USD/JPY Rises to the 148 JPY Range, U.S. Interest Rate Cut Expectations Delayed【January 18, 2024】

Fundamental Analysis

- U.S. interest rate cut expectations delayed, U.S. 10-year Treasury yield rises

- UK Consumer Price Index exceeds expectations, leading to a stronger pound

- In the foreign exchange market, the dollar strengthens, with USD/JPY rising to the 148 JPY range

USDJPY Technical Analysis

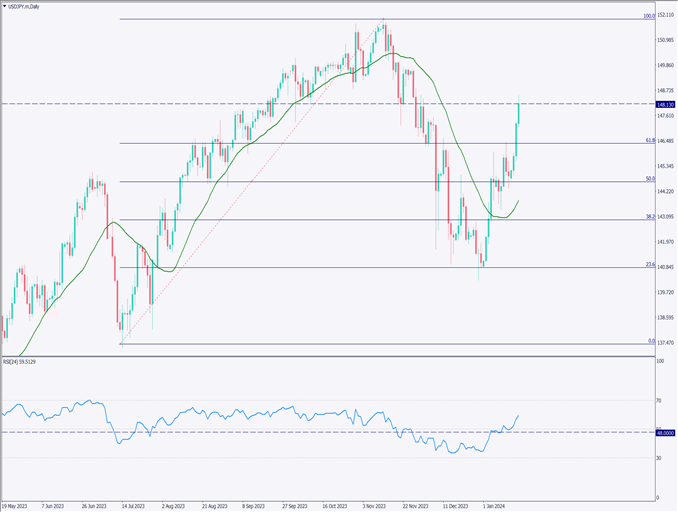

Analyzing the daily chart of the USD/JPY. Currently, the price has entered the 148 JPY range, approaching the important monthly resistance line near 148.13 JPY. A reversal at this level is possible. The RSI shows 57, maintaining a strong upward trend, but caution is needed in contrarian positions under these circumstances.

Even for trend-following strategies, it is necessary to be wary of adjustments and reversals, keeping the monthly resistance line in mind. With 85% of the market sentiment in sell positions, significant selling pressure is expected, making a breakthrough of the resistance line at one go difficult.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the USD/JPY. Currently, it is maintaining an upward trend above the 24-hour moving average. Particularly notable is the RSI trend, which, after temporarily exceeding 70, is now at 67. This does not necessarily indicate an immediate decline but suggests the possibility of a downturn triggered by some event.

Entering aggressively into buying at the 148 JPY range is risky, and selling should also be approached with caution. Considering the likelihood of maintaining the 24-hour moving average, considering buying on dips around this area is advisable. Planning entry in the late 147 JPY range and targeting 148.13 JPY for settlement, a wait-and-see approach is preferred if there is no decline.

Support and Resistance Lines

Upcoming significant support and resistance lines:

148.13 JPY – Monthly resistance line

Market Sentiment

USDJPY Sell: 85%, Buy: 15%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. Unemployment Insurance Claims | 16:00 |

| FOMC Member Comments | 1:30 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.