Gold Falls as Fed Chair Signals Hawkish Shift, USD Demand Increases【May 1, 2024】

Fundamental Analysis

- Gold declines amidst easing tensions in the Middle East and rising yields on US 10-year Treasuries.

- Attention on upcoming FOMC meeting; Fed Chair may suggest a hawkish turn.

- Gold shifts to a downward trend; watch for downside risks.

XAUUSD technical analysis

Analysis of the daily gold chart shows a break below the 23.6% Fibonacci retracement level and the 28-day moving average, suggesting a pause in the upward trend that began in February.

Moreover, breaking below the recent low of 2291USD indicates the onset of a downward trend according to Dow theory.

This shift is influenced by rising US employment cost index and persistent high inflation, suggesting that the Fed might turn hawkish.

Today’s FOMC session is critical, with Chair Powell’s remarks anticipated. He might express caution against rate cuts and mention the possibility of further rate hikes. If the Fed turns hawkish, gold could face selling pressure, making USD likely to strengthen, thus expecting USDJPY to rise.

Day trading strategy (1 hour)

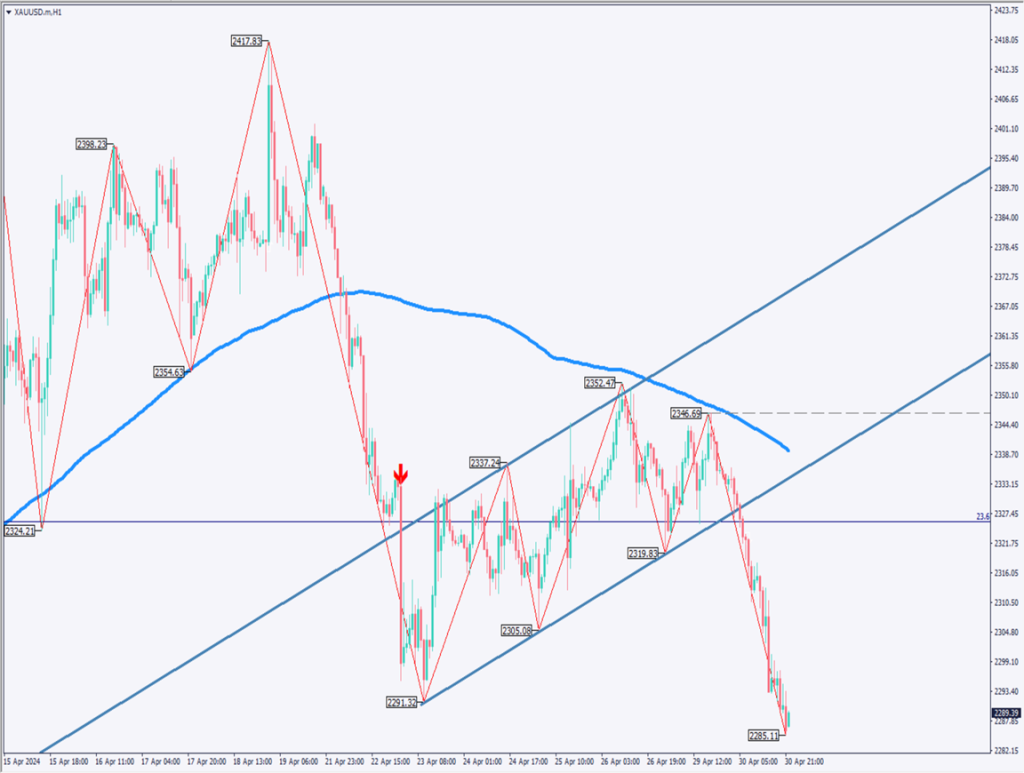

Analysis of the 1-hour chart of gold shows a typical descending flag pattern, with a significant drop due to the breakout of the flag and the daily chart’s 23.6% Fibonacci level.

Considering the ‘N wave,’ the fall from 2417USD to 2291USD and the decline from 2352USD are roughly equal. Based on this, the target for gold could be around 2226USD. However, the 38.2% Fibonacci level at 2260USD and the 52-day moving average at 2248USD suggest a rapid drop is unlikely. A realistic target would be in the 2220USD range.

For day trading, the approach should lean towards selling, setting up a sell on a retrace to 2300USD. Place a stop loss if it exceeds 2305USD, with a target of 2260USD for closing.

Support/Resistance lines

Upcoming important support and resistance lines to consider:

2260USD — 38.2% Fibonacci

Market Sentiment

XAUUSD Sell: 47%, Buy: 53%

Featured Currency Pair of the Week (EURCHF)

EURCHF is on the rise. A weekly chart pattern of ‘bearish + hammer + bullish’ candles suggests an uptrend. It has risen to the 0.98CHF range, focusing on whether it can surpass the recent high of 0.985CHF.

If it exceeds 0.985CHF, the 61.8% Fibonacci expansion level of 0.990CHF would be the next resistance. The rise is supported by the 28-day moving average. Watch for updates to recent highs.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Germany & UK Holiday | – |

| US ADP Employment Report | 21:15 |

| US FOMC & Interest Rate Decision | Next 3:00 |

| Fed Chair Press Conference | Next 3:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.