Euro-Dollar Continues to Fall for Second Day, U.S. Inflation Expectations Rise for First Time in Seven Months【November 23, 2023】

Fundamental Analysis

- Mr. Altman Returns to OpenAI, Board Refreshment Resolves Situation

- USD/JPY Recovers to 149.75, Volatile Movements Continue Ahead of Thanksgiving

- Japanese and U.S. Stock Markets Closed, Caution Advised Due to Exchange Rate Fluctuations in Thin Trading

EURUSD Technical Analysis

Analyzing the daily chart of the Euro-Dollar rate. It has fallen for two consecutive days, with the recent high being 1.0965 USD, but the candlestick formed at that high was a bearish candlestick, a “high bearish line”. A pullback is seen at 161.8% of the Fibonacci expansion, with the 1.0950 USD resistance playing a role.

The RSI is hovering around 61, and GMMA analysis shows a gap between the long-term and short-term GMMA, suggesting some adjustment but the possibility of forming a dip. The next downside target is around the previous low of 1.0835 USD.

Day Trading Strategy (1-Hour Chart)

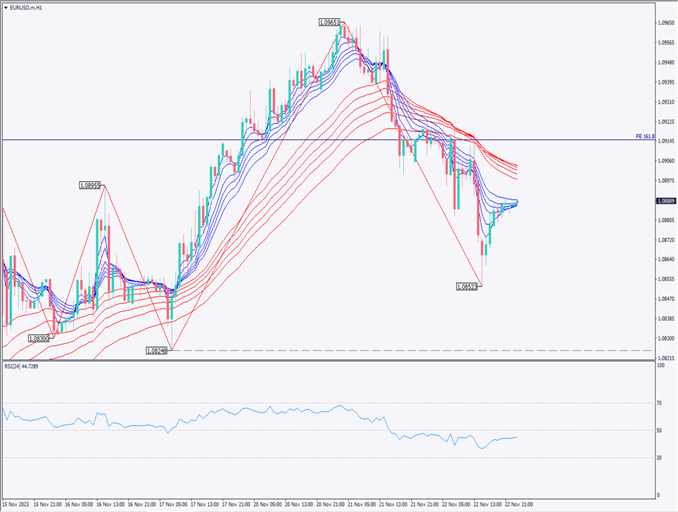

Analyzing the 1-hour chart of the Euro-Dollar rate. Currently, the downward trend continues, with rising U.S. bond yields influencing the dollar’s strength. GMMA analysis shows the formation of a recovery high. The RSI is 44, maintaining a downward trend.

Today, with Thanksgiving approaching and the Japanese and U.S. stock markets closed, the foreign exchange market will be thinly traded, possibly leading to extreme volatility. Therefore, the day trading strategy should focus on scalping with short-term trades. Specific entries and stop-loss settings are not set, and trading should be in line with market movements.

Support and Resistance Lines

Upcoming resistance lines to consider:

1.0965 USD – Recent high on the daily chart

Market Sentiment

EURUSD – Sell: 74%, Buy: 26%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. Stock Market Closed | – |

| Japanese Stock Market Closed | – |

| EU Manufacturing Purchasing Managers’ Index | 18:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.