USDJPY Surges to the 158 JPY Range, 160 JPY Range in Sight【April 29, 2024】

Fundamental Analysis

- The Bank of Japan maintains current monetary policy, interpreted as dovish, accelerating JPY selling

- USDJPY has surged to the 158 JPY range, with no stop to the weakening JPY and strengthening USD

- U.S. GDP is slowing, focus on U.S. interest rate policy

USDJPY technical analysis

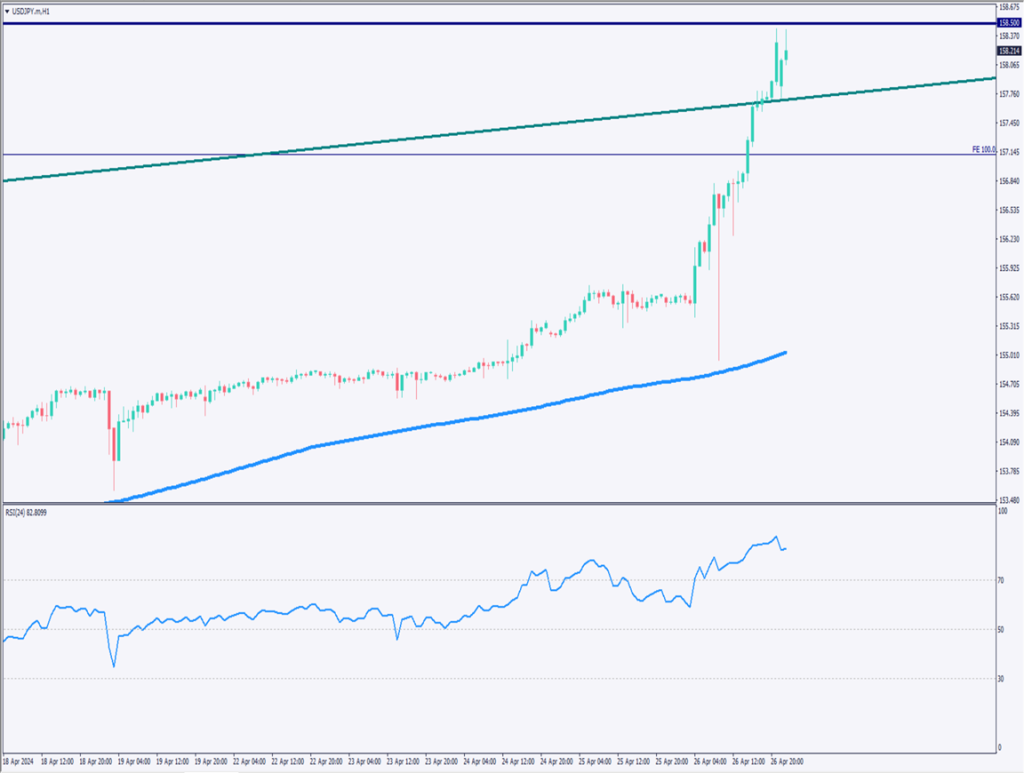

Analyzing the daily chart of USDJPY. According to technical analysis, it has broken out upwards through the rising channel, indicating a somewhat overheated state. The RSI is around 79, high, signaling that a pullback adjustment might be necessary.

As the upper limit price range for April is 158.50 JPY, reaching the 160 JPY range might be postponed until May. With the Golden Week period typically seeing low trading volumes, the likelihood of currency intervention is low, hence, speculators might further sell JPY.

Therefore, during Golden Week, there is a high possibility of increased volatility, and caution is needed against sudden market shifts.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY. RSI is at 82, indicating a significantly overheated market. The appearance of candlesticks with long lower shadows and doji suggests that JPY selling is not stopping.

As long as the Bank of Japan does not hint at a rate hike, the interest rate differential between Japan and the U.S. will remain, thus, a weaker JPY and stronger USD trend is likely to continue. However, due to the overheated market, a corrective sell-off is probable.

Buying on dips is considered a good strategy, but since tomorrow is month-end, it might be better to wait for a deeper adjustment.

As a specific day trading strategy, aim to buy on dips in the early 157 JPY range. Set the entry at 157.15 JPY, the take-profit at 157.75 JPY, and the stop-loss at 156.85 JPY.

Support/Resistance lines

Key support and resistance lines to consider are as follows:

158.50 JPY – Monthly resistance line

Market Sentiment

USDJPY Selling: 85% Buying: 15%

Featured Currency Pair of the Week (EURCHF)

The Euro-Swiss Franc might find resistance at 0.9850 CHF. After rebounding from the 200-day moving average, it is rising again and may try to break 0.9850 CHF once more. It has escaped a long-term downtrend and is now in an uptrend.

Breaking 0.9850 CHF could start to bring the round number of 1.00 into focus.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| German Consumer Price Index | 21:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.