USDJPY Reacts to Dollar Strength; Trump Leads in Debate【July 1, 2024】

Fundamental Analysis

- The U.S. presidential debate shows Trump in the lead, raising concerns about President Biden’s age.

- The U.S. PCE core price index falls short of expectations, possibly increasing speculation of a U.S. rate cut.

- The French general election sees the far-right party leading, with Macron’s party expected to lose a significant number of seats.

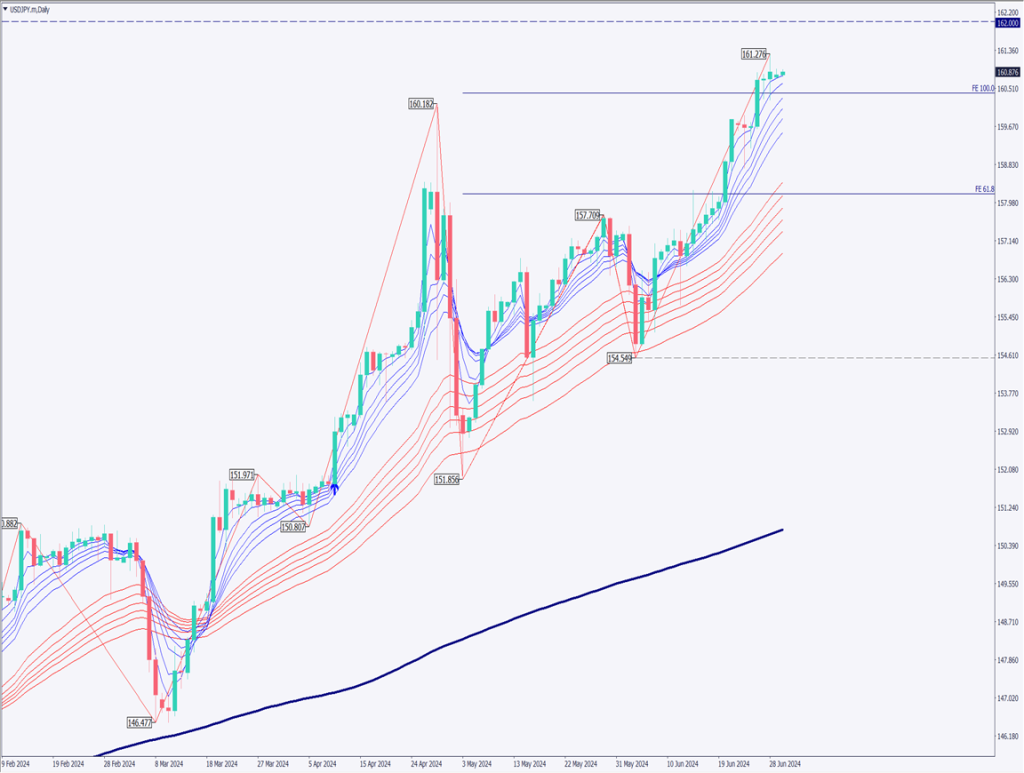

USDJPY technical analysis

Analyzing the USDJPY daily chart: The pair has reached the 161 JPY level and is hovering in the upper 160 JPY range at the time of writing. This is the weakest yen level since 1987, indicating almost an unbounded yen depreciation. It is projected to aim for 164 JPY, though some experts suggest it could target 170 JPY.

In the U.S. presidential debate, Trump emerged as the dominant figure. He has called dollar strength “the worst scenario,” and if he wins, there could be a shift to yen appreciation. However, the initial reaction to Trump’s lead was dollar strength, making predictions challenging.

At the very least, a continued yen depreciation trend is expected over the coming weeks.

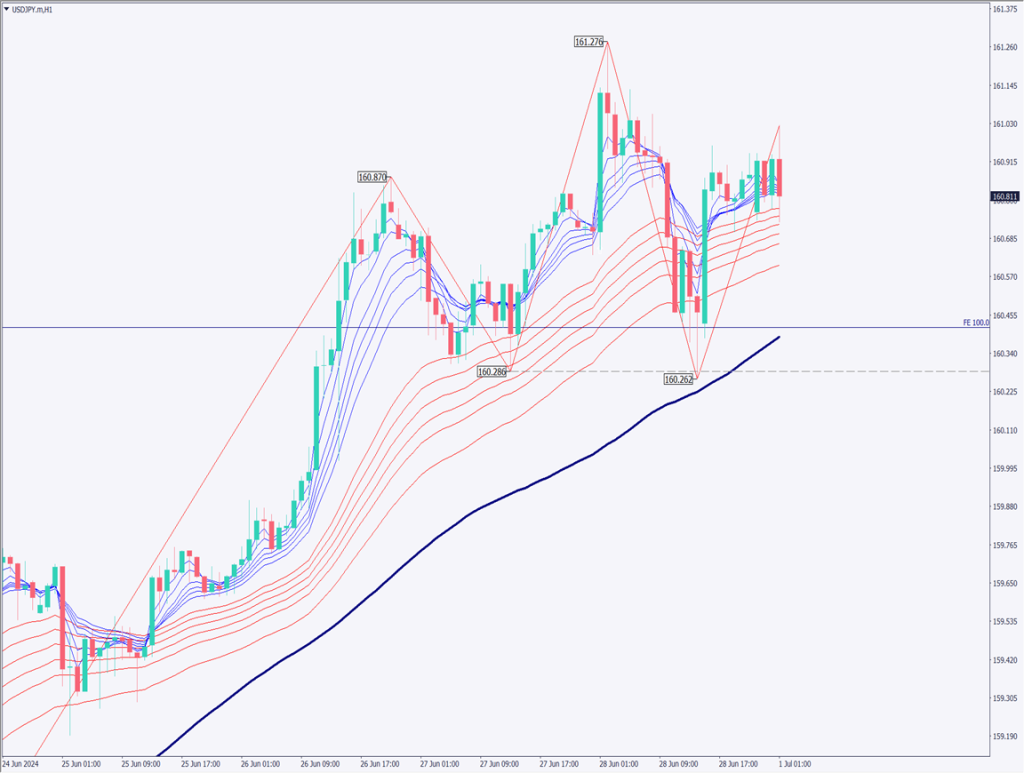

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart: Despite a pullback at the 161 JPY level, there has been a rebound at 160.40 JPY, suggesting continued dip-buying. The recent high is at 161.27 JPY, and attention is on whether it will break above this level. If it does, it is likely to aim for the 161 JPY range.

The day trading strategy is to buy on dips. Entry at 160.40 JPY, take profit at 161 JPY, and stop loss at 160.15 JPY.

Support/Resistance lines

The support and resistance levels to consider are as follows:

160.40 JPY .. Fibonacci 100%

Market Sentiment

USDJPY Selling: 52% Buying: 48%

Featured Currency Pair of the Week (NZDJPY)

The New Zealand Dollar to Japanese Yen shows a strong yen depreciation trend. Since around May 6, it has continuously risen from the 91 JPY range to the 98 JPY range. New Zealand maintains a hawkish stance with comments like “considering additional rate hikes” due to a high underlying inflation rate. The widening interest rate differential accelerates yen depreciation.

NZDJPY is likely to aim for 100 JPY. Having already surpassed the pre-Lehman high of 97.74 JPY, the extent of its rise is uncertain. Yen depreciation is expected to continue.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Australia Retail Sales | 10:30 |

| Germany Consumer Price Index | 21:00 |

| U.S. ISM Manufacturing PMI | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.