USDJPY Slightly Bullish, Focus on BOJ’s Interest Rate Decision【July 31, 2024】

Fundamental Analysis

- Simultaneous BOJ Meeting and FOMC, Attention on Each’s Interest Rate Policies

- If the BOJ Decides on an Additional Rate Hike, It Could Reach the 140 JPY Level

USDJPY technical analysis

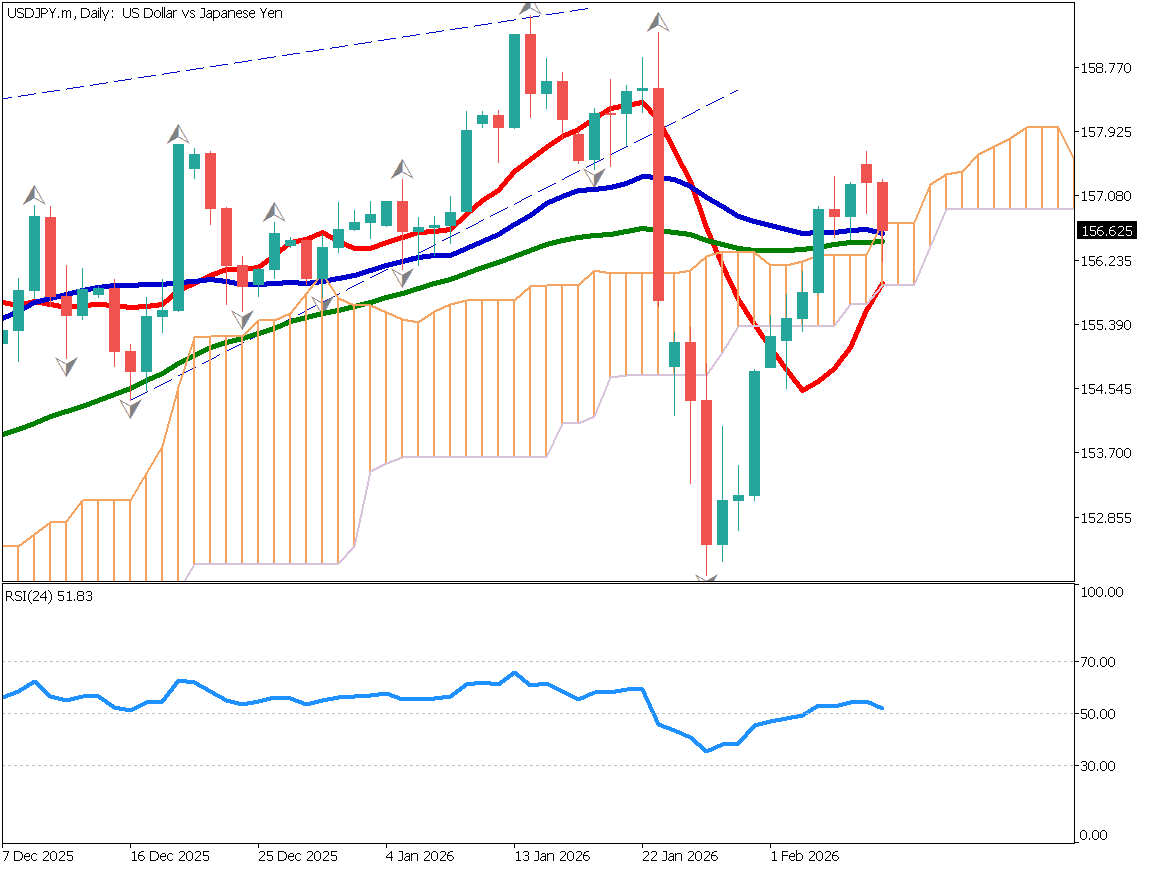

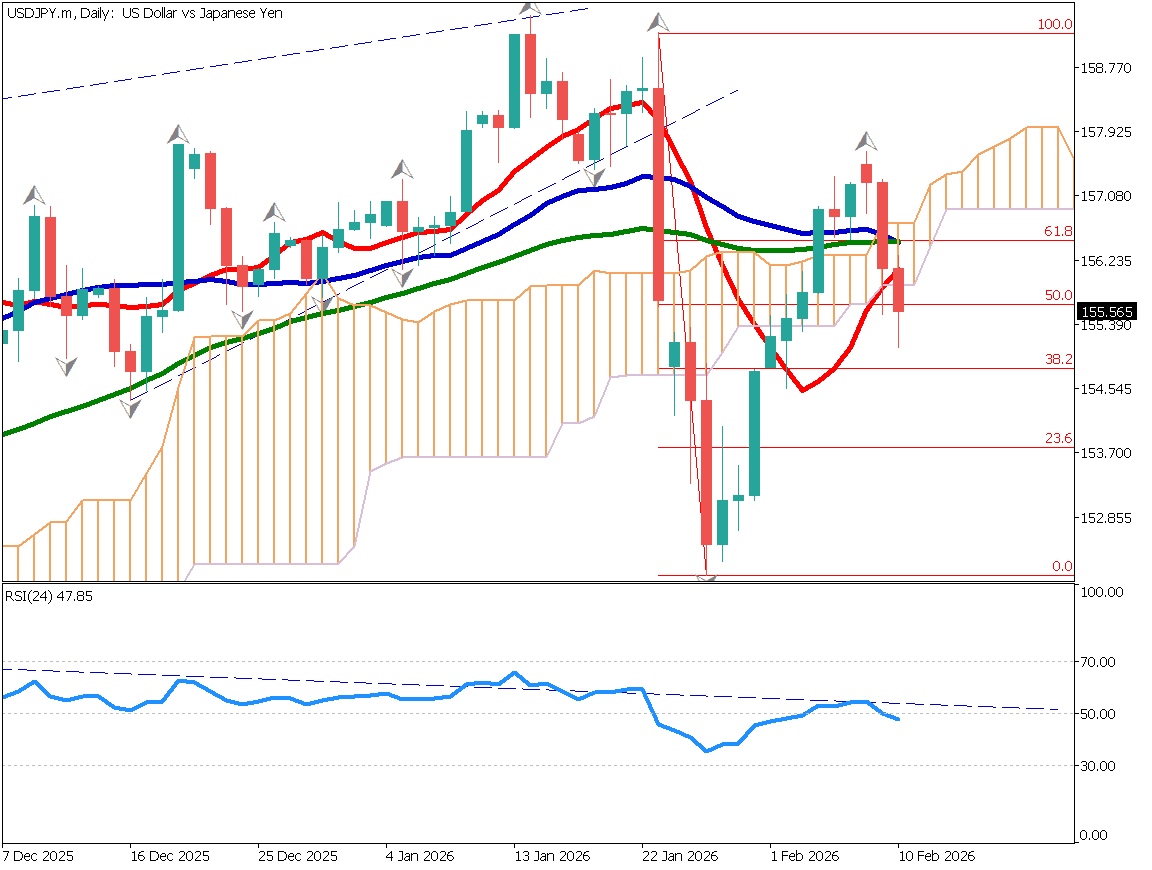

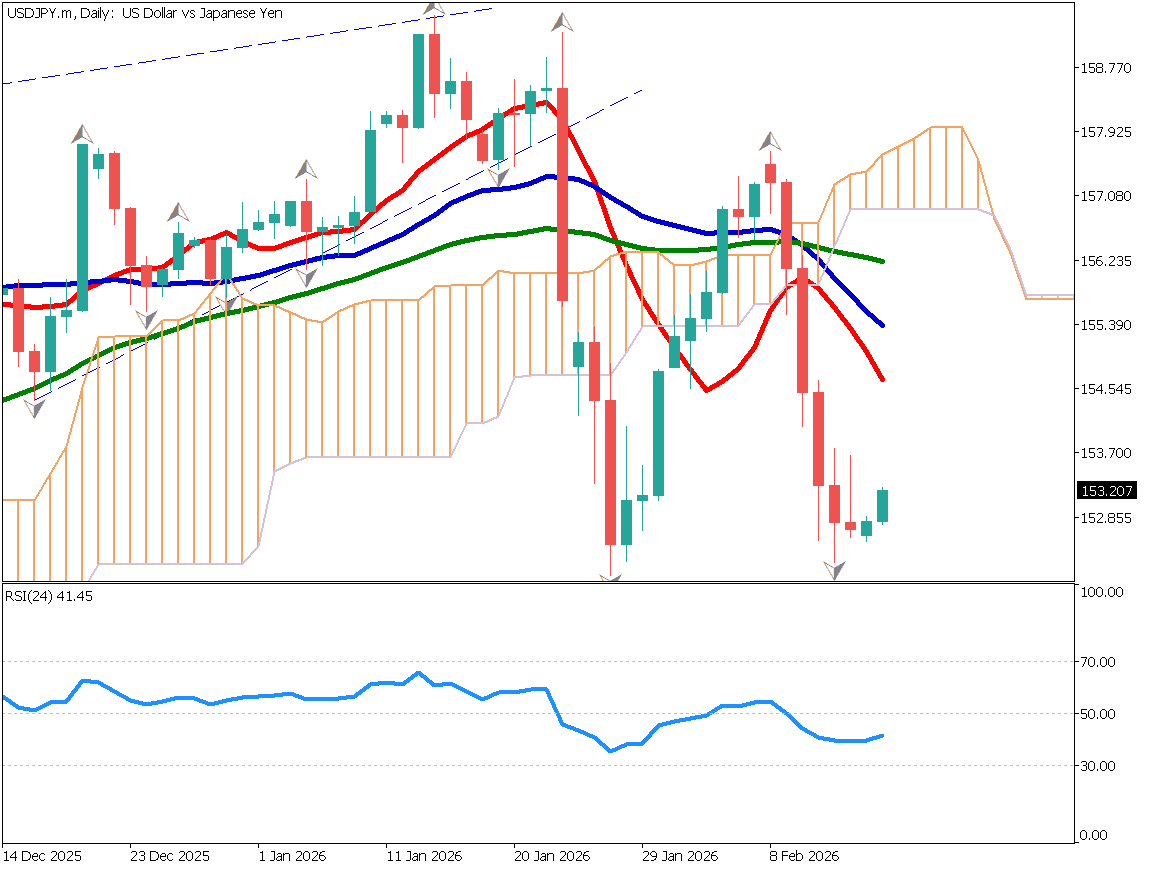

USDJPY rose to the 155 JPY level but fell to the 152 JPY level as yen buying intensified. A report that the BOJ is considering a rate hike during the late hours of the New York session spurred further yen buying. U.S. stock indices are plummeting, casting a shadow over the U.S. economy. The market expects the U.S. FOMC to indicate some stance on rate cuts.

With the U.S. Federal Reserve (FRB) leaning towards rate cuts and the BOJ towards rate hikes, USDJPY is in an environment conducive to a decline. This trend is contrary to the movement from April to July. If a rate hike is decided today, there is a possibility of a decline towards the 149.75 JPY level.

