Gold Plummets, Focus on Fibonacci Retracements【April 23, 2024】

Fundamental Analysis

- Iran announces no further retaliation, easing Middle East tensions

- Chinese gold demand increases, influenced by prolonged real estate and financial instability

- Chinese central bank also net buys gold, high demand likely to continue

XAUUSD technical analysis

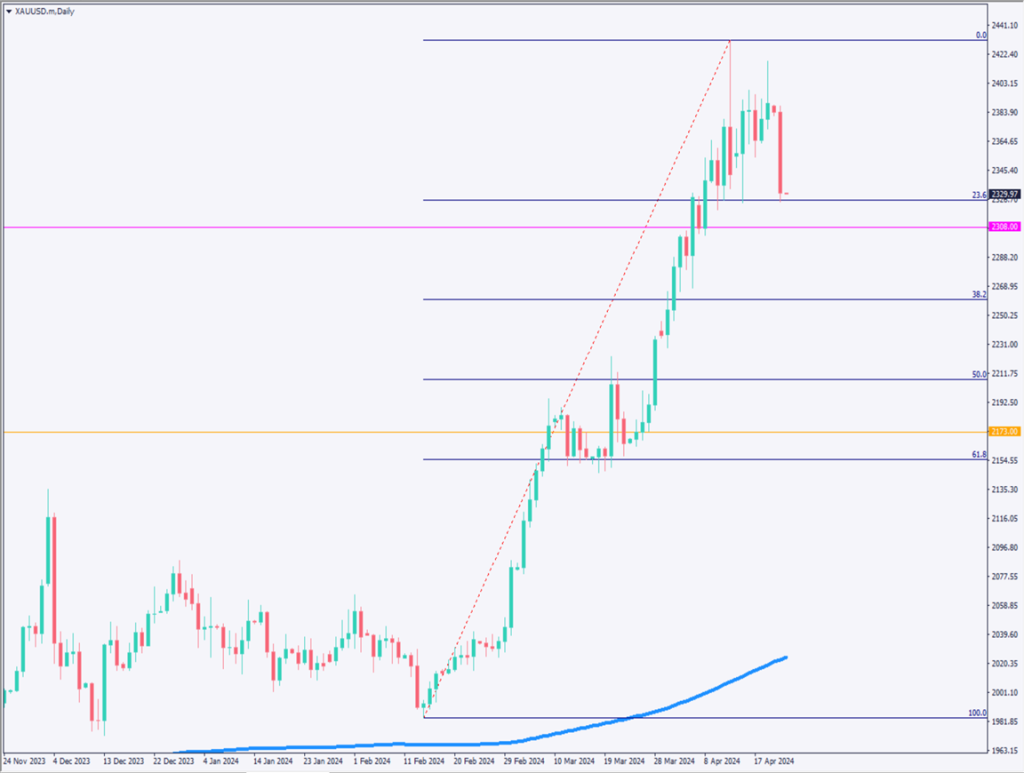

Analyzing the daily chart for gold. After reaching a record high of 2431USD, news of eased tensions in the Middle East triggered profit-taking sales. Drawing Fibonacci retracements shows a decline to the 23.6% level at 2325USD.

Demand for gold as a safe asset has waned, but jewelry demand and Chinese gold buying remain strong, with potential buying opportunities on declines. China has many regulations and limited investment options compared to developed countries. Currently, China’s real estate bubble is collapsing, increasing investments in gold.

Key focus points going forward are whether gold will break below 2325USD or 2308USD. A break below 2300USD could lead to a further drop to around 2250USD.

Day trading strategy (1 hour)

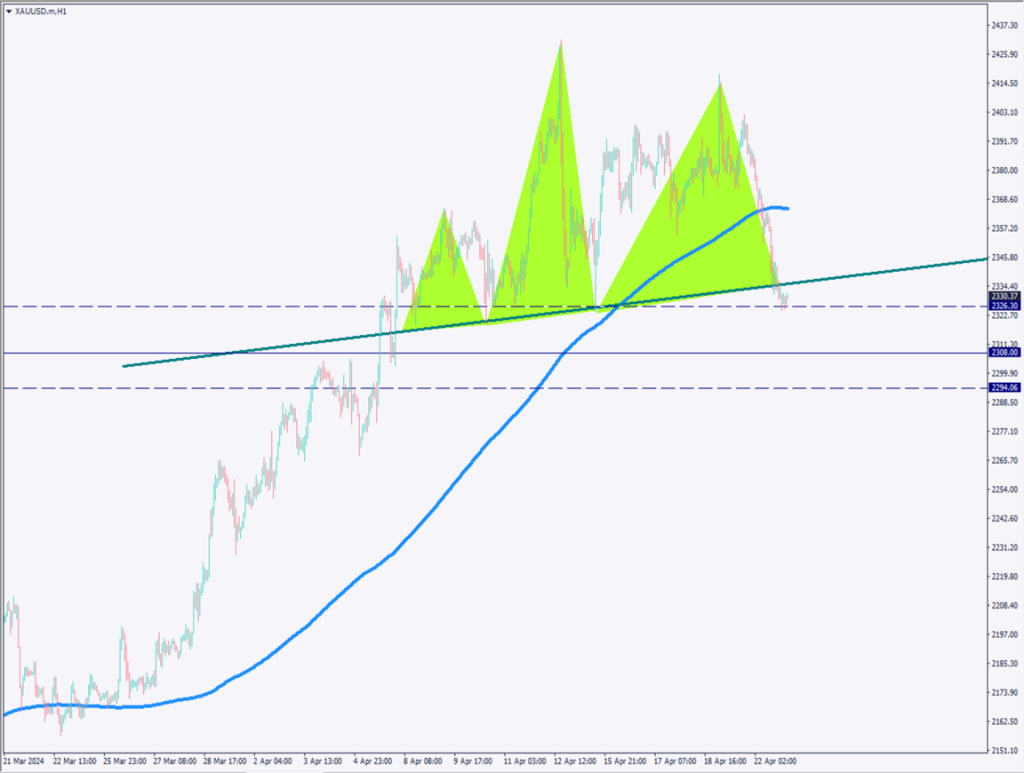

Analyzing the 1-hour chart for gold. Drawing three triangles, one neckline emerges. Currently breaking out of this neckline, which may act as a resistance line.

Breaking below 2325USD leads to a potential drop to 2308USD. 2308USD corresponds to a monthly support line, making it relatively likely to rebound.

If buying pressure is strong and clearly surpasses the neckline, it could rise to 2346USD.

Day trading approach: consider selling around 2350USD, stop at 2355USD, and look to close around 2308USD.

Support/Resistance lines

Key support and resistance lines to consider:

2325USD – Fibonacci 23.6%

2308USD – Monthly support line

2260USD – Fibonacci 38.2%

Market Sentiment

XAUUSD Sell: 55% Buy: 45%

Featured Currency Pair of the Week (USDCHF)

USD to Swiss Franc is ranging, moving between 0.91USD to 0.9150USD. With an RSI at 62, the momentum has paused, but surpassing 0.9150USD could lead to a rise to 0.9215USD.

0.9150USD is a monthly resistance line, taking time to overcome. No economic indicators related to the Swiss Franc are scheduled for today, suggesting a wait-and-see stance.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Nikkei Services PMI | 9:30 |

| US Manufacturing Purchasing Managers’ Index | 22:45 |

| New Residential Sales | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.