USDJPY Loses Upward Momentum, Monthly Pivot Turns Downward【June 3, 2024】

Fundamental Analysis

- Weak US PCE Results, Signs of Slowing Inflation

- US Long-term Yields in Downward Trend, Falling for Two Consecutive Days

- USDJPY Continues to Hover Around 157 JPY, Limited Rise in Japanese Long-term Yields

USDJPY technical analysis

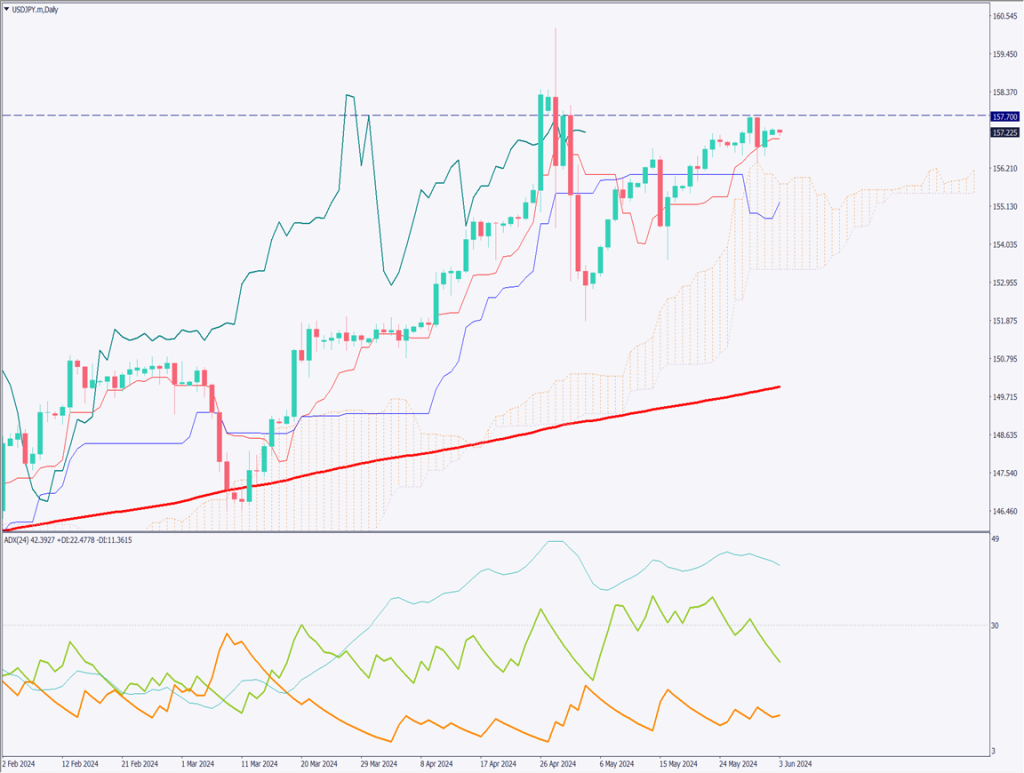

USDJPY is losing its upward momentum. Looking at the ADX, it indicates a strong trend at 42, but the +DI is at 22, below 30, suggesting weakened momentum. While it is not in a downward trend, the strong JPY depreciation seen before is no longer present. Intervention in the forex market from late April to early May successfully curbed the upward momentum. The focus now is on whether USDJPY can break above 157.70 JPY.

Looking at the monthly pivot transition, it had been rising for five consecutive months, but the June pivot fell below the previous month’s pivot point to 155.70 JPY. Japanese long-term yields are gradually rising, while US long-term yields are falling. Depending on US economic indicators, there is a need to prepare for downside risks.

Day trading strategy (1 hour)

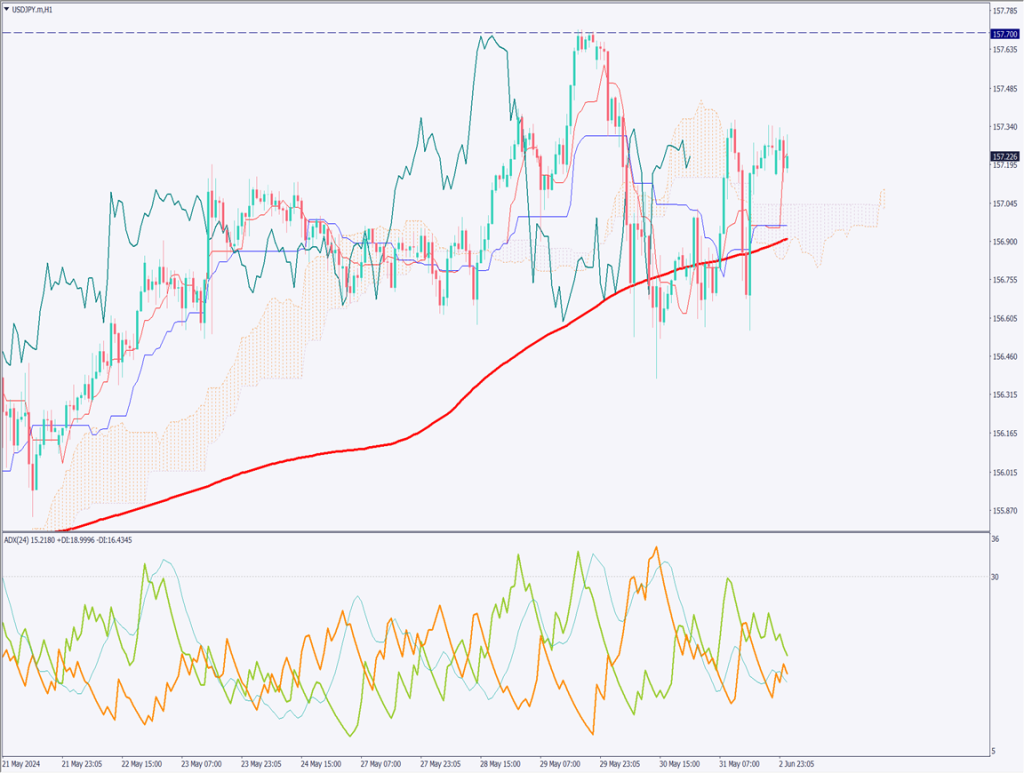

USDJPY has been repeatedly rebounding around the 200-period moving average. Although selling pressure is gradually increasing, it seems to be in a standoff with traders buying on dips. USDJPY is hovering around 157.20 JPY, unable to break above the recent high of 157.70 JPY, resulting in a range-bound market.

With the employment statistics ahead this week, it seems likely that the range market around 157 JPY will continue. Policy rate announcements from the EU and Canada are also forthcoming. If the US PCE results are weak and the US employment statistics also weaken, there is a high possibility that USDJPY will turn downward.

The day trading policy is to adopt a range strategy. The range width is 156.50 JPY to 157.96 JPY. The approach is to buy in the mid-156 JPY range and sell in the upper 157 JPY range.

Support/Resistance lines

The support and resistance lines to consider going forward are as follows:

155.70 JPY – Monthly Pivot Point

Market Sentiment

USDJPY Sell: 65% Buy: 35%

Featured Currency Pair of the Week (NZDCAD)

The most significant event for New Zealand Dollar/Canadian Dollar this week will be the policy rate announcement from Canada. It is expected that Canada will implement a rate cut from 5.0% to 0.25%. On the other hand, there were reports that the NZ Central Bank discussed raising rates. This will exert upward pressure on NZDCAD.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| US ISM Manufacturing PMI | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.