USDJPY Aiming for 162 Yen, US CPI Released Today【July 11, 2024】

Fundamental Analysis

- US Stock Indices and Nikkei 225 Updating Record Highs

- US Rate Cut Expectations Persist, Capital Flows into Stock Markets

- US Consumer Price Index to be Announced Today, Caution for Forex Market Volatility

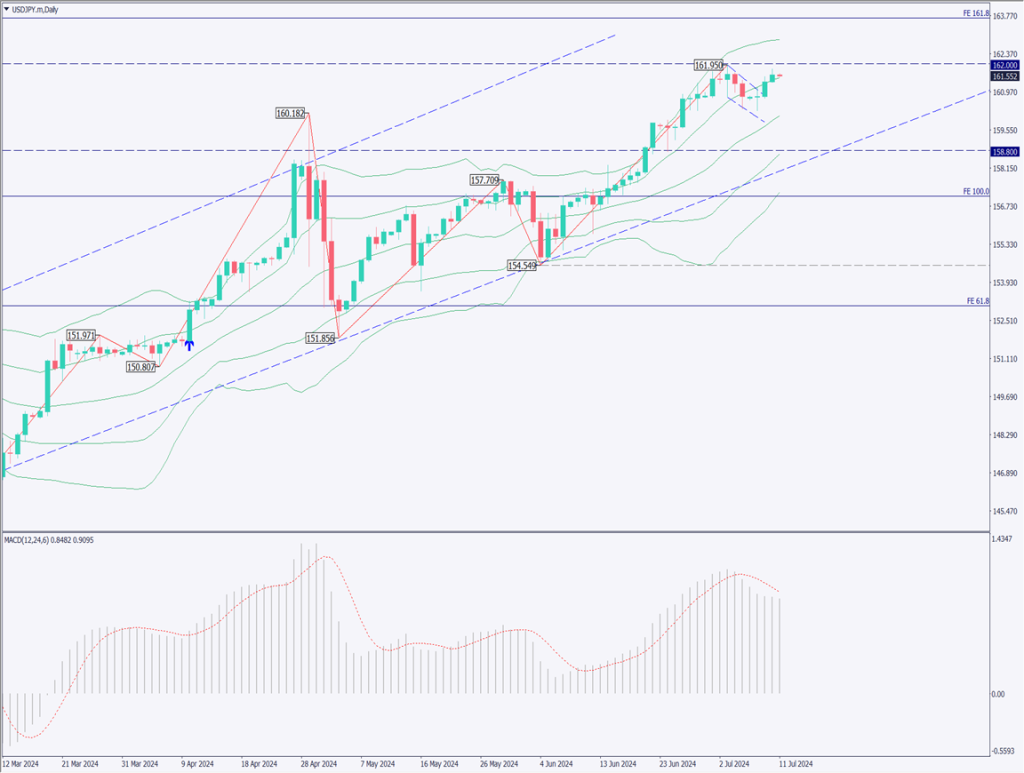

USDJPY technical analysis

Analyzing the daily chart of USDJPY. USDJPY rebounded at 160.30 JPY and is recovering. The recent high is 161.95 JPY, and the focus is on whether it can break above the 162 JPY level. It has crossed above the conversion line of the Ichimoku Kinko Hyo and surpassed the +1σ line of the Bollinger Bands.

A concern is that the MACD histogram is below the signal line.

If today’s US CPI increases rate cut expectations, there is a possibility of a momentary dollar sell-off. However, even at the current level of 161 JPY, 31% of the market sentiment is buy positions, and the more it drops, the more new buy orders and limit orders will increase.

We want to consider whether it is possible to buy on dips.

