USD/JPY Continues to Rise for the Second Day, Focus on Today’s U.S. Consumer Price Index【December 12, 2023】

Fundamental Analysis

- USD/JPY continues its two-day rise, with revisions in the interpretation of the Bank of Japan Governor’s statements

- USD/JPY rose to around 146.50 JPY, then fell back to 145.70 JPY

- Focus on today’s U.S. CPI and this week’s U.S. FOMC

USDJPY Technical Analysis

Analyzing the daily chart of the USD/JPY pair, a two-day consecutive rise is observed. However, a cautious market stance may spread ahead of the U.S. CPI and FOMC. Drawing a Fibonacci retracement connecting the high of 151.90 JPY and the recent low of 141.60 JPY, the halfway point at 146.71 JPY becomes the immediate target.

A rebound from the 240-day moving average and some adjustments suggest a high likelihood of a range-bound market ahead. The RSI is at 42, and if it reaches 50 near 146.70 JPY, there is a possibility of a pullback. Tonight’s U.S. CPI is worth attention.

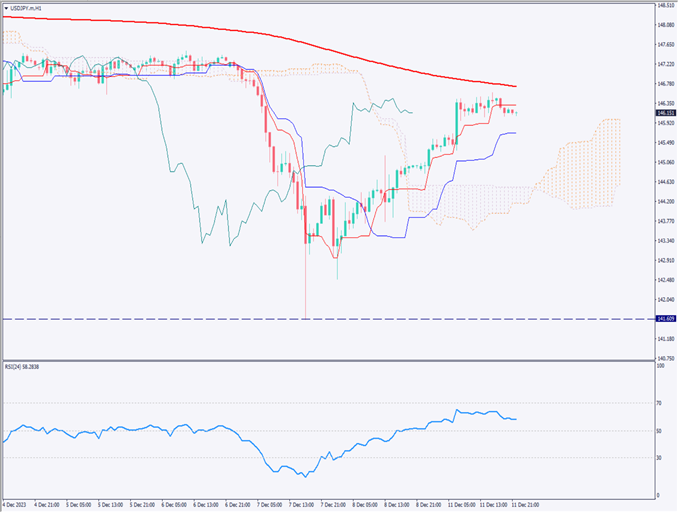

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the USD/JPY pair, it has almost recovered its losses, with the focus now on breaking above the 240 moving average. Whether it breaks through this line is the current focal point. The 1-hour RSI is at 52, showing a slight downward trend after marking a recovery high.

The market seems to be in a wait-and-see mode, so a short-selling opportunity may arise if the RSI drops below 50. Additionally, if there is a move above the recent high of 146.58 JPY, it would be prudent to consider a stop-loss at that point. Attention is also needed on the movement around the Ichimoku Kinko Hyo’s standard line at 145.69 JPY.

Support and Resistance Lines

Upcoming resistance lines to consider:

146.58 JPY – Recent high on the 1-hour chart

145.69 – Ichimoku Kinko Hyo’s standard line

Market Sentiment

USDJPY Sell: 59%, Buy: 44%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK Employment Statistics | 16:00 |

| U.S. Core Consumer Price Index | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.