Gold Plummets, U.S. Employment Report Surprises【June 10, 2024】

Fundamental Analysis

- The U.S. employment report surprises with a significant increase in new hires.

- The forex market sees a strong USD, with rate cut expectations diminishing.

- Interest rate forecasts are scheduled to be announced this week, with a shift from twice to once a year cut expectation.

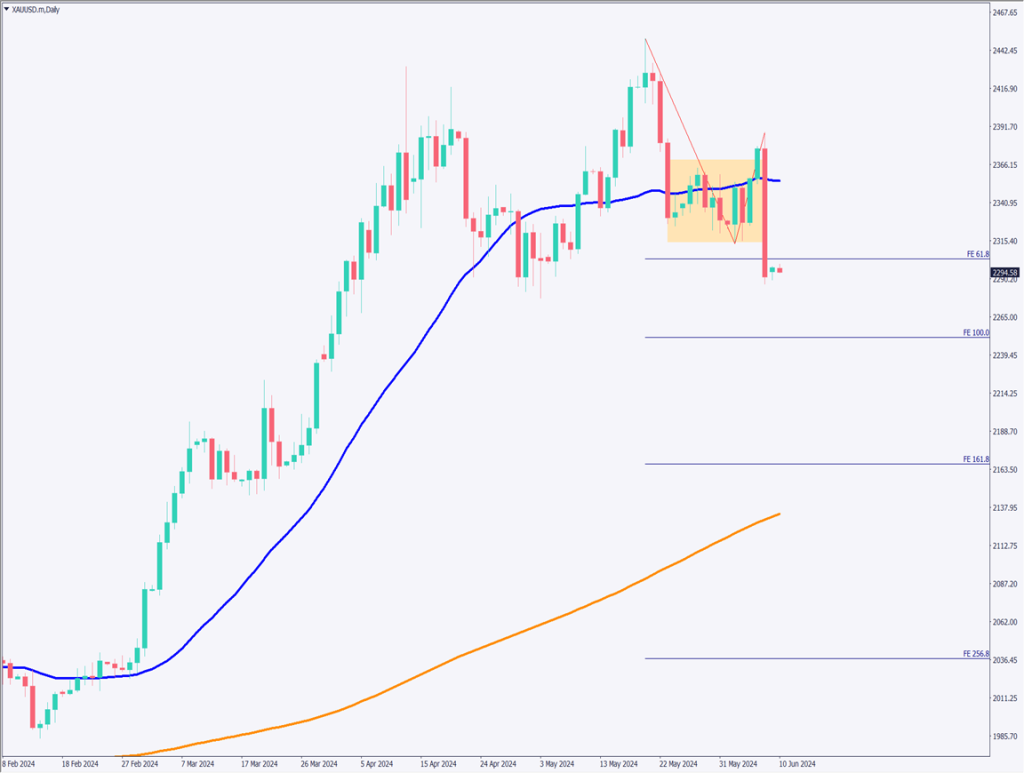

XAUUSD technical analysis

Analyzing the daily chart of gold. Gold has significantly fallen below the 28-day moving average, showing a pattern similar to the three black crows. An engulfing pattern at the high range is one sign indicating a potential decline. Drawing the Fibonacci expansion reveals that it has broken below 61.8% and is aiming for 100%.

A major support line is around 2255USD to 2265USD, indicating a potential sharp drop until this range, requiring caution. However, with the RSI at 32, a sharp rebound is also possible.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of gold. The 28MA has fallen below the 52MA, completing a death cross. The downward trend is expected to continue for a while. Despite the dot plot announcement this week, the surprise in the employment report suggests a selling-led market. If it reaches the 2300USD range, selling pressure may increase.

Currently, the RSI is at 32, indicating it is slightly oversold. However, the significant reduction in rate cut expectations implies that the possibility of a July rate cut is now considered null. Therefore, the day trading strategy remains to approach with selling.

The day trading strategy is to sell when approaching 2300USD. Continuously sell down to 2260USD. Due to the possibility of a rebound, careful position management is required. The strategy involves frequently selling and settling.

Support/Resistance lines

The support and resistance lines to consider are as follows:

2265USD: Major support line

2250USD: Fibonacci 100%

Market Sentiment

XAUUSD Sell: 61%, Buy: 39%

Featured Currency Pair of the Week (GBPNZD)

GBP/NZD surged from 2.06NZD to 2.08NZD. The RSI at 51 indicates an upward trend for the first time in a while. Due to the U.S. employment report, NZD selling outweighed GBP selling, resulting in a surge in GBPNZD. A slightly tricky market. This week, multiple UK economic indicators are scheduled to be released and should be noted.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Japan GDP | 8:50 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.