USDJPY Briefly Drops below 153 JPY, Chair Powell Comments on Low Probability of Rate Hike【May 2, 2024】

Fundamental Analysis

- Fed Chair maintains dovish stance, hints at delayed timing for rate cuts

- Anticipated rate hikes deemed unlikely, leading to USD selling

- US crude oil inventories increase, resulting in a sharp drop in oil prices

USDJPY technical analysis

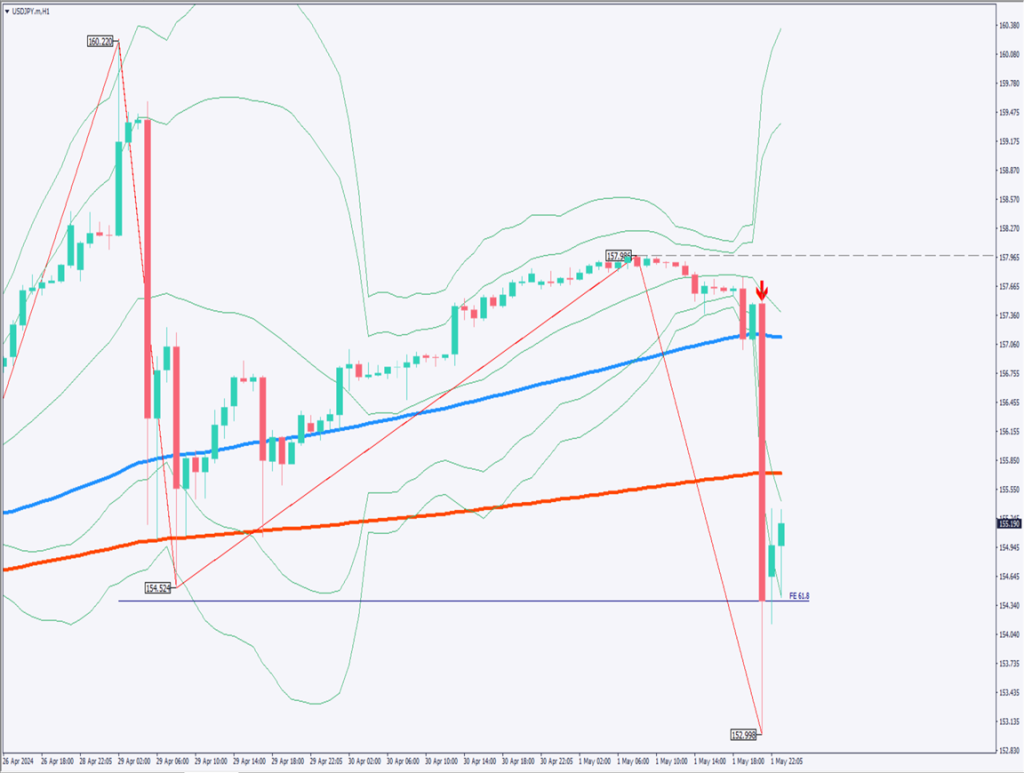

Examining the daily chart of USDJPY, it fell sharply following a press conference by Chair Powell, breaking below the 23.6% Fibonacci level, and temporarily dipping below 153 JPY.

The 28-day moving average will be a focus, with the next support level expected around the 38.2% Fibonacci retracement at approximately 152.50 JPY. The 152.26 JPY level serves as a major support line on both weekly and daily charts, and the early 152s appear solid, potentially requiring time to breach.

The short to medium-term trend is shifting, and a one-sided strategy favoring JPY weakness could backfire. A technical pause in the uptrend is anticipated, with corrective movements expected.

Day trading strategy (1 hour)

Analysis of the 1-hour chart of USDJPY shows a significant rebound at the 61.8% Fibonacci expansion. After breaking below the 240-moving average at 153 JPY, short covering brought it up to 154.38 JPY, and it is currently at 155.30 JPY.

Due to the steep decline breaking the -3σ line of the Bollinger Bands, a return to the 240-moving average could be possible. Attention is on whether this line will act as resistance; if so, a decline to 152.26 JPY, corresponding to 100%, might occur. Here, selling on the rebound near the 240-moving average is considered.

Entry strategy would be selling at 155.85 JPY, first take-profit at 154.50 JPY, and second take-profit at 152.50 JPY. The stop would be set if it exceeds the 240-moving average at 156.15 JPY.

Support/Resistance lines

The following are key support and resistance levels to consider:

154.38 JPY – 61.8% Fibonacci Expansion

152.26 JPY – Major weekly and daily support line

Market Sentiment

USDJPY: 69% selling, 31% buying

Featured Currency Pair of the Week (EURCHF)

EURCHF continues to rise. The 28-day moving average is acting as support, reaching up to 0.9835 CHF. While it has not touched 0.9850 CHF yet, surpassing it seems only a matter of time. Although the EUR was more frequently sold than the CHF at one point, it is now strengthening again.

Analyzing long-term trends, the EUR is clearly more often bought than the CHF, suggesting that EURCHF is likely to rise. Whether it surpasses 0.985 CHF remains a focal point, deserving continued attention.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Minutes of Japan’s Monetary Policy Meeting | 08:50 |

| Swiss Consumer Price Index | 15:30 |

| US Unemployment Claims | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.