USDJPY Surpasses 152 JPY, U.S. CPI Rises for Three Consecutive Months Fueling Dollar Buying【April 11, 2024】

Fundamental Analysis

- U.S. Consumer Price Index exceeds market expectations for three consecutive months

- U.S. inflation trend continues, making a rate cut difficult; rate cut speculations recede

- USDJPY surges as the continuation of the Japan-U.S. interest rate differential is anticipated, rising to 153.24 JPY

USDJPY technical analysis

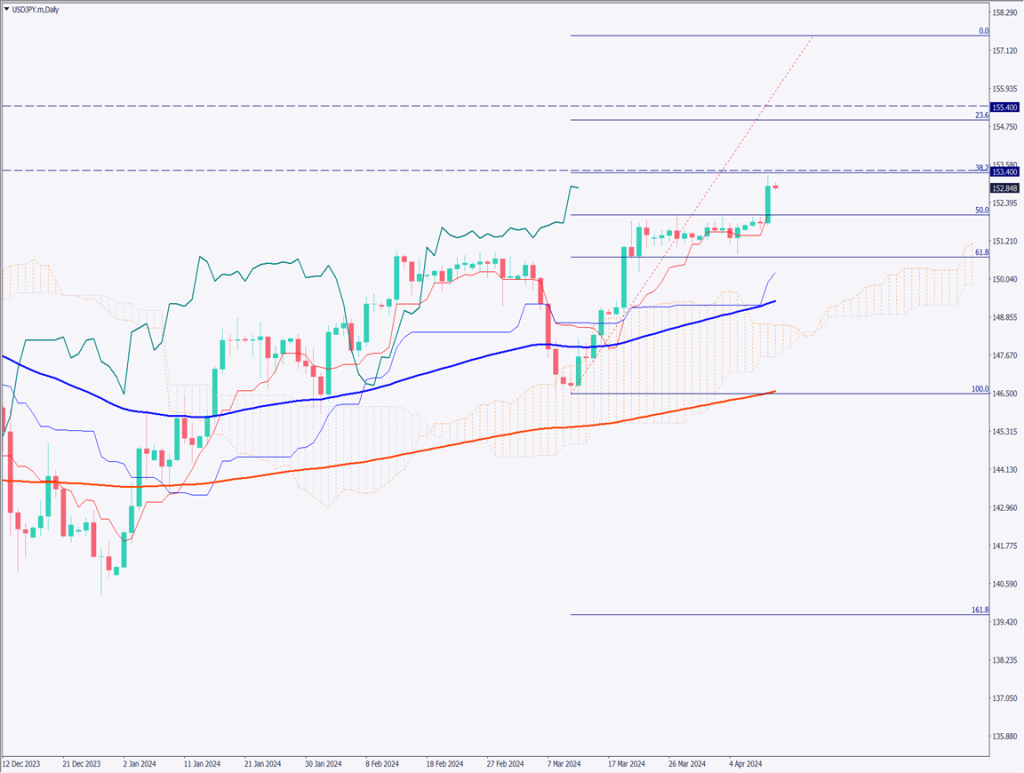

Analyzing the daily chart of USDJPY. Backed by the U.S. CPI exceeding market expectations and surpassing the 152 JPY resistance line. The recent U.S. employment data also exceeded market forecasts, contributing to inflation rise and making a significant market impact.

Currency intervention was feared but did not occur, possibly due to the dollar-led rise. The rise in USDJPY is fundamental-driven, with rate cut speculations receding. Some officials even suggest the possibility of a rate hike instead of a cut.

Despite adjustments, the upward trend in USDJPY is unlikely to be halted, with the “N-shaped rule” suggesting a potential target price around 155.40 JPY.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY. After a surge, there’s a high chance of correctional selling the following day, expecting a decline to the early 152 JPY. As a reference for the decline, the Ichimoku Kinko Hyo’s baseline at 152.40 JPY and the 90MA at 152 JPY are considered.

The day trading strategy would be to buy on dips, aggressively purchasing between the late 151 JPY to early 152 JPY. The stop loss would be set if it falls below 151.50 JPY, aiming for a settlement around 152.65 JPY.

Support/Resistance lines

The following are the support and resistance lines to consider:

153.40 JPY – Monthly resistance line

153.24 JPY – Recent high

152.45 JPY – Ichimoku Kinko Hyo baseline

Market Sentiment

USDJPY Sell: 80% Buy: 20%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| ECB Interest Rate Decision | 21:15 |

| U.S. Producer Price Index | 21:30 |

| ECB President Press Conference | 21:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.