USDJPY Reaches 156 Level Following Hawkish Remarks from Fed Officials, Poised to Break Recent High【May 21, 2024】

Fundamental Analysis

- Hawkish remarks from Fed officials are pouring in, with many advocating for maintaining current interest rates.

- US long-term interest rates have risen, pushing USDJPY to the 156 level.

- Attention is focused on whether USDJPY will break the recent high of 156.76.

USDJPY technical analysis

Analyzing the daily chart for USDJPY, the pair continues to rise, reaching 156.38. The focus is on whether it will break the recent high of 156.76. Analyzing the ADX, the upward trend momentum is resurfacing, and if 156.76 is surpassed, there is potential to challenge the 158 and 160 levels.

Hawkish remarks from Fed officials are abundant. One official commented that “expectations for three rate cuts are no longer appropriate,” while another Fed member emphasized the idea of persistently maintaining current rates. While Fed Chair Powell holds a dovish stance with a preference for rate cuts, he appears to be in the minority within the Fed.

The rise in US long-term interest rates has led to dollar strength and yen weakness pressures.

Day trading strategy (1 hour)

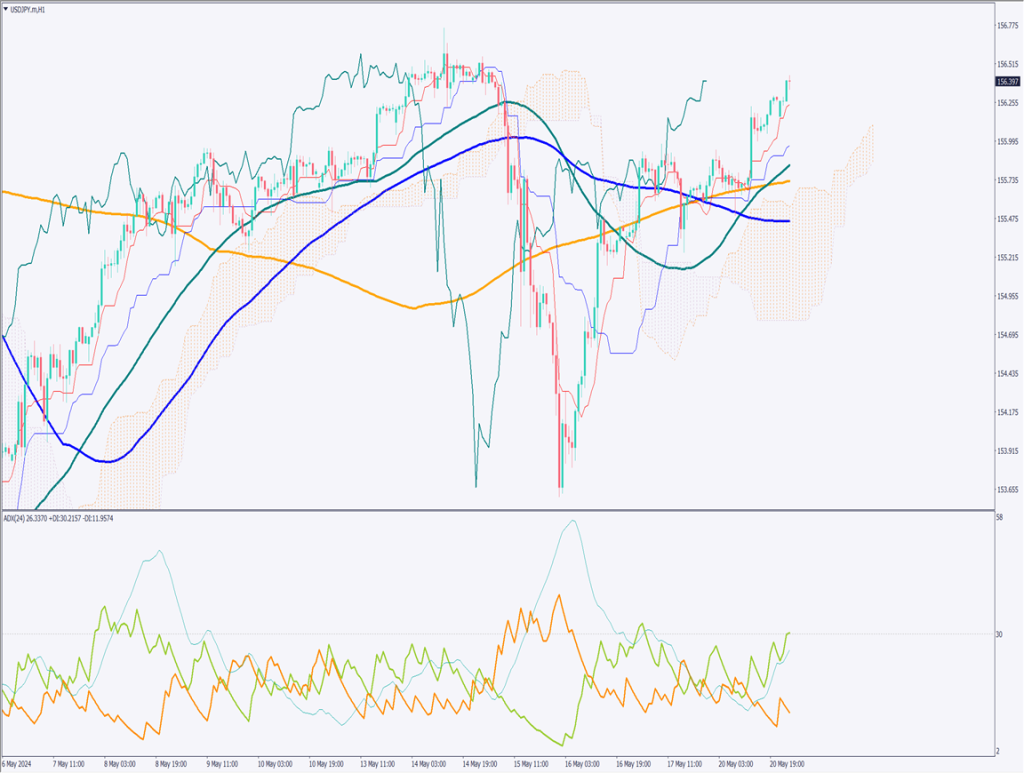

Analyzing the hourly chart for USDJPY:

It has nearly fully retraced, and a new high is close. There are no significant resistance lines, and it is forming an uptrend along the Ichimoku Kinko Hyo’s conversion line. A golden cross has occurred with the 52-period moving average crossing above the 200-period moving average. The key point is whether it will break the recent high.

The day trading strategy is to buy on dips. We want to wait for a drop to around 156.00. Specifically, buy at 156 JPY, target 156.75 JPY for closing, and set a stop at 155.75 JPY.

Support/Resistance lines

The support and resistance lines to consider moving forward are as follows:

156.76 JPY – Recent high

Market Sentiment

USDJPY – Sell: 68%, Buy: 32%

Featured Currency Pair of the Week (CHFJPY)

Swiss Franc to Japanese Yen (CHFJPY) has risen to 171.78 JPY, continuing its uptrend for three days. The conversion line of the Ichimoku Kinko Hyo acts as a resistance line, and if it breaks through, there is potential to rise to the recent high around 172.70 JPY. Analyzing the ADX, although the upward momentum has slightly weakened, yen weakening pressures remain strong.

There are few factors for yen strength, and the market is swayed by comments from US financial officials. With many significant remarks expected today, caution is advised.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Australian Monetary Policy Meeting Minutes | 10:30 |

| US Treasury Secretary Yellen’s Remarks | 17:00 |

| ECB President Lagarde’s Remarks | 17:00 |

| Canada Consumer Price Index | 21:30 |

| Fed Officials’ Remarks | 22:00 |

| FOMC Members’ Remarks | 22:10 |

| Bank of England Governor’s Remarks | 2:00 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.