Eurodollar Sees Significant Rise, Beware of Pullback【December 28, 2023】

Fundamental Analysis

- The Eurodollar has broken through USD 1.10, making a significant rise and entering the overbought zone.

- There is a split opinion within the Bank of Japan, with high market expectations for interest rate normalization.

- Japan anticipates rate hikes, while the global trend is expected to lean towards rate cuts.

EURUSD Technical Analysis

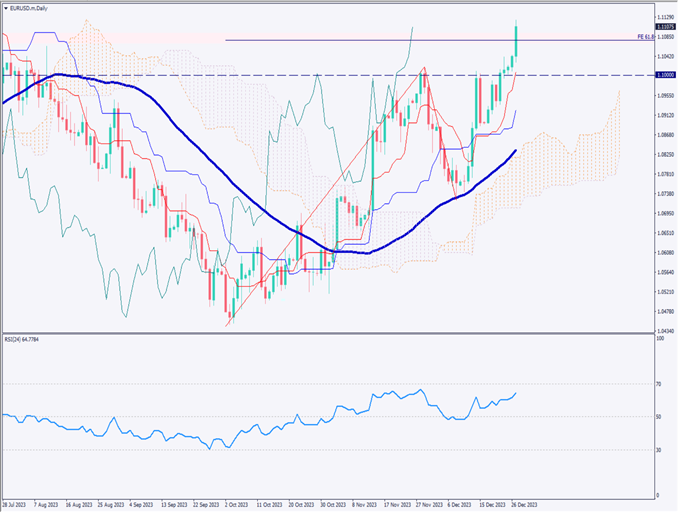

Analysis of the Eurodollar daily chart shows a move above the crucial USD 1.10 mark, surpassing USD 1.11. The 52-day moving average is being acknowledged, showing an upward trend. At USD 1.1130, there is a monthly resistance line, with a high possibility of a temporary overshoot followed by a pullback.

Due to the continued trend of a weaker dollar, a long-term upward trend is expected. The daily RSI stands at 64, with the possibility of USD 1.107, 61.8% Fibonacci expansion, becoming a new support line. The market appears slightly overextended, hence, short-term pullbacks should be watched.

Day Trading Strategy (1-Hour Chart)

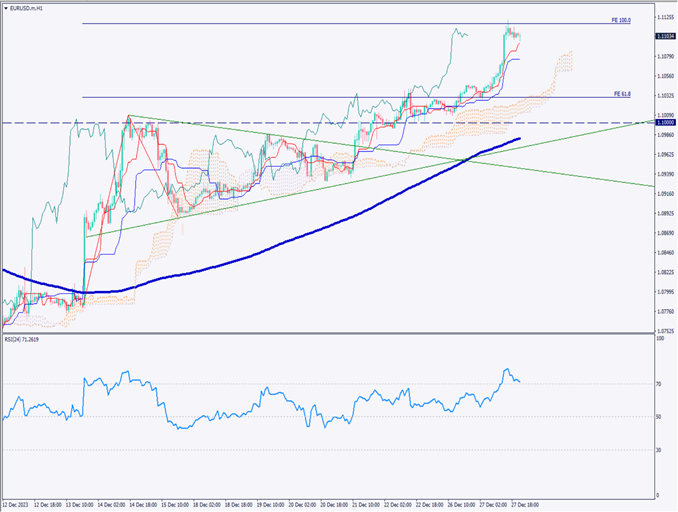

Analyzing the Eurodollar 1-hour chart, the current upward trend line is significant, showing a pullback at the 100% Fibonacci expansion. Notably, 161.8% corresponds to USD 1.1250, a target price after breaking 100%.

There is a significant resistance line at USD 1.1130, and a breakout above this level is not easy. With the RSI at 72, entering the overbought zone, a dip below 70 might indicate position adjustments. The market sentiment shows 92% in selling positions.

The day trading strategy suggests a limit sell at USD 1.1130, take profit at USD 1.1075, and a stop loss at USD 1.1165.

Support and Resistance Lines

Upcoming resistance lines to consider:

USD 1.1113 – Monthly resistance line

USD 1.1075 – Daily Fibonacci expansion 61.8%

USD 1.10 – Round number

Market Sentiment

EURUSD Sell: 92%, Buy: 8%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Japanese Retail Sales | 8:50 |

| Unemployment Insurance Claims | 22:30 |

| Crude Oil Inventory | Next 1:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.