Gold Reaches USD 2130 Temporarily, Surpassing All-Time Highs Instantly【December 4, 2023】

Fundamental Analysis

- The market is notable for anticipating a decrease in U.S. interest rates.

- The Federal Reserve Chairman acknowledges the suppression of inflation but cautions against preemptive moves.

- At the beginning of the week, gold rose to USD 2130, increasing by USD 50 in just 20 minutes.

XAUUSD Technical Analysis

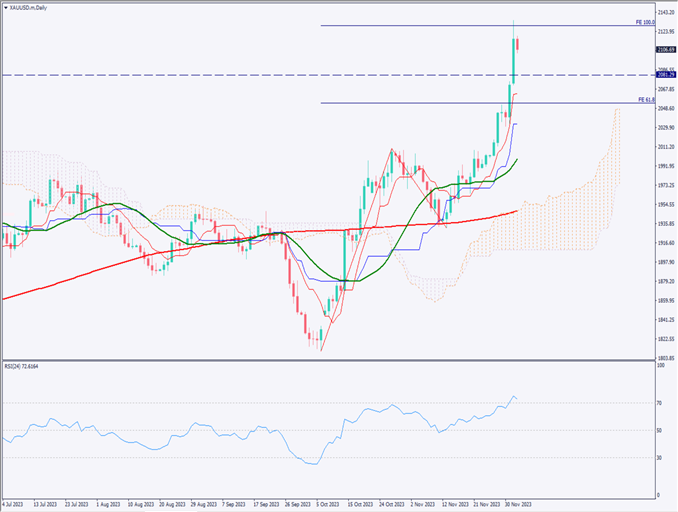

Analyzing the daily chart of the gold market. At the start of the week, factors such as the Israeli military’s incursion into southern Gaza, weakening dollar, and expectations of lower U.S. interest rates combined, resulting in a rapid surge of USD 50 within 20 minutes. Consequently, gold reached USD 2130, corresponding to 100% of the expansion.

However, with the RSI momentarily reaching 92, there’s a high likelihood of increased selling due to overheating. Given the quick achievement of the target price, a short-term bearish perspective seems prudent. The extent of the potential decline remains uncertain, necessitating cautious observation in this new price range.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the gold market. Given the attainment of all-time highs, the start of profit-taking selling is anticipated. Current price trends are influenced by the escalating Middle East situation and a weaker dollar, though specific factors remain unclear.

Consequently, an adjustment period with potential significant declines is expected. In this case, the area around the 24-moving average line may present a good buying opportunity, especially if the price falls to around USD 2060, creating a short-term buying chance.

The day trading approach involves entering at USD 2060, settling at USD 2080, and setting a stop at USD 2055.

Support and Resistance Lines

Upcoming resistance lines to consider:

2130 USD – 100% of the expansion

2091 USD – 24-day moving average

Market Sentiment

XAUUSD Sell: 75%, Buy: 25%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Retail Sales | 9:30 |

| Speech by President Lagarde | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.