USDJPY Continues to Weaken Amid Bank of Japan Policy Meeting【April 26, 2024】

Fundamental Analysis

- The US GDP underperformed against market expectations, and the personal consumption expenditures price index rose

- The United States is experiencing ‘stagflation’—a state of economic slowdown coupled with rising prices

- There is growing unease about the prospects for a soft landing of the economy

USDJPY technical analysis

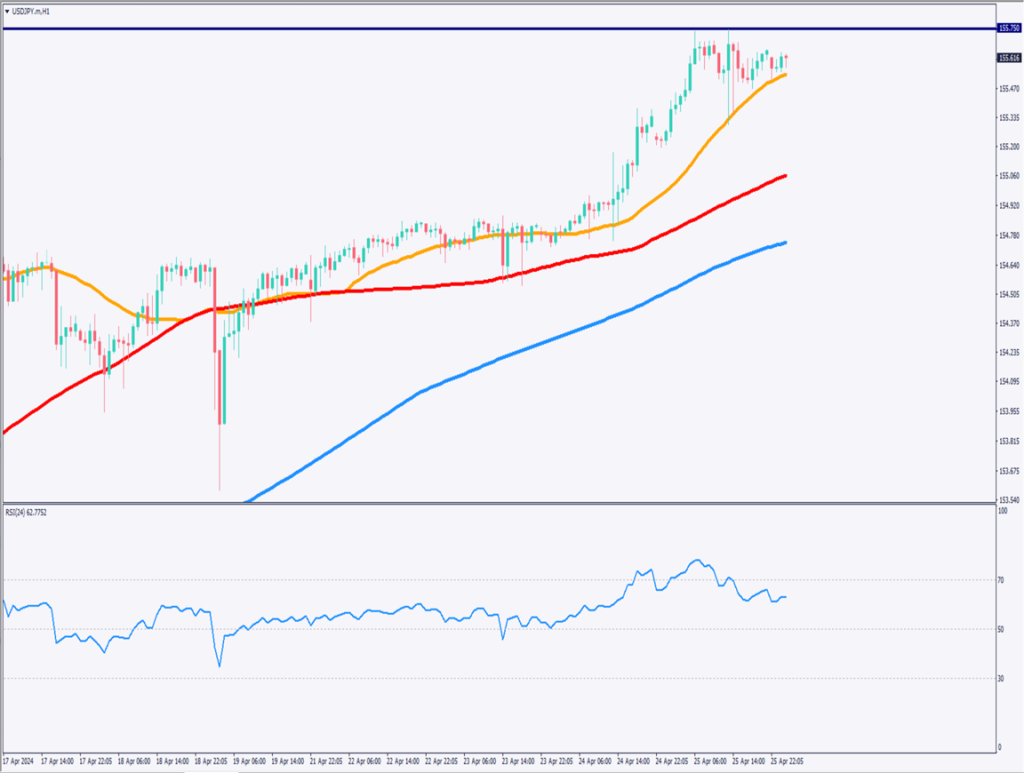

An analysis of the daily chart for USDJPY shows an update to a high of 155.75JPY, moving within an upward channel. However, concerns of stagflation are emerging in the United States, a challenging economic situation where weakening economic growth persists alongside rising prices.

The Federal Reserve continues to prioritize inflation control by maintaining high interest rates, further weakening the economy. On the other hand, prioritizing economic recovery could lead to uncontrollable inflation.

Technically, the 28-day, 90-day, and 200-day moving averages have formed a perfect order, suggesting a bullish market. However, with U.S. Treasury Secretary Yellen commenting that “currency intervention should be rare,” Japan finds itself compelled to be cautious about intervening in the forex market.

Drawing a Fibonacci expansion suggests that the 100% price level could be 157.080JPY. USDJPY is currently seeking direction amidst U.S. stagflation concerns and Japan’s cautious stance on currency intervention.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY, it seems natural to expect an update of the recent high of 155.75JPY. The daily RSI is at 74, indicating some overheating, but the 1-hour RSI stands at 63, suggesting a possibility of retesting 155.75JPY.

The Bank of Japan policy meeting is taking place today, and the market is closely watching for any surprise announcements or comments from the governor. Should there be no significant news, USDJPY might surge, potentially targeting 157JPY and then 160JPY.

Post-event, the day trading strategy involves assessing if a buying opportunity presents itself.

Support/Resistance lines

The following are key support and resistance levels to consider:

155.75JPY – Recent high

155.42JPY – Major support line

Market Sentiment

USDJPY Sell: 84%, Buy: 16%

Featured Currency Pair of the Week (USDCHF)

The U.S. Dollar-Swiss Franc is facing resistance at 0.9150USD, failing to break through. Today, a statement from a Swiss National Bank official is scheduled, which might trigger some movement. The 28-day moving average acts as a support line, with 0.9150USD as the upper limit of the ongoing range-bound market.

In the coming weeks, keep an eye on whether 0.9150USD will be breached.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Bank of Japan Outlook Report | 11:30 |

| Bank of Japan Policy Rate Announcement | 12:00 |

| Bank of Japan Governor’s Press Conference | 15:30 |

| Swiss National Bank Official Speech | 17:00 |

| U.S. Core PCE Price Index | 21:30 |

| University of Michigan Consumer Sentiment Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.