USD/JPY Rises as Powell’s Comments Drive Up US 10-Year Treasury Yields【November 10, 2023】

Fundamental Analysis

- Fed Chairman Powell has stated that further rate hikes could be considered depending on circumstances.

- USD/JPY has risen to the mid-151 JPY level without falling, aiming for a move towards 151.70 JPY.

- The global economy is slowing, with US unemployment insurance claims increasing for seven consecutive weeks.

USDJPY Technical Analysis

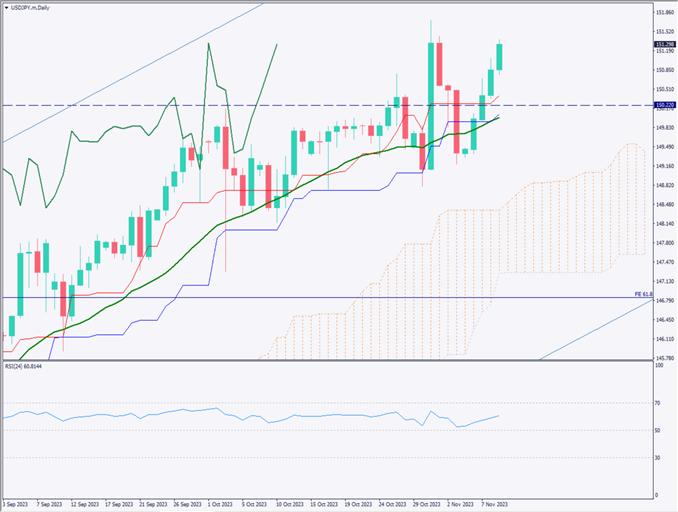

Analyzing the daily chart for USD/JPY. The pair recorded five consecutive days of gains, influenced by Chairman Powell’s comments on additional rate hikes, creating a market environment favorable to buying USD. Consequently, USD/JPY is showing movement to break through the recent high of 151.77 JPY.

Exceeding this high, the next target is 152.77 JPY, which corresponds to the 100% point of the Fibonacci expansion. The upward trend continues, and further rises towards the upper limit of the rising channel are conceivable. However, considering the risk of currency intervention, a short-term trading strategy would be advisable.

Day Trading Strategy (1-Hour Chart)

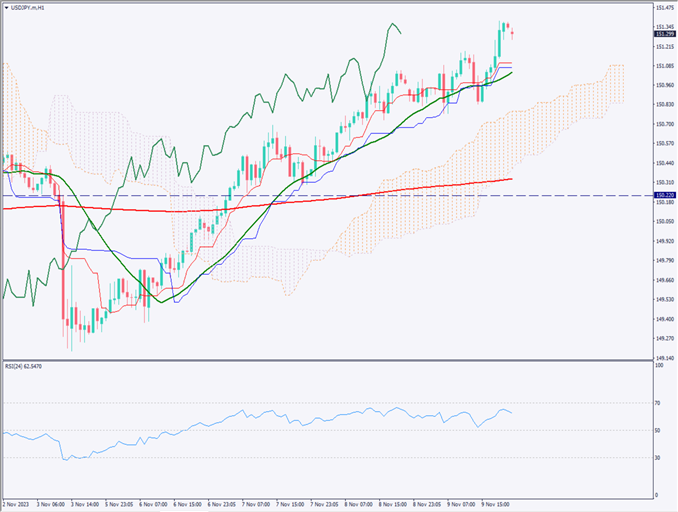

Analyzing the 1-hour chart for USD/JPY. After Chairman Powell’s speech, there was a rise beyond the mid-151 JPY level, and the lower support is being reinforced. Despite concerns about currency intervention, fundamentals continue to support an upward trend. The Ichimoku cloud and the 24-hour moving average indicate an upward trend, with the 240-hour moving average also gaining momentum.

As a trading strategy, it’s recommended to buy on dips at 151.00 JPY, with a target of 151.70 JPY and a stop-loss line at 150.80 JPY. In the current market conditions, it’s worth focusing on the continuation of the upward trend and trading on pullbacks.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

151.770 JPY: Recent high

150.220 JPY: Fibonacci level

Market Sentiment

USDJPY Sell: 79% Buy: 21%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK GDP | 16:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.