Euro-Dollar Outlook Remains Strong, Focus on Upcoming Early Morning FOMC Meeting【December 13, 2023】

Fundamental Analysis

- US CPI Surpasses Market Expectations, Rate Cut Expected in May Next Year

- Early Morning FOMC Meeting Tomorrow, Chair Powell Could Pour Cold Water on Rate Cut Hopes

- USD/JPY Temporarily Drops to 144 Yen but Recovers, Trading in the Early 145s

EURUSD Technical Analysis

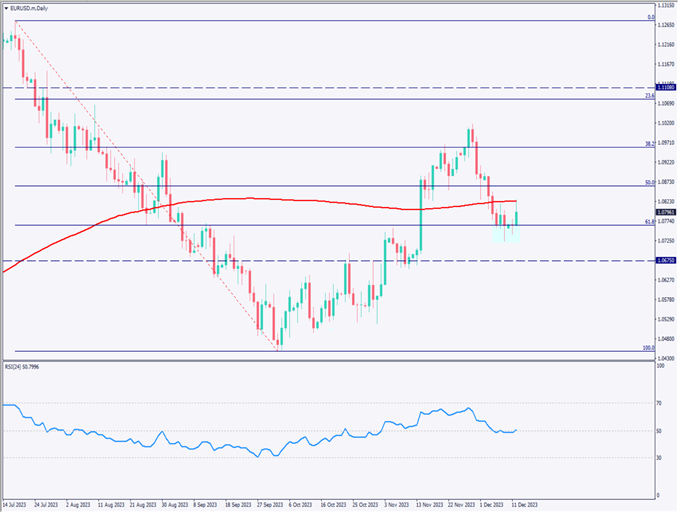

Analyzing the daily chart of the Euro-Dollar pair. Currently, the price is capped by the 240-day moving average and reacting to the 61.8% Fibonacci retracement level. The market is trying to ascertain direction between these two indicators.

The upcoming early morning FOMC announcement could significantly impact the market. Trading volumes are expected to decrease ahead of the FOMC. It’s challenging to determine whether the current situation is a retracement in a downtrend or a buying opportunity in an uptrend. Post-FOMC market reactions are crucial to watch.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the Euro-Dollar pair. Currently, the 24-hour moving average is above the 72-hour moving average, and the price is gradually rising, supported by the 24-hour moving average. Yesterday, it briefly rose to USD 1.0825 but was resisted by the 240-day moving average on the daily chart. The 1-hour RSI is at 58, indicating an upward trend.

Amid expectations of maintaining policy rates in the early morning FOMC, Chair Powell might dampen early rate cut expectations next year. If so, continued high-interest rates might lead to a stronger USD, tilting the Euro-Dollar towards a downward trajectory.

Today’s day trading strategy involves anticipating significant fluctuations due to the FOMC, refraining from predictions, and adopting a flexible, wait-and-see approach.

Support and Resistance Lines

Upcoming resistance lines to consider:

1.080 USD – Moving average and resistance zone

1.0725 USD – Recent low on the daily chart

Market Sentiment

EURUSD Sell: 44%, Buy: 56%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Bank of Japan Tankan Large Manufacturers Index | 8:50 |

| UK GDP | 16:00 |

| US Producer Price Index | 22:30 |

| US Crude Oil Inventories | 24:30 |

| US FOMC Policy Rate Announcement (Expected: Unchanged) | Following Day 3:00 |

| US FOMC Economic Projections & Statement | Following Day 4:00 |

| US Fed Chair Powell Press Conference | Following Day 4:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.