USD/JPY Rises to the 148 JPY Range, Heavy Resistance Continues the Downtrend【December 1, 2023】

Fundamental Analysis

- US economic indicators broadly decline, signaling economic slowdown and leading to expectations of a rate cut

- Eurodollar plummets as EU inflation rates drop, possibly a contributing factor

- OPEC+ meeting agrees on voluntary production cuts but fails to meet market expectations

USDJPY Technical Analysis

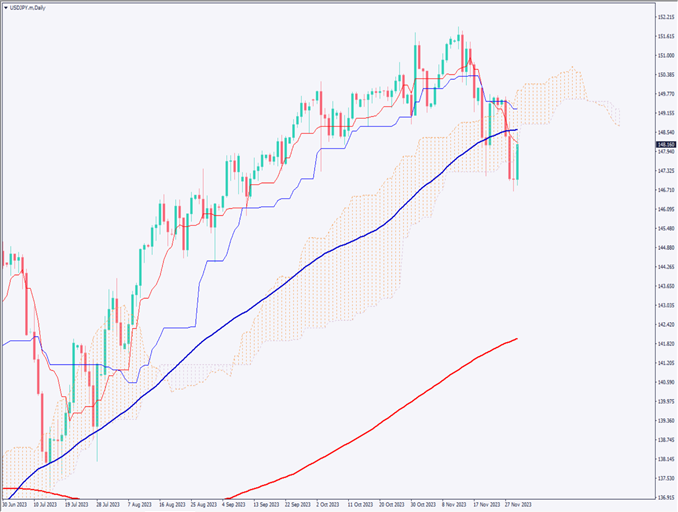

Analysis of the daily chart for USD/JPY. Though it recovered to the early 148 JPY range, it failed to surpass the Ichimoku Kinko Hyo Conversion Line, highlighting a clear downtrend. A break below the Ichimoku cloud has also been confirmed, alongside broad declines in US economic indicators and signs of economic slowdown. Expectations of a rate cut are driving stock gains, but this enthusiasm is expected to cool.

USD/JPY is likely to strengthen its downtrend, facing a significant turning point. Close attention to fundamental changes is required.

Day Trading Strategy (1-Hour Chart)

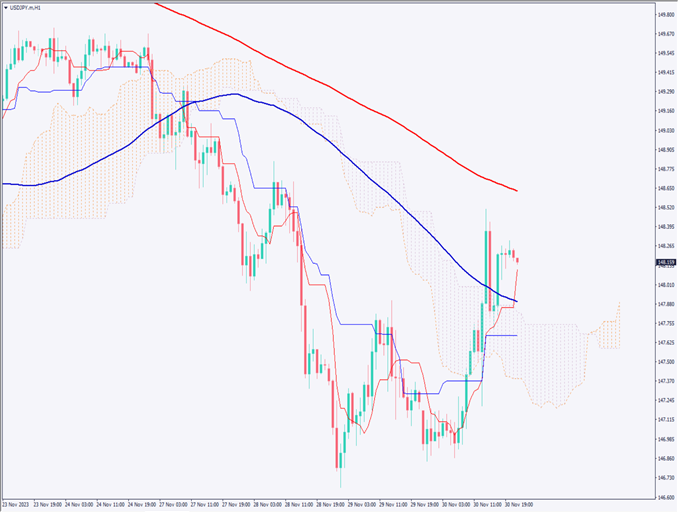

Analysis of the 1-hour chart for USD/JPY. A double bottom pattern has emerged, and the completion of this pattern was confirmed yesterday with a breakout above the neckline. The 90 moving average has also been breached, indicating some adjustment. If the downtrend continues in December, a drop to at least 144.79 JPY is possible.

However, considering the adjustment movements, one should be cautious with short-term selling. The day trading strategy should focus on selling on rallies, with an entry at 148.55 JPY, target at 146.85 JPY, and stop at 148.85 JPY.

Support and Resistance Lines

Upcoming resistance lines to consider:

148.65 JPY – 90-day moving average

148.21 JPY – Daily Ichimoku Kinko Hyo Conversion Line

146.67 JPY – Recent low

Market Sentiment

USDJPY Sell: 53%, Buy: 47%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Canadian Employment Data | 22:30 |

| US ISM Manufacturing PMI | Midnight |

| Speech by Fed Chairman Powell | 1:00 AM the following day |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.