EURUSD Rises as U.S. Unemployment Claims Increase【May 10, 2024】

Fundamental Analysis

- U.S. unemployment claims have increased, leading to speculation of a rate cut and selling of the USD

- The Bank of England has decided to keep interest rates unchanged

- Two members of the Bank of England’s committee support a rate cut, leading to selling of the GBPUSD

EURUSD technical analysis

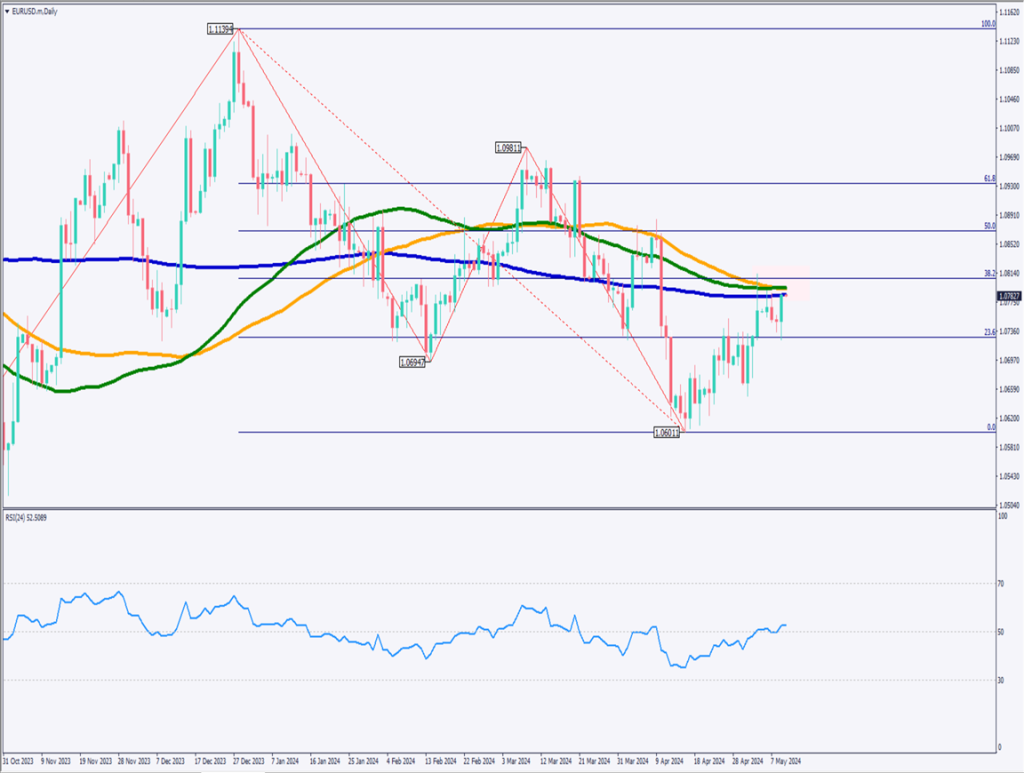

EURUSD has rebounded at the 23.6% Fibonacci retracement level, rising to 1.078 USD. The RSI is above 50, indicating an upward trend. However, resistance is seen at the 200-day, 90-day, and 72-day moving averages, and the 38.2% Fibonacci retracement level, specifically between 1.078 USD and 1.08 USD.

It’s natural to assume some traders might enter sell positions in this price range, expecting a possible decline. Moreover, with the increase in U.S. unemployment claims, there was strong selling of the USD, but the EUR also has potential downsides due to rate cut expectations.

Technically, until EURUSD clearly breaks above 1.08 USD, caution is warranted. Traders might want to engage in sell positions until a clear break above 1.08 USD occurs. If it surpasses 1.08 USD, a shift from a bearish to a bullish outlook is anticipated.

Day trading strategy (1 hour)

Analysis of the 1-hour chart for EURUSD shows that, despite rebounding at the daily Fibonacci retracement’s 23.6%, there has been strong selling pressure just below 1.08 USD, leading to repeated declines.

The convergence of three moving averages on the daily chart forms a strong resistance zone, making it difficult to break above easily. Remarks from Fed officials suggesting a rate cut could provide a catalyst to break above 1.08 USD. The results of next week’s U.S. CPI are also awaited.

Today’s day trading strategy involves a range strategy, selling around 1.08 USD and buying back around 1.073 USD, rotating positions accordingly. If a clear breakout occurs in either direction, positions should be stopped.

Support/Resistance lines

The following are important support and resistance lines to consider:

1.08 USD – Upper range limit

1.073 USD – Lower range limit

Market Sentiment

EURUSD Selling: 72% Buying: 28%

Featured Currency Pair of the Week (EURAUD)

EURAUD has declined at the conversion line of the Ichimoku cloud. A bearish engulfing pattern formed at the retracement high, and it has been trading below 1.63 AUD. However, immediate selling is not advisable after a decline. Around 1.62 AUD, there is strong buying interest, and short covering may occur.

A large-scale analysis of the daily chart suggests a transition from an uptrend to a downtrend. However, it’s premature to confirm a fully bearish trend.

1.62 AUD and 1.6130 AUD will be important support lines to watch.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Japanese Consumer Spending | 8:30 |

| UK GDP YoY | 15:00 |

| FOMC Member Speech | 22:00 |

| University of Michigan Consumer Sentiment Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.