USD/JPY Plummets to 141 JPY, Anticipation of BoJ Policy Revision Precedes【December 8, 2023】

Fundamental Analysis

- Governor of the Bank of Japan comments on increasing challenges towards the end of the year and into next year

- Rapid appreciation of the yen due to growing expectations among foreign investors for BoJ policy revision

- USD/JPY plummets to 141 JPY, a level not seen in about five months, with attention on U.S. employment statistics

USDJPY Technical Analysis

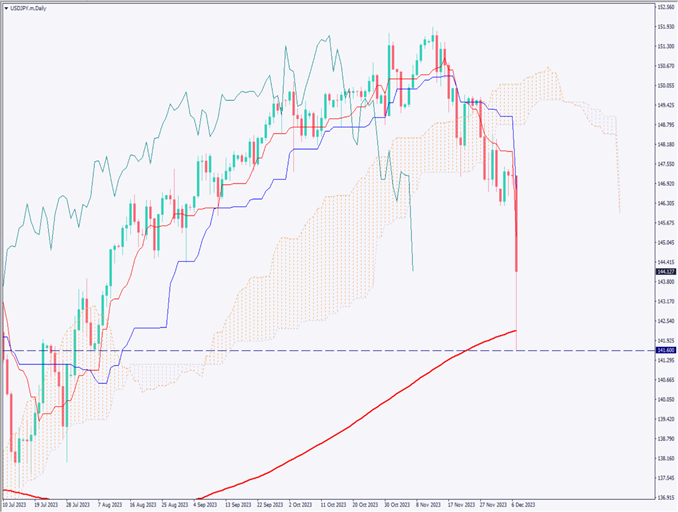

Analyzing the daily chart of the USD/JPY. The pair has plummeted to the 141 JPY level, subsequently touching and rebounding off the 240-day moving average. At the time of writing, it is trading around 144 JPY. When drawing a Fibonacci retracement, an adjustment movement can be seen up to near 23.6%.

Today, the release of U.S. employment statistics is scheduled, and due to the significant fluctuation last night, small changes are highly likely during the day. Market sentiment analysis shows 79% are in buying positions, suggesting that adjustment movements may continue for some time.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the USD/JPY. After breaking out of a range market, it plummeted to the 141 JPY level. This sharp decline is primarily due to the anticipation of a BoJ policy revision. Although the implementation of policy revision is unclear, Japan’s GDP and today’s U.S. employment statistics will be in focus.

Resistance line is at the Ichimoku Kinko Hyo base line, near 146.20 JPY. Despite the expected adjustments during the day, a wait-and-see market is anticipated before the U.S. employment statistics. If the U.S. employment data falls short of market expectations, further appreciation of the yen could occur due to expectations of a U.S. rate cut and a Japanese rate hike.

Day trading strategy recommends selling at rebound highs, with an entry at 146.50 JPY, take profit at 144.20 JPY, and stop loss at 147.50 JPY.

Support and Resistance Lines

Upcoming resistance lines to consider:

146.20 JPY – Near the lower end of the range

141.60 JPY – Yesterday’s recent low

Market Sentiment

USDJPY Sell: 21%, Buy: 79%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Japan GDP | 8:50 |

| German Consumer Price Index | 16:00 |

| U.S. Employment Statistics | 22:30 |

| U.S. University of Michigan Consumer Sentiment Index | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.