USDJPY Falls to 155 JPY, Downtrend Triggered by Dow Theory【July 24, 2024】

Fundamental Analysis

- Government and ruling party officials demand BOJ normalization, de facto rate hike comments lead to JPY appreciation.

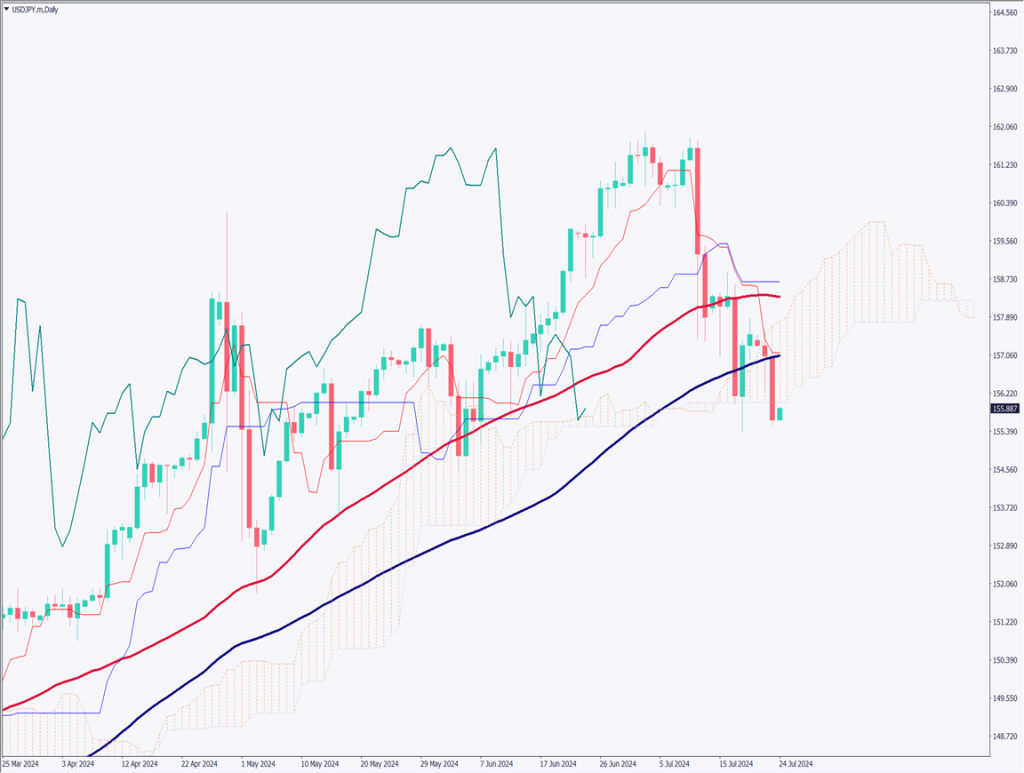

- USDJPY breaks below the 90-day moving average, initiating a downtrend.

- USDJPY falls below the Ichimoku Cloud.

USDJPY technical analysis

Analyzing the daily chart of USDJPY, the pair fell significantly below the 90-day moving average. Yesterday, LDP Secretary-General Toshimitsu Motegi demanded “BOJ policy normalization,” effectively calling for a rate hike. The USDJPY market reacted with JPY appreciation, hitting a low of 155.550 JPY. It broke through the Ichimoku Cloud.

Since it is below the recent low, a downtrend is triggered according to Dow Theory. Expectations are rising for a simultaneous reduction in large-scale government bond purchases and a rate hike at next week’s BOJ meeting.

However, there are also cautious views on rate hikes, as domestic consumption in Japan is declining. Some argue that raising rates amid declining consumption could cause significant damage. Next week’s USDJPY market is likely to be tense.

Day trading strategy (1 hour)

USDJPY fell from 157 JPY to 155 JPY in response to government officials’ demands for a rate hike. However, 155.50 JPY is solid, making it difficult to enter a sell position at the 155 JPY level. It might be better to wait for a rebound and sell.

While officials’ comments are unpredictable, a short sell entry might be considered in the high 157 JPY range. If it clearly breaks below 155.50 JPY, it could target 154.50 JPY.

Support/Resistance lines

The following support and resistance levels should be considered going forward.

154.50 JPY – Past Low

Market Sentiment

USDJPY Sell: 48% Buy: 52%

Featured Currency Pair of the Week (USDCHF)

USDCHF continues to rise. USD buying is strengthening, and it has risen to 0.8920 CHF. There is a base line at 0.8935 CHF and a 52-day moving average at 0.8960 CHF, and it is noteworthy whether it can break above these levels. First, we need to confirm that the 52-day moving average is functioning as a resistance line.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Nikkei Services PMI | 9:30 |

| Canada Policy Rate | 22:45 |

| US Crude Oil Inventory | 23:30 |

| Bank of Canada Governor Press Conference | 23:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.