USDJPY Rises Amid Concerns of Concurrent Bond Purchase Reduction and Rate Hike【June 26, 2024】

Fundamental Analysis

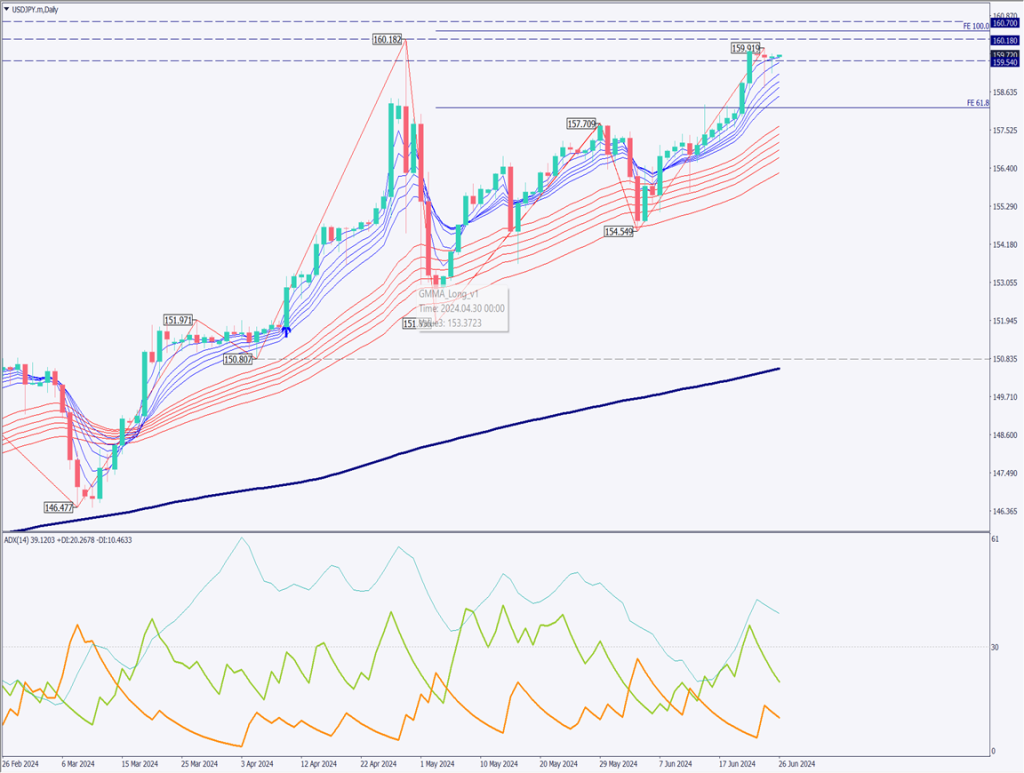

- USDJPY remains stuck in the 159 JPY range, failing to reach the 160 JPY range.

- An increase in positions anticipating currency intervention, targeting a high of 160.18 JPY.

- Expectations rise for the simultaneous implementation of the BOJ’s bond purchase reduction and rate hike.

USDJPY technical analysis

USDJPY remains stuck in the high 159 JPY range. Analyzing the daily chart, the week closed above 159.50 JPY, continuing the struggle between selling and buying pressure in the 160 JPY range. The main opinions from the BOJ’s policy decision meeting have been published. Hawkish opinions are lined up, such as implementing a policy rate hike and balance sheet reduction separately from interest rate policies.

The simultaneous implementation of the BOJ’s bond purchase reduction and policy rate hike appears to be capping the upside of USDJPY. The current target high is expected to be 160.18 JPY. If it reaches 160.40 JPY, there is a high likelihood of corrective selling.

Day trading strategy (1 hour)

Analyzing the market sentiment for USDJPY, over 70% are in selling positions, expecting currency intervention. However, actual currency intervention might only occur if it reaches a high above 165 JPY. The conditions for currency intervention are “rapid” JPY depreciation, and gradual depreciation may not be subject to intervention.

The day trading policy is to sell at 160.40 JPY, buy back at 159.65 JPY, and set a stop at 160.80 JPY. If it breaks above 160 JPY, it may rise rapidly, but selling pressure is also expected, so a deeper contrarian approach is desired.

Support/Resistance lines

The following support and resistance lines should be considered in the future:

- 160.18 JPY: Recent high

Market Sentiment

USDJPY Sell: 73%, Buy: 27%

Featured Currency Pair of the Week (GBPCHF)

GBPCHF continues to rise. The reason is the additional rate cut policy in Switzerland, leading to the selling of CHF. Currently, it is trading at 1.135 CHF and may rise to 1.138 CHF, but a correction could occur.

If it drops to 1.1318 CHF, consider a buying position.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| US New Home Sales | 23:00 |

| US Crude Oil Inventories | 23:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.