USDJPY Rebounds, U.S. Treasury Secretary Warns Against Intervention【May 8, 2024】

Fundamental Analysis

- U.S. Treasury Secretary Yellen has cautioned the Japanese monetary authorities against continuing market interventions, affecting the USDJPY rate and increasing pressure towards a weaker JPY

- Kanda, the Japanese Finance Official, has no comment on the matter

- The focus for USDJPY returns to the interest rate differential between the U.S. and Japan, potentially aiming for 160JPY again

USDJPY technical analysis

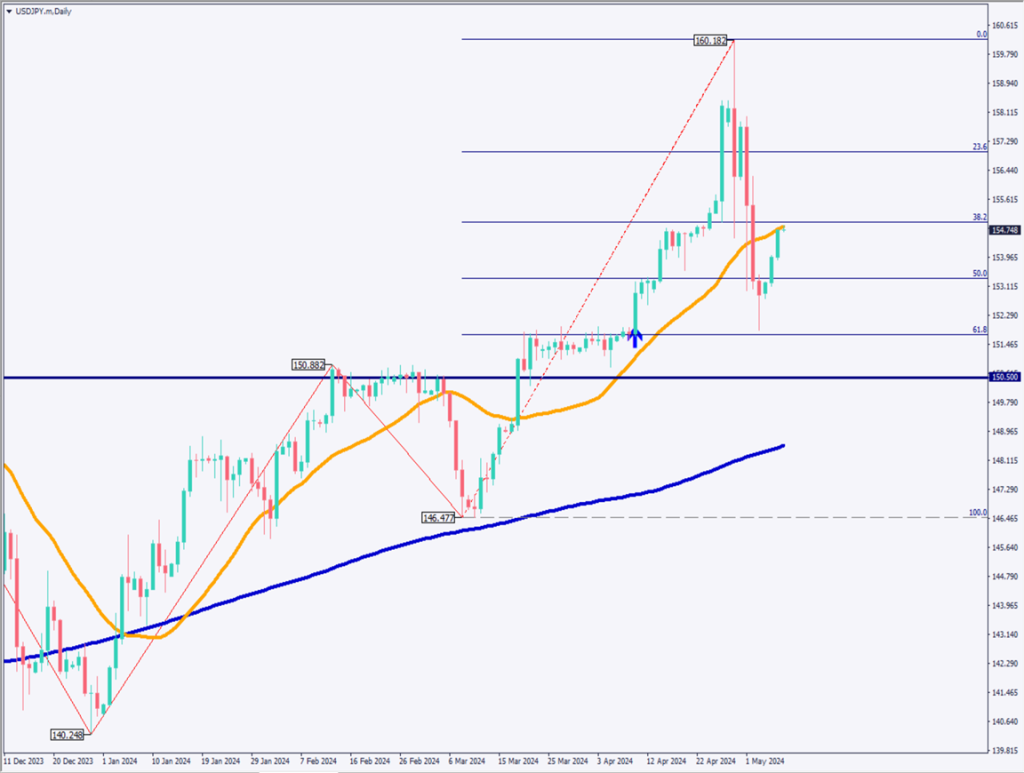

Analyzing the daily chart for USDJPY, the 24-day moving average is acting as a resistance line, but a weaker JPY trend is observed. This is partly due to U.S. Treasury Secretary Yellen’s remarks warning against ongoing interventions by Japanese authorities. There have already been interventions amounting to 8 trillion JPY, making a third intervention unlikely, as perceived by many traders.

Traders, previously cautious of further selling JPY due to fear of intervention, now find it easier to sell JPY and buy USD. USDJPY has continued to rise for three days, with renewed focus on the interest rate differential between the U.S. and Japan.

Keep an eye on movements around 154.90JPY, which corresponds to the 38.2% Fibonacci retracement level on the daily chart.

