USDJPY Sees Short-Covering as US Unemployment Claims Fall Below Expectations【May 17, 2024】

Fundamental Analysis

- US unemployment claims fell 10,000 below expectations, boosting USD buying.

- USDJPY dropped to the 153 JPY level but rebounded to the 155 JPY level due to short-covering.

- US financial officials suggest high interest rates might persist longer than expected.

USDJPY technical analysis

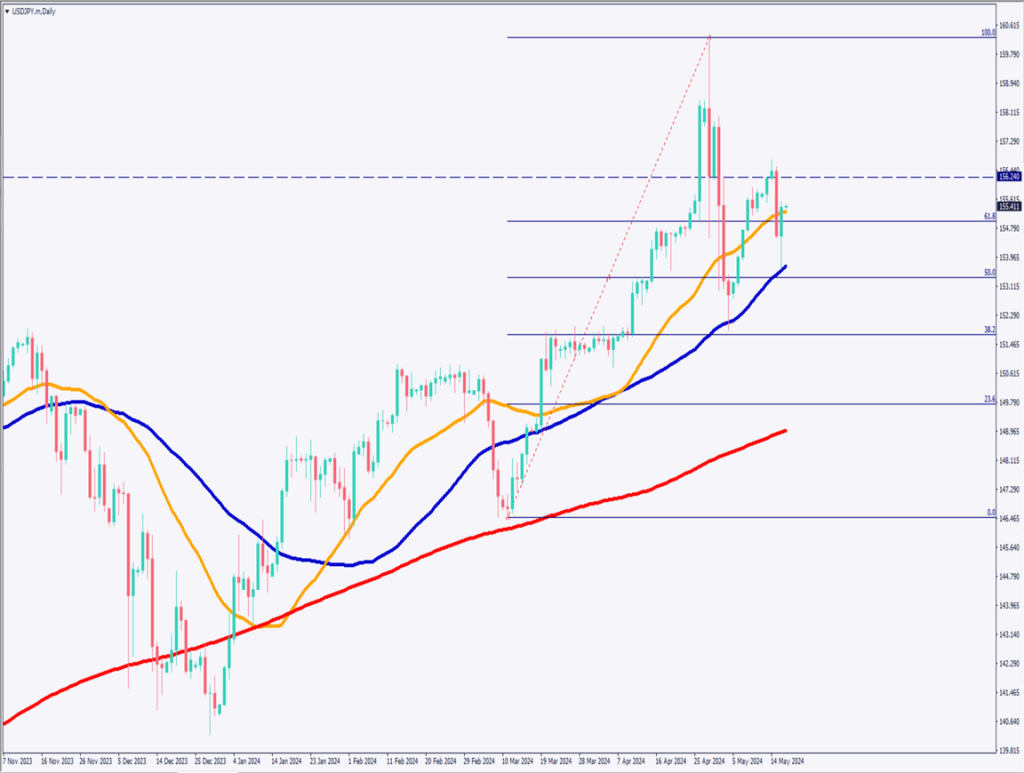

Analyzing the USDJPY daily chart: after breaking below the 28-day moving average, it rebounded at the 52-day moving average and the 50% Fibonacci retracement level.

Technically, there is a possibility of shifting from an upward to a downward trend.

Considering the case in 2022 when the exchange rate intervention caused a drop from the 151 JPY level to the 129 JPY level, a sharp JPY appreciation is possible this time as well.

However, with continued USD buying due to the decline in US unemployment claims and employment recovery, JPY appreciation is unlikely unless the Japan-US interest rate differential narrows.

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart: after plummeting from the 156 JPY level to the 153 JPY level, it has recovered to the 155 JPY level. Currently, it is trading above 155.50 JPY, with significant volatility.

In this situation, there is a possibility of aiming for the 156 JPY level again due to short-covering.

For day trading, a buy-on-dip strategy is recommended. Take a buy position if it drops to the lower 155 JPY level, set the target take-profit price at 156 JPY, and for risk management, set the stop-loss at 154.90 JPY.

Support/Resistance lines

The support and resistance lines to consider going forward are as follows:

156.25 JPY: Monthly resistance line

Market Sentiment

USDJPY Sell: 65%, Buy: 35%

Featured Currency Pair of the Week (AUDNZD)

The AUDNZD has declined for three consecutive days. It has broken below the 52-day moving average and is trading around 1.09 NZD. The 1.09 NZD level is also a monthly support line, so a rebound is expected.

The price of 1.087 NZD corresponds to the 50% Fibonacci retracement level, and a rebound is also expected here.

While being cautious of the rebound, it is a situation where we want to aim for selling on rallies. Around 1.093 NZD, we want to consider whether we can try selling on a rally.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| ECB Vice President Speech | 16:20 |

| Bank of England Official Speech | 17:00 |

| EU Consumer Price Index | 18:00 |

| US Leading Index | 23:00 |

| Federal Reserve Official Speech | 23:15 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.