Euro-Dollar Retreats as Eurozone Economic Indicators Further Deteriorate【December 18, 2023】

Fundamental Analysis

- Lagarde, ECB President, comments that there is absolutely no discussion on rate cuts

- Eurozone PMI worsens, extremely high probability of a recession

- Euro-Dollar fails to breach 1.10 USD, retreats at 1.10 USD

EURUSD Technical Analysis

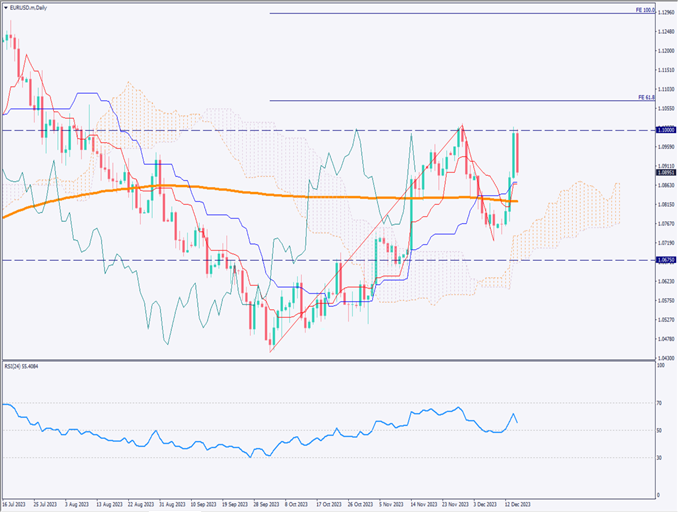

Analyzing the Euro-Dollar daily chart. Failing to surpass the round number of 1.10 USD, with Eurozone PMI deteriorating more than expected, increasing the likelihood of a recession. However, the ECB currently has no plans to ease its high-interest-rate policy, maintaining a hawkish stance.

The 200-day moving average shows a horizontal trend, potentially a key indicator for future Euro-Dollar market trends. It’s essential to carefully observe market movements while paying attention to the impact of Eurozone economic indicators and ECB monetary policy statements.

Day Trading Strategy (1-Hour Chart)

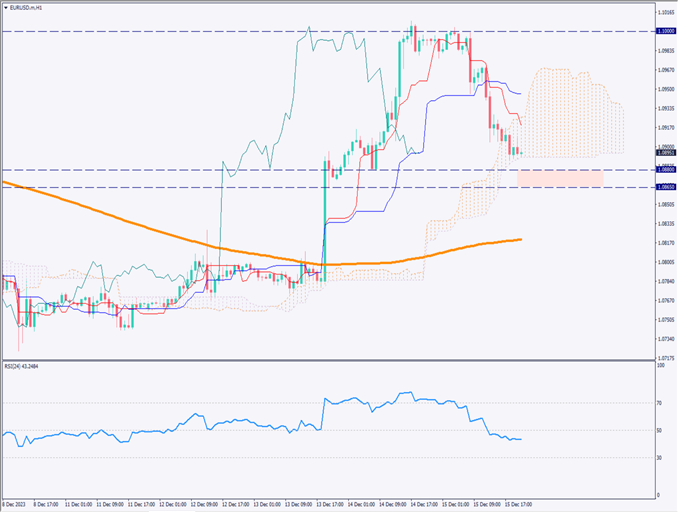

Analyzing the Euro-Dollar daily chart. After retreating at 1.10 USD, it fell to near the neckline, with the past low of 1.088 USD becoming the recent support line. The range of 1.0865 to 1.088 USD likely forms a support band.

A break below 1.0865 USD could lead to a sharp drop to 1.0820 USD. This price range coincides with the daily chart’s 200-day moving average.

For day trading, consider selling on a breakout if it falls below 1.0865 USD, setting a take-profit target at 1.0825 USD and a stop-loss at 1.088 USD. Additionally, consider buying on dips around 1.0825 USD, anticipating a rebound. This price range overlaps the 200-day moving average on both the hourly and daily charts, suggesting a potential rebound and presenting an opportunity.

Support and Resistance Lines

Upcoming resistance lines to consider:

1.10 USD – Round number

1.088 USD – Past support line

Market Sentiment

EURUSD Sell: 58%, Buy: 42%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK Official Speech | 19:30 |

| ECB Official Speech | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.