Day trading strategy (1 hour)

USDJPY has plunged from the 155 JPY level. The immediate target low is considered to be around 152.20 JPY. The market appears to be preparing for yen buying in anticipation of an additional rate hike. However, whether a rate hike will actually occur is uncertain, and if the market is caught off guard, there could be a sudden surge.

As for the day trading strategy, it is advisable to remain cautious today. With major events such as the BOJ meeting, U.S. ADP employment report, and FOMC, predicting the direction is challenging. A trading strategy will be considered from tomorrow onwards.

Support/Resistance lines

The following support and resistance levels should be considered in the future:

152.20 JPY – Support line on the 1-hour chart

Market Sentiment

USDJPY Sell: 42% Buy: 58%

Featured Currency Pair of the Week (EURAUD)

Euro/Australian Dollar is on the rise. Today, the consumer price indices for both the Eurozone and Australia will be released. Additionally, the FOMC will take place, making this one of the most significant days of the year for major events. It is challenging to predict whether the trend will continue or reverse. For Euro/Australian Dollar, attention should be paid to whether it exceeds the 1.67 USD level.

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Australian Consumer Price Index | 10:30 AM |

| BOJ Monetary Policy Announcement | 12:00 PM |

| BOJ Outlook Report | 1:00 PM |

| BOJ Governor Ueda’s Press Conference | 3:30 PM |

| EU Consumer Price Index | 6:00 PM |

| U.S. ADP Employment Report | 9:15 PM |

| FOMC Statement & Policy Rate Announcement | 3:00 AM (Next day) |

| FRB Chairman Powell’s Press Conference | 3:30 AM (Next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.