USD/JPY Declines, Fails to Break Through 200-Day Moving Average【January 9, 2024】

Fundamental Analysis

- U.S. stock indices surge, with NASDAQ skyrocketing

- USD/JPY faces resistance at the 200-day moving average

- A candlestick pattern similar to ‘Evening Star’ appears in USD/JPY

USDJPY Technical Analysis

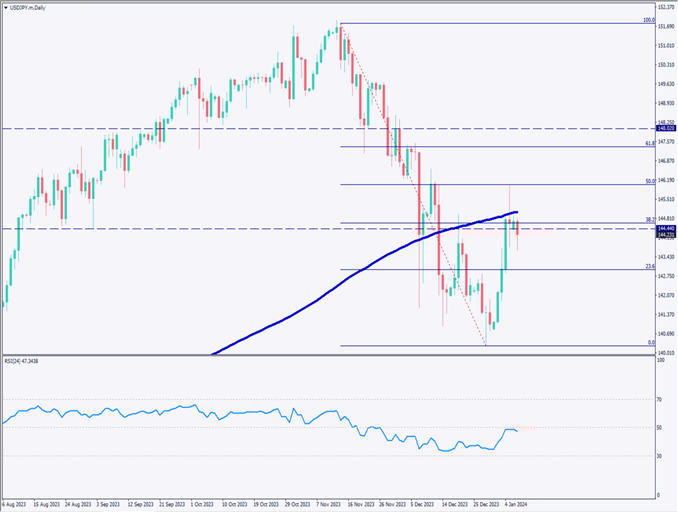

Analysis of the daily chart for USD/JPY shows a decline after failing to break through the 200-day moving average. A pattern with an extended upper shadow is observed, forming an ‘Evening Star’ signal with a sequence of ‘bullish candle + doji + bearish candle’.

Selling pressure is concentrated around the halfway mark of the Fibonacci retracement, intensifying the downward momentum. The RSI is below 50, acting as resistance. Currently, there’s a high possibility of forming a retracement high, with the 23.6% level at 143 JPY being the next critical support zone.

Day Trading Strategy (1-Hour Chart)

Analysis of the 1-hour chart for USD/JPY. The 90 moving average is acting as a support line, and breaking below this line could lead to a significant drop. The RSI is at 47, indicating a downward trend. Considering currency strength, the USD is slightly dominant, and the market could temporarily retrace to around 144.40 JPY.

The range from 144.44 to 144.65 JPY forms a significant resistance zone, with the Ichimoku cloud also nearby, likely to be strongly acknowledged by market participants.

The day trading strategy is to aim for selling on the rebound, with a sell entry at 144.44 JPY, take profit at 143.50 JPY, and stop loss at 144.89 JPY.

Support and Resistance Lines

Upcoming resistance lines to consider:

144.40 JPY – Major resistance line

Market Sentiment

USDJPY: Sell: 61%, Buy: 39%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Tokyo Core Consumer Price Index | 8:30 |

| Australian Retail Sales | 9:30 |

| Canadian Building Permits | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.