Gold Rises as a Safe Haven Asset, U.S. and UK Militarily Attack Houthi Strongholds【January 15, 2024】

Fundamental Analysis

- U.S. and UK military attack Houthi strongholds in Yemen, escalating tensions in the Middle East

- Islamic nations strongly react, increasing demand for Gold as a safe haven asset

- Gold recovers to around USD 2,050

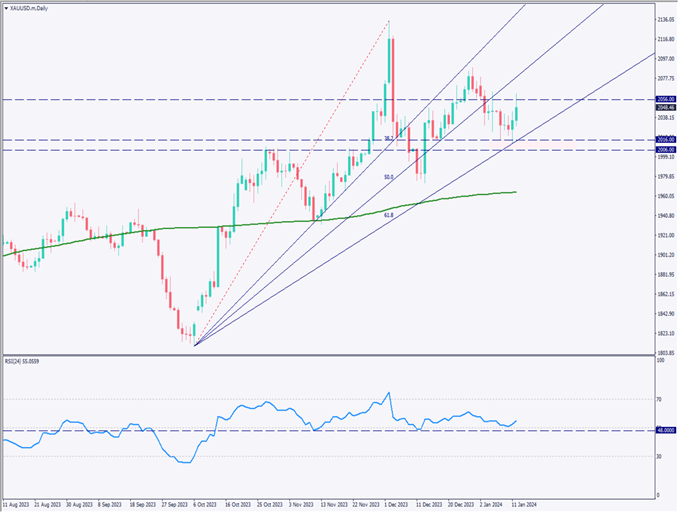

XAUUSD Technical Analysis

Analyzing the daily chart of Gold prices. The Middle East situation is tense due to the U.S. and UK’s military retaliation against Houthi ship attacks in the Red Sea. The increase in geopolitical risk has led to a strong tendency to buy Gold as a safe haven asset.

The market has reacted to the 61.8% line of the Fibonacci fan, with rising lows and the RSI bouncing around 50 for the past three times. This movement suggests a strong desire for Gold to rise. The immediate resistance levels are expected to be USD 2,056 and USD 2,070, and these levels will be key to the future Gold market.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of Gold prices. Gold surged significantly due to heightened tensions in the Middle East, jumping from USD 2,016 to USD 2,060.

This movement is presumed to be the result of rapid buy orders near the low and catching the stop of sell limit orders at the range’s upper limit. Despite overall dollar strength in currency strength, the demand for buying Gold is prevailing.

USD 2,056 is an important resistance line, and surpassing this price could lead to a target of USD 2,070. In day trading, it is desirable to aim for entry in the USD 2,040 range, settle around USD 2,056 or USD 2,070, and set a stop at USD 2,035.

Support and Resistance Lines

Upcoming significant support and resistance lines:

USD 2,056 – a significant resistance line

USD 2,016 – a major support line

Market Sentiment

XAUUSD Sell: 67%, Buy: 33%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. Holiday | – |

| Canadian Wholesale Sales | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.