USD/JPY Forms a Range Market, U.S. ADP Employment Report Falls Short of Expectations【December 7, 2023】

Fundamental Analysis

- The U.S. ADP employment report falls short of market expectations, focus on Friday’s government employment statistics

- Crude oil breaks below the key support line of 70 dollars, trading in the 69 dollar range

- USD/JPY forms a range market, attention on whether it breaks below 146.25 JPY

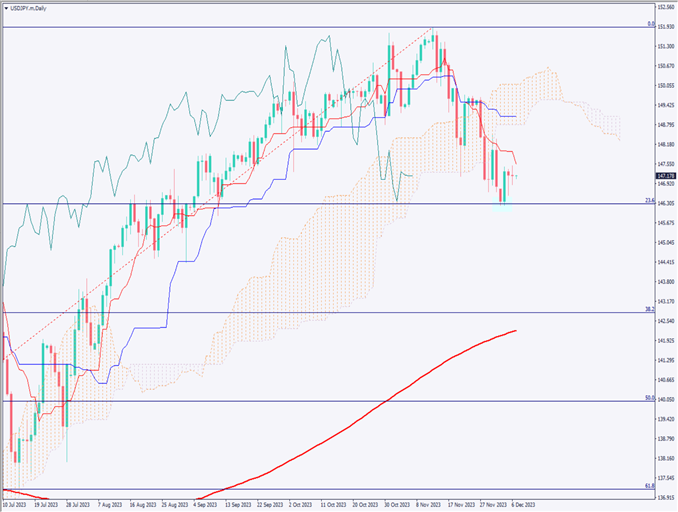

USDJPY Technical Analysis

Analyzing the daily chart of the USD/JPY market. It rebounded from the 23.6% Fibonacci retracement, currently in a consolidation phase. The Ichimoku Kinko Hyo conversion line acts as a resistance line, making it difficult to rise.

The U.S. ADP employment report fell short of market expectations, suggesting a relaxation in the labor market. This supports expectations for a U.S. rate cut, and depending on the outcome of Friday’s employment statistics, there could be a significant drop. Today’s movement is watchful, likely maintaining a range market.

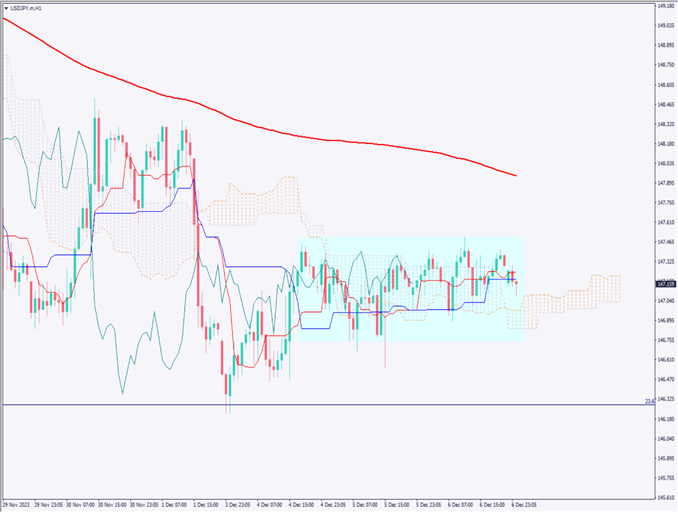

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the USD/JPY market. The 240 moving average maintains a downward direction, and currently, USD/JPY is forming a range market between 146.73-147.50 JPY. The focus is on tomorrow’s U.S. employment statistics, and with crude oil continuing to break key support lines, a market environment conducive to a stronger JPY is forming. Considering the current market environment, the perspective is towards selling.

As a day trading strategy, consider selling gradually near the upper limit of the range at 147.50 JPY, setting the settlement target at 146.75 JPY, and the stop at 147.75 JPY.

Support and Resistance Lines

Upcoming resistance lines to consider:

146.25 JPY – Recent low

Market Sentiment

USDJPY Sell: 51%, Buy: 49%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| EU Zone GDP | 19:00 |

| U.S. Unemployment Insurance Claims | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.