USDJPY Rises, Forex Market Favors USD as US Inflation Persists【March 15, 2024】

Fundamental Analysis

- US PPI Exceeds Market Expectations, Forex Market Favors USD

- US Rate Cut Speculation Recedes as PPI Follows CPI in Underlining Inflation’s Strength

- USDJPY Rebounds to 146.50 JPY, Market May Have Priced in Potential Abolishment of BOJ’s Negative Interest Rate

USDJPY Technical Analysis

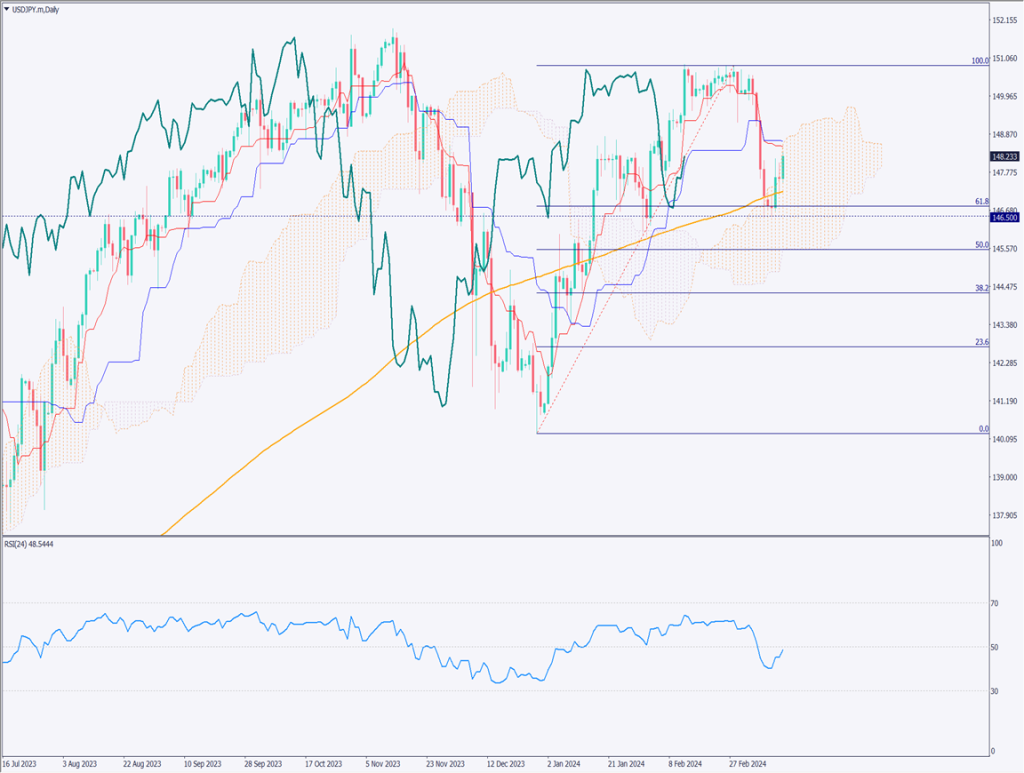

Analyzing the Daily Chart of USDJPY. USDJPY rebounds near the 200-day and 90-day Moving Averages, reaching a high of 148.35 JPY. Although it hasn’t broken through the Ichimoku cloud, it’s approaching the conversion line and base line, making it crucial to watch for a potential decline. If the downtrend continues, the conversion line is likely to act as resistance.

Attention on USDJPY market shifts to next week’s BOJ meeting. The meeting is expected to discuss ending negative interest rates, a topic that has been frequently covered in the news. With major companies responding positively to wage hikes in the spring wage negotiations, the market may have already priced this in.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour Chart of USDJPY. After rebounding from 146.50 JPY, USDJPY has been gradually increasing. It may rise to 148.75 JPY, attempting to surpass the 200-day Moving Average, with the 90-day Moving Average serving as support and having reacted twice, which is noteworthy.

Today’s market is somewhat complex and challenging. With US inflation not subsiding, the USD is strengthening, but the extent to which the BOJ meeting’s discussion on ending negative interest rates will affect the market remains uncertain. Moreover, as it approaches major moving averages, there’s a possibility for short-selling.

With the RSI around 48 and nearing the daily conversion line, the initial strategy is to lean towards short-selling. Envision selling at 148.50 JPY and buying back at 148.15 JPY. If it clearly surpasses 148.70 JPY, set that as the stop.

Support and Resistance Lines

The following are the support and resistance lines to consider:

148.95 JPY – Monthly resistance band

147.65 JPY – Price level that rebounded three times this week

146.50 JPY – Monthly support band

Market Sentiment

USDJPY Sell: 48% Buy: 52%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| University of Michigan Consumer Sentiment Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.