USDJPY Rises, Aiming for Steady High Updates【July 10, 2024】

Fundamental Analysis

- Chairman Powell commented on signs of softening US employment

- The forex market reacted with a stronger USD, and USDJPY temporarily traded around 161.50 JPY

USDJPY technical analysis

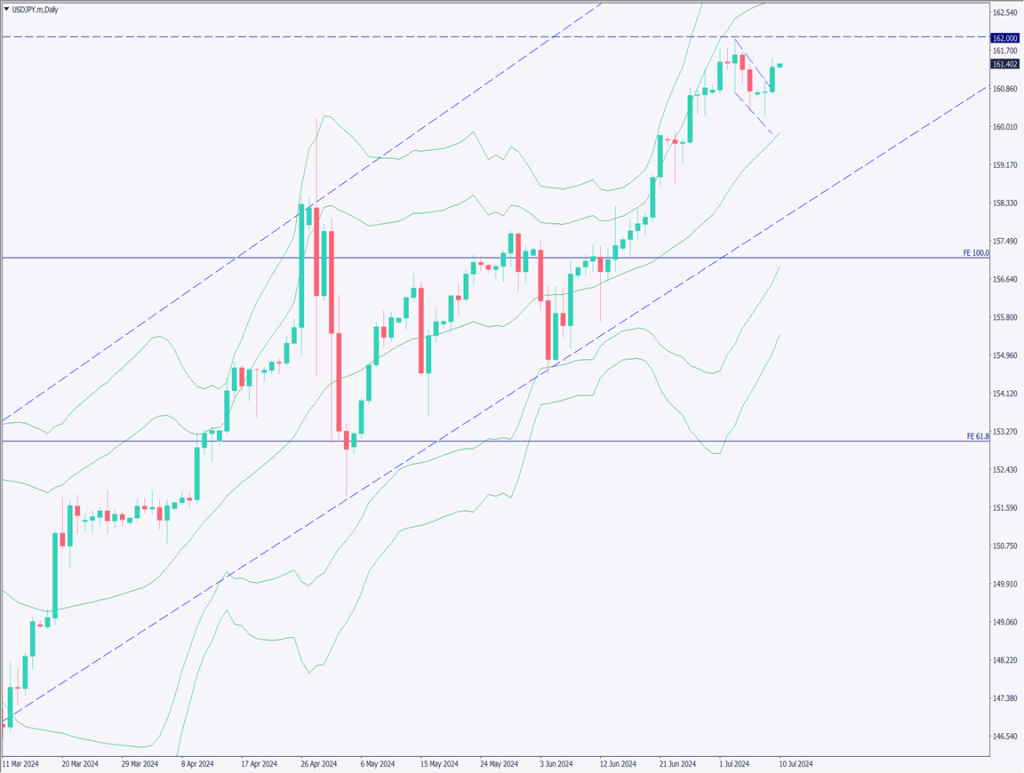

Analyzing the daily chart of USDJPY, it is trading within a large ascending channel, confirming a steady trend of JPY depreciation. As it hasn’t surpassed the +2σ of the Bollinger Bands and is fluctuating slowly, I don’t think we need to worry about forex intervention for the time being.

The major resistance band on the upside is predicted to be at 163.20 JPY. If it surpasses 162 JPY, it might trigger stop losses and rise significantly. At 163.65 JPY, there is the 161.8% line of Fibonacci expansion, so it may take some time to break through 163 JPY.

Day trading strategy (1 hour)

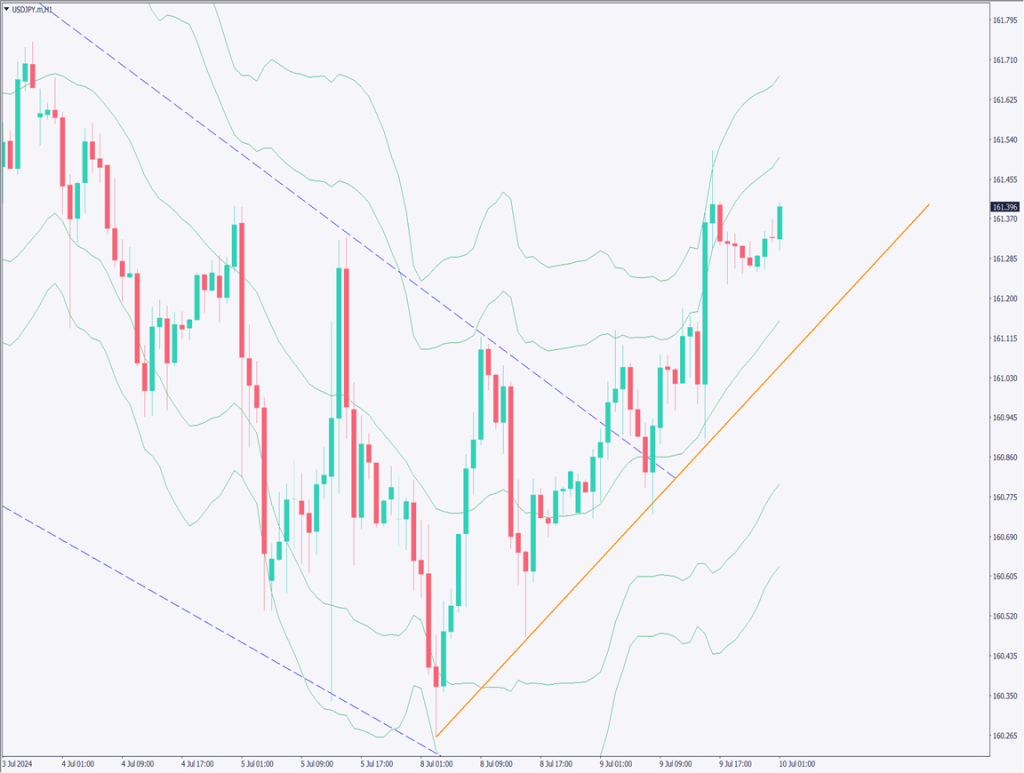

Analyzing the 1-hour chart, the lows are rising, confirming a short-term upward trend. The major resistance line on the upside is around 163.20 JPY, and while some adjustments might be interspersed, I believe JPY depreciation will continue steadily.

The direction is likely to be determined by tomorrow’s US CPI announcement.

Today’s day trading policy is buying. Since 161.55–161.65 JPY is a resistance band, I aim to buy on dips. The strategy is to enter a buy position around the centerline of the Bollinger Bands, sell out at 161.55 JPY, and set a stop if it falls below 160.80 JPY.

Support/Resistance lines

The support and resistance lines to consider going forward are as follows:

162 JPY – Resistance Line

Market Sentiment

USDJPY – Sell: 66% Buy: 34%

Featured Currency Pair of the Week (AUDJPY)

AUDJPY has risen. At the time of writing, it is trading around 108.80 JPY. As USDJPY recovered to the mid-161 JPY level, JPY depreciation progressed. The upward momentum is very gradual, and it is steadily rising towards the target of 109 JPY. There may be an adjustment at 109 JPY, but it seems likely to try once. At 109 JPY, profit-taking sales might occur.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| RBNZ Policy Rate | 11:00 |

| OPEC Monthly Report | 20:00 |

| Chairman Powell’s Testimony | 23:00 |

| US Crude Oil Inventories | 23:30 |

| BoE Official Speeches | 0:30 the next day |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.