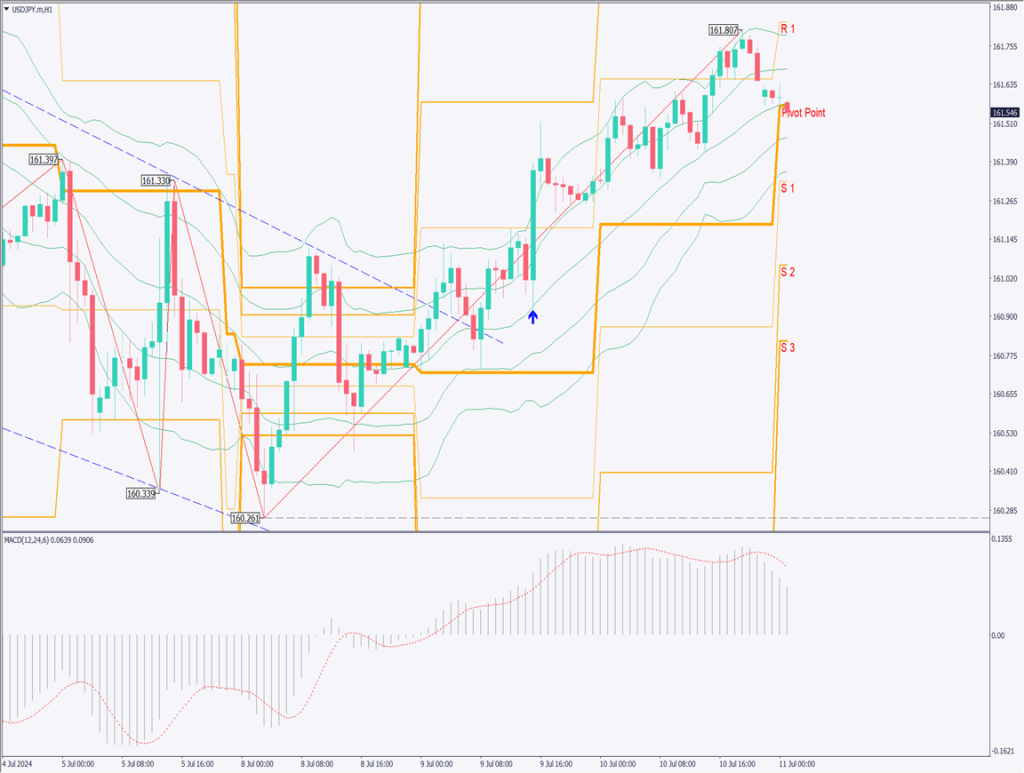

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY. The pivot point is at 161.56 JPY, and it might be difficult to buy actively before the CPI. This is a crucial indicator that depends on whether US rate cuts will materialize, and market interest is high.

Looking at recent US economic indicators, weak results stand out. Therefore, it is thought that the CPI might result in weaker numbers. If this happens as expected, considering USDJPY, there is a possibility of a momentary dollar sell-off and a decline. We want to try to buy on dips.

If the CPI results are strong, the rate cut expectations will recede. USDJPY is likely to rise sharply. However, this would be a negative factor for stock prices. If the result is strong, we expect a final rise to 163.21 JPY.

Support/Resistance lines

The support and resistance lines to consider going forward are as follows:

161.56 JPY – Pivot Point

Market Sentiment

USDJPY Sell: 69% Buy: 31%

Featured Currency Pair of the Week (AUDJPY)

AUDJPY has reached the 109 JPY level. There is no sign of correction, and the yen’s depreciation is gradually progressing. Drawing Fibonacci expansion on the daily chart shows that 109.70 JPY corresponds to 100%. Pay attention to the movement around 109.70 JPY.

Due to the dovish statement from the RBNZ, NZDJPY is falling. An engulfing pattern has appeared at the high range.

However, this has not affected AUDJPY, and there is currently no impact. Today’s US CPI will determine the market direction. If the CPI is weak, the AUD might become relatively strong against the USD, and AUDJPY might rise sharply. Pay attention to tonight’s movement.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| UK GDP | 15:00 |

| Germany Consumer Price Index | 15:00 |

| US Core CPI | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.