Day trading strategy (1 hour)

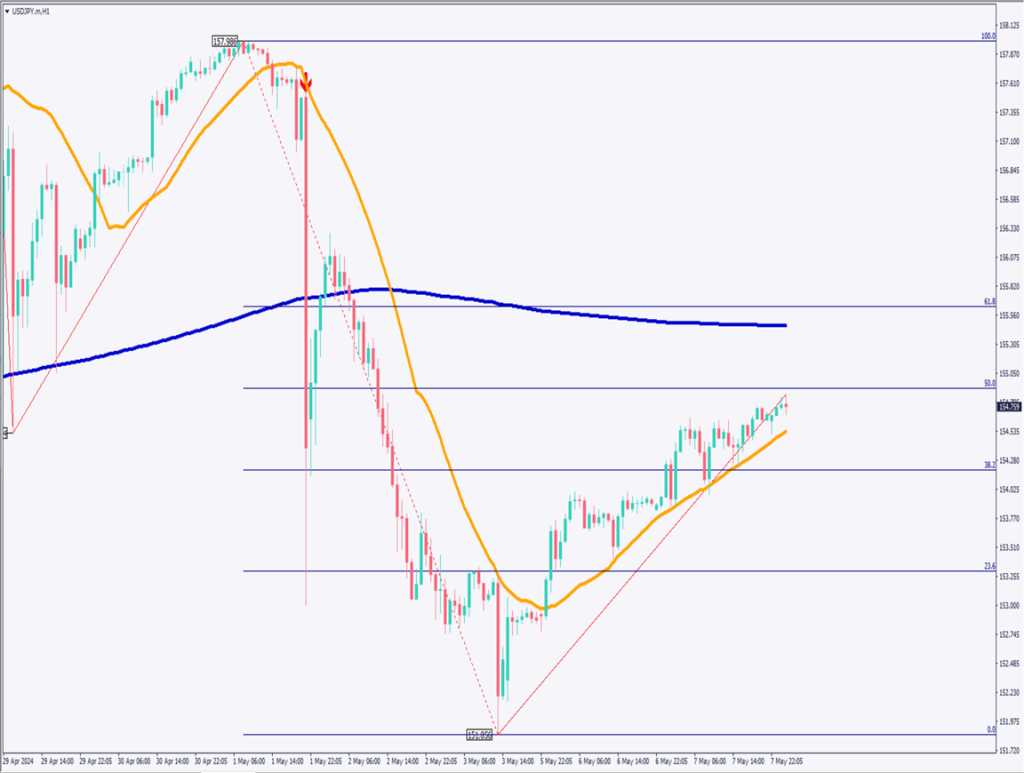

Analyzing the 1-hour chart for USDJPY, the pair has risen to around 154.80JPY. The area near 154.90JPY, corresponding to 38.2% on the daily Fibonacci retracement and 50% on the hourly Fibonacci retracement, appears to be a strong resistance level. Additionally, the 200 moving average lies just above.

Rather than the mid-154s, a strategy to pick dips in the early 154s or late 153s is preferable. Specifically, consider buying at 154.25JPY and selling at 155.35JPY, setting a stop loss if it falls below 153JPY.

Support/Resistance lines

The following are key support and resistance levels to consider:

154.90JPY — A pivotal price on the Fibonacci scale.

Market Sentiment

USDJPY Sell: 65%, Buy: 35%

Featured Currency Pair of the Week (EURAUD)

EURAUD has rebounded significantly. After initially dropping to 1.6217AUD, profit-taking activities are believed to have occurred. 1.62AUD is a very strong support level, so a prolonged rebound might be possible.

The Australian policy interest rate remains unchanged. Comments by the Governor of the Reserve Bank of Australia were dovish, leading to active selling of the AUD. Upcoming remarks on Euro interest rate policy are anticipated.

Attention should be given to movements seeking clues on policy rates and statements from key figures.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| U.S. Crude Oil Inventories | 23:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.