USDJPY Breaks 155 JPY, Intervention Concerns Fail to Halt Yen’s Decline【April 25, 2024】

Fundamental Analysis

- While USDJPY broke through 155 JPY, no currency intervention was carried out

- The easing situation in the Middle East has once again shifted focus to the interest rate differential between Japan and the USA

- Tomorrow, the Bank of Japan’s outlook and policy meeting are scheduled, with a focus on the governor’s statement

USDJPY technical analysis

Analysis of the USDJPY daily chart reveals that, with the start of yesterday’s NY market, a strong buying momentum pushed USDJPY past the psychological barrier of 155 JPY. This move, incorporating stop-loss orders, updated the high to 155.42 JPY, marking a 34-year low for the yen.

The Middle East situation has stabilized, hence, the market has once again turned its attention to the interest rate differences. Tomorrow’s Bank of Japan policy meeting is unlikely to change policies since negative interest rates were abolished in March. The focus on Japan-US interest rate differentials has intensified dollar buying. Despite concerns about currency intervention, no actions were taken.

The recent high of 155.42 JPY corresponds to a price level where monthly and weekly resistance lines intersect, indicating that breaking this barrier could take time. Market sentiment analysis also shows selling pressure. Therefore, caution is advised in holding long positions.

If 155.42 JPY is breached, the 157 JPY level comes into view, necessitating preparedness for further yen depreciation.

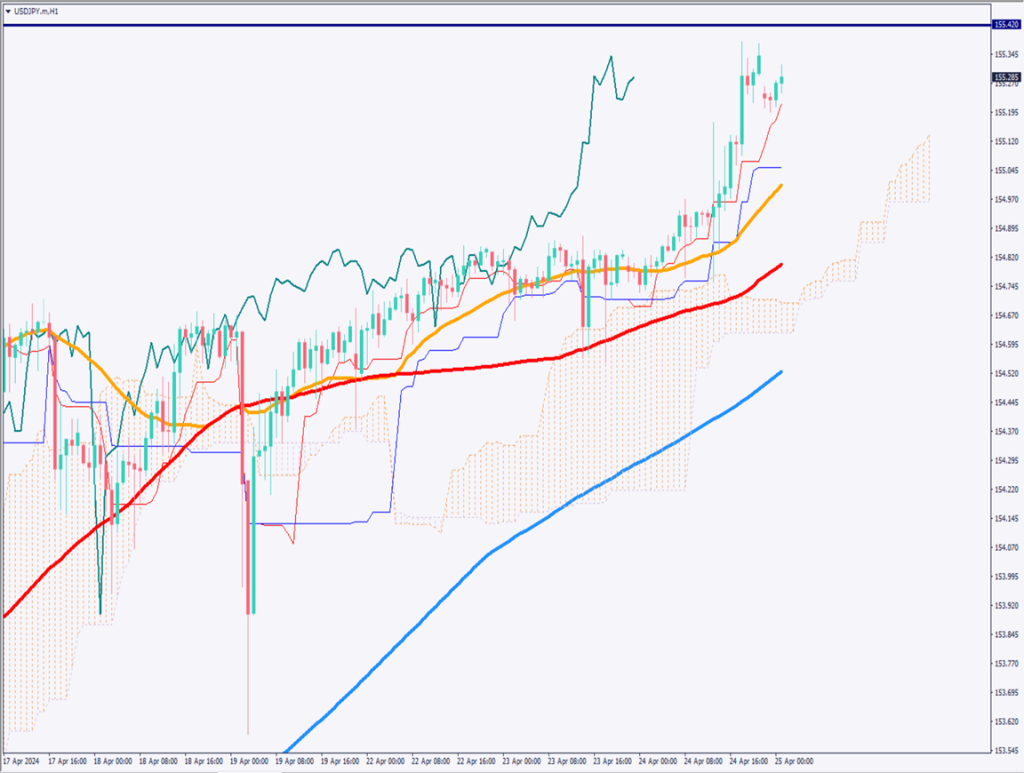

Day trading strategy (1 hour)

Analysis of the USDJPY 1-hour chart shows that the recent high at approximately 155.42 JPY continues to be pivotal, with the current price hovering around 155.28 JPY. Given the overlap of weekly and monthly resistance lines at 155.42 JPY, a breakout might not occur until May or later, thus avoiding aggressive buying entries.

The day trading approach might seem contrarian, but a short-term selling position is considered. Entry prices are set between 155.35 JPY and 155.40 JPY, with take profits at 155.10 JPY and stops at 155.55 JPY, set conservatively.

Support/Resistance lines

The following are key support and resistance levels to consider:

155.42 JPY — Recent high / weekly and monthly resistance lines

155.07 JPY — Pivot point

154.85 JPY — Monthly support line

Market Sentiment

USDJPY Sell: 80% Buy: 20%

Featured Currency Pair of the Week (USDCHF)

Analysis of the USDCHF daily chart reveals that the resistance line at the upper range limit of 0.9150 USD was breached, updating the high to 0.9153 USD. Currently, the price is around 0.9140 USD, but the upward pressure is apparent.

Given the typically low volatility of USDCHF, breaking through 0.9150 USD suggests the next resistance line around 0.9175 USD. Breaking 0.9175 USD could lead to 0.9215 USD.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| U.S. GDP | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.