EURUSD Continues to Rise, Engulfing Pattern Recently Appeared【May 27, 2024】

Fundamental Analysis

- UK Prime Minister Sunak announces July general election, June rate cut virtually ruled out

- GBPUSD and GBPJPY continue to rise, GBPJPY nears 200 JPY

- BOJ Governor Ueda comments that long-term interest rates should be market-formed

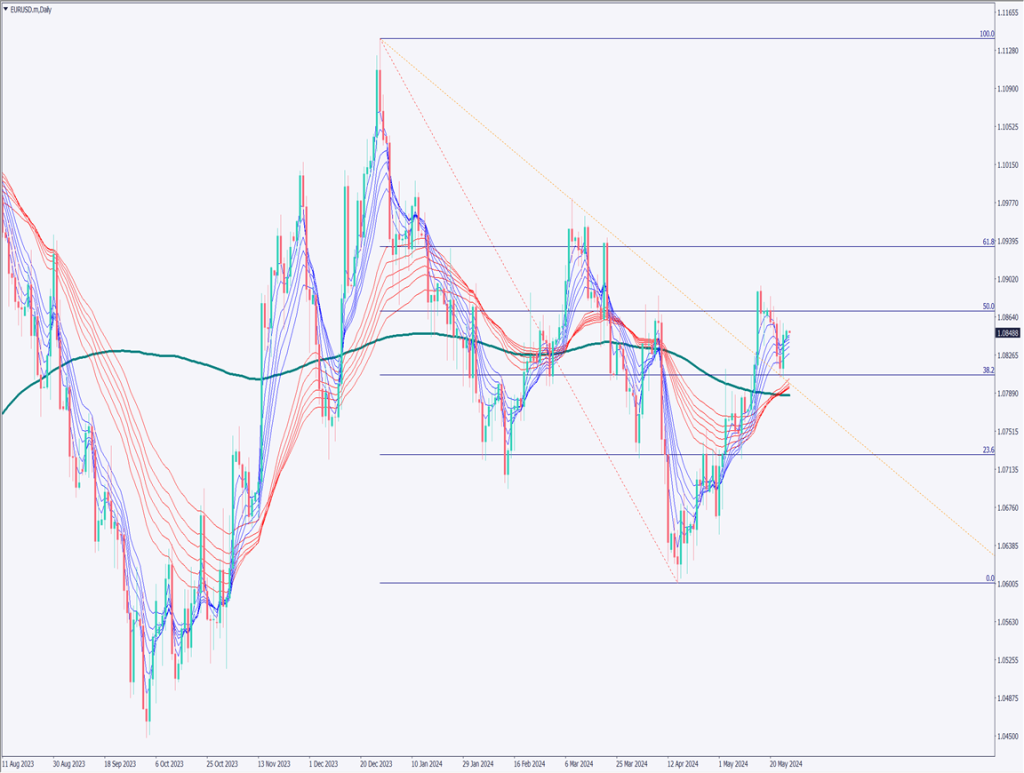

EURUSD technical analysis

Analyzing the daily chart of EURUSD, an engulfing pattern has recently appeared, and Friday saw a continued rise. This is considered to be a buy-on-dip occurrence.

Drawing a Fibonacci retracement shows that the 50% level will be the next resistance. The long-term GMMA has crossed above the 240-day moving average, forming a golden cross. If this situation continues, it is likely that the price will rise today as well, aiming for 1.087 USD.

Day trading strategy (1 hour)

In the 1-hour chart analysis of the day trading strategy, drawing a descending channel shows the upper line as resistance, making the upper price heavy. While the daily chart suggests a transition to an uptrend, the 1-hour chart remains unstable until the upper line is breached.

The descending trend line has broken out, and the focus is on whether it can break above the descending channel. Analyzing market sentiment shows that 87% are holding short positions, and if the upper line of the descending channel is broken upwards, stop-loss orders may trigger a significant rise.

The day trading policy is to consider entering a buy position upon confirming a clear break above the 1.085 USD upper line. However, with resistance also at 1.086 USD, caution is required regarding position size. If 1.086 USD is surpassed, the scenario considers a rise towards 1.09 USD. If the upper line cannot be breached, entry should be avoided.

Support/Resistance lines

The following support and resistance lines should be considered going forward:

1.086 USD – Fibonacci 61.8%

Market Sentiment

EURUSD Sell: 83% Buy: 13%

Featured Currency Pair of the Week (GBPCAD)

Analyzing GBPCAD, the UK is approaching a general election in July. Due to this political event, a rate cut in June is virtually off the table. While major countries focus on when rate cuts will be implemented, funds seem to be flowing into the more likely-to-remain-steady GBP. GBPCAD has been rising since May 9th, surpassing recent highs. However, it is essential to consider that resistance around 1.74 CAD may make the upper price gradually heavier.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| UK, US Holidays | – |

| Germany Economic Forecast | 17:00 |

| ECB Official Speech | 21:00 |

| FOMC Member Speech | Next Day 2:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.