USD/JPY Consolidates, Volatility Decreases in Forex Market Due to US Thanksgiving【November 24, 2023】

Fundamental Analysis

- Due to US Thanksgiving, the forex market sees thin trading and decreased volatility

- USD/JPY is consolidating around 149.50 JPY, with uncertainty over whether it will rise back to the 150 JPY level

- ECB minutes indicate a potential for further rate hikes, leading to a rise in EUR/USD

USDJPY Technical Analysis

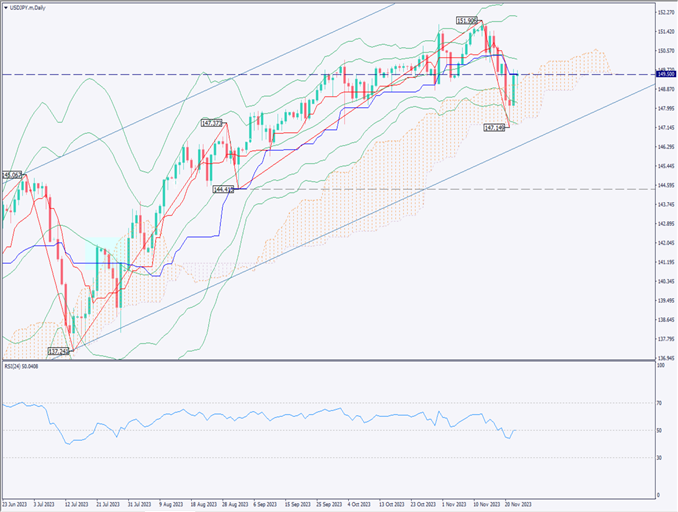

Analyzing the daily chart of USD/JPY. After touching the -3σ line of the Bollinger Bands, it recovered to around 149.50 JPY due to short covering.

Currently, the price action is sluggish around 149.50 JPY, where the Ichimoku Kinko Hyo’s baseline and conversion line are located. There’s a possibility of a rebound from the Ichimoku cloud, but the outlook remains unclear due to the US market closure for Thanksgiving.

According to the Ichimoku Kinko Hyo, there’s a possibility that the market balance might shift, turning an uptrend into a downtrend. Key points to watch are whether the market will fall below the recent low of 147.15 JPY or rise above 149.50 JPY towards 150 JPY.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of USD/JPY. Yesterday, it failed to reach the recent high of 149.75 JPY, with 149.69 JPY being the high. The current focus is on the high of 149.990 JPY, surpassing which might signal an uptrend. The Fibonacci retracement is noted around 50%, with consolidation currently observed at this level.

If it rises today, a pullback at 61.8% at 150.08 JPY is possible. Conversely, a clear fall below 148.88 JPY might lead to a greater downward pressure. The current market is in a holiday mood with reduced volatility, making the situation challenging, but slightly bearish.

The day trading approach is to sell on the rally, with an entry at 150.08 JPY, a target at 149.50 JPY, and a stop at 150.30 JPY.

Support and Resistance Lines

Upcoming resistance lines to consider:

149.98 JPY – Recent pivotal high

149.50 JPY – Major price zone

Market Sentiment

USDJPY – Sell: 58%, Buy: 42%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Japan Nationwide Core CPI | 8:30 |

| Germany Gross Domestic Product (GDP) | 16:00 |

| US Service Sector Purchasing Managers Index | 23:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.