USD 1925 level will determine short-term direction. A break above signals bullishness, while a break below confirms bearishness. It’s essential to closely monitor the resistance at USD 1925 and focus on its movement.

Day Trading Strategy (Hourly)

Analysis of the 1-hour chart for gold. After breaking below the 240-day moving average, a temporary recovery (return move) can be observed. Attention is centered on the potential dead cross between the 24-day and 240-day moving averages. Though the Ichimoku conversion line is above, the dollar’s strength can be observed, leading to the assessment that the downward pressure remains high for today.

Day trade policy suggests a sell entry. Entry point at USD 1921, stop at USD 1925, and target for settlement at USD 1908. If a dead cross is confirmed or if the Ichimoku conversion line signals a drop, consider bolstering the sell position.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1936 USD – Ichimoku cloud upper limit

1907 USD – Support line

1900 USD – Round number

Market Sentiment

XAUUSD Sell: 33% Buy: 67%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Japan Consumer Price Index | 8:30 |

| Bank of Japan Monetary Policy Announcement | 12:00 |

| Press conference by the Governor of the Bank of Japan | 15:30 |

| US Service Sector Purchasing Managers’ Index | 22:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.