Gold Rises to USD 2,045, Boosted by Increased Expectations for US Interest Rate Cuts【December 22, 2023】

Fundamental Analysis

- US GDP Revised Downwards, Adding Wind to Next Year’s Rate Cut Expectations

- US Dollar Weakens, USD/JPY Falls to the Early 142s

- Gold Rises, Hitting Resistance at USD 2,045

XAUUSD Technical Analysis

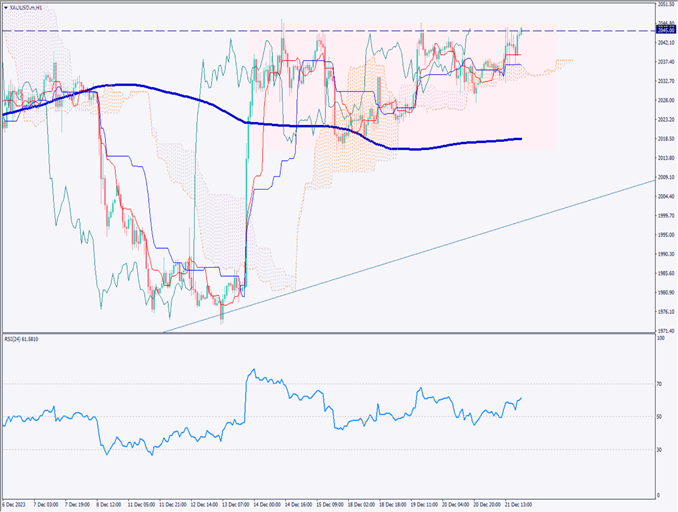

Analyzing the daily chart of gold prices. Currently, gold is firming and rising, supported by expectations of US rate cuts. The chart shows a situation sandwiched between the Ichimoku Kinko Hyo’s standard line and conversion line. Particularly, there is a resistance band between USD 2,045 and USD 2,053, and attention should be paid to the movement exceeding the standard line transitioning to USD 2,053.

Overall, it’s forming a parallel channel and is currently in an upward phase. RSI analysis indicates a rebound at 50, suggesting a continuation of the upward trend. Therefore, the gold market is expected to continue its upward trajectory.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the gold market. Currently, gold is forming a large range (rectangle) or an ascending triangle, having failed to break through USD 2,045 three times, but with higher lows, suggesting a high likelihood of an upward breakout.

The RSI stands at 64, indicating a stable upward trend. Expectations for a US rate cut are significantly influencing market fundamentals.

For day trading, after exceeding USD 2,045, confirm that USD 2,045 functions as a support line before considering entry. The profit target is USD 2,053, where the Ichimoku Kinko Hyo’s standard line on the daily chart is transitioning, with a stop if it clearly falls below USD 2,045.

Support and Resistance Lines

Upcoming resistance lines to consider:

USD 2,045 – A significant resistance band

Market Sentiment

XAUUSD Sell: 64%, Buy: 36%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Japan Nationwide Consumer Price Index | 8:30 |

| UK GDP | 16:00 |

| Personal Consumption Expenditures Price Index Core | 22:30 |

| Canada GDP | 22:30 |

| University of Michigan Consumer Sentiment Index | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.