Euro-Dollar Sees Modest Rise as Dollar Selling Strengthens with Lower U.S. Inflation Expectations【November 14, 2023】

Fundamental Analysis

- The USD/JPY briefly rose to 151.90, with a new high seemingly imminent.

- The Euro-Dollar modestly increased; surpassing 1.0750 USD could continue the upward trend.

- U.S. NY Fed Inflation Expectations decrease, leading to a shift towards selling dollars.

EURUSD Technical Analysis

Analyzing the Euro-Dollar daily chart. After confirming strong support at 1.05 USD, prices rebounded and continued to rise. The Ichimoku Kinko Hyo conversion line acts as a support line, sustaining the upward trend, with breaking through the cloud being a critical point.

The round number of 1.070 USD is a recent resistance line, but surpassing this level could make the 240-day moving average at 1.075 USD and 1.08 USD the next targets.

Furthermore, the chart suggests an ‘N’ shape, and if this pattern completes, 1.0895 USD could potentially be the final target price. The RSI rebounding at 50 indicates sustained buying pressure, suggesting a continuation of the upward trend.

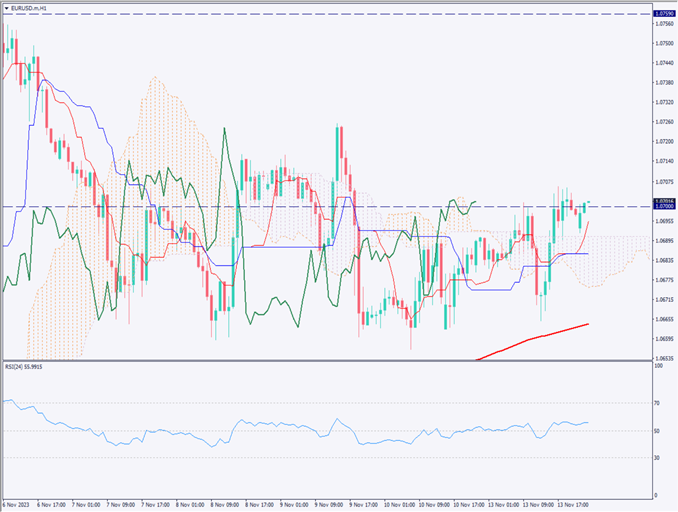

Day Trading Strategy (1-Hour Chart)

Analyzing the Euro-Dollar 1-hour chart. Currently, the range market continues, with the upper limit forming around 1.0715 USD. Ichimoku Kinko Hyo signals suggest an upward trend, with 1.07 USD being a key point, coinciding with the 10-day moving average on the daily chart. Dollar selling is accelerating due to downward revisions in U.S. inflation expectations.

In day trading, consider market orders for buying entries, with settlement targets at 1.0732 USD and then 1.0759 USD.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1.0759 USD – a major resistance line

1.070 USD – round number

Market Sentiment

EURUSD Sell: 62% Buy: 38%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK Employment Statistics | 16:00 |

| EU Gross Domestic Product | 19:00 |

| U.S. Consumer Price Index | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.