USDJPY Temporarily Hits 149 JPY Range, U.S. Economic Data Shows Positive Results【August 16, 2024】

Fundamental Analysis

- U.S. retail sales far exceeded expectations.

- U.S. jobless claims decreased, U.S. stock indices continued their rally with significant gains.

- USDJPY surged as the dollar strengthened.

USDJPY technical analysis

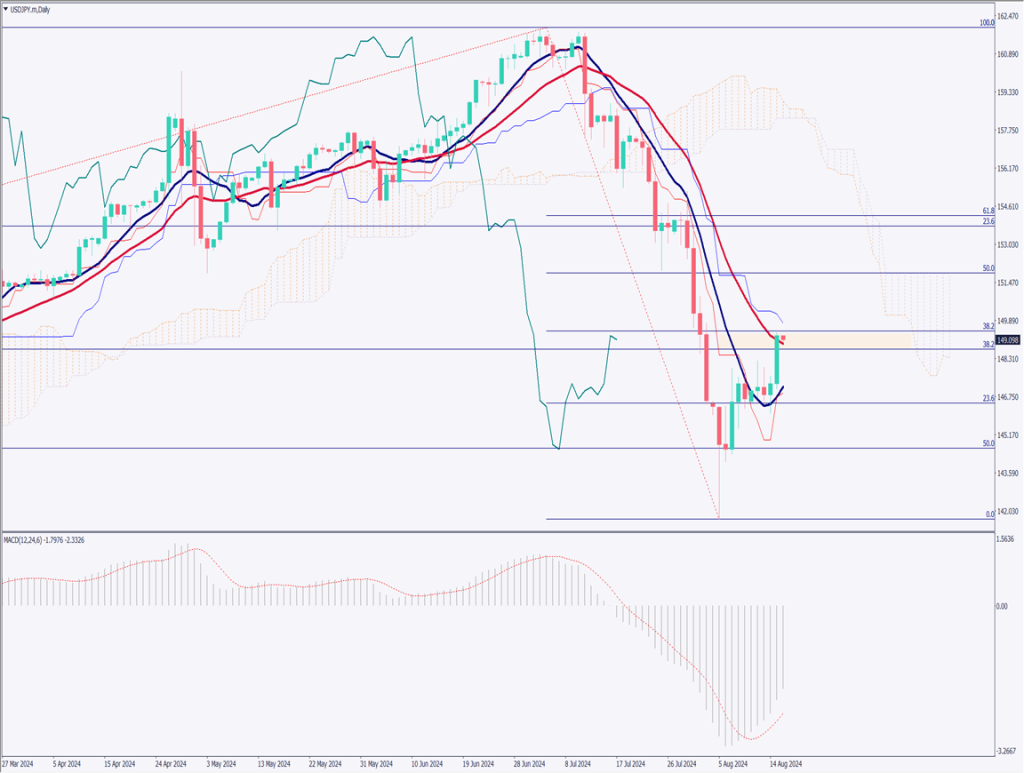

Analyzing the daily chart for USDJPY. USDJPY broke above the 28-day moving average and is approaching the 38.2% Fibonacci retracement level. The 10-day moving average is also providing support, which is noteworthy.

U.S. retail sales exceeded market expectations, and jobless claims decreased, suggesting a resilient U.S. economy. Optimism is spreading across the market, with stock indices seeing significant gains and a strengthening USD in response.

Technically, the base line of the Ichimoku Kinko Hyo indicator is looming above as resistance, with 149.78 JPY likely to act as a resistance level. Additionally, the area around 149.43 JPY corresponds to the Fibonacci retracement, so breaking through this level may take some time.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY, it shows a pattern of an upward trend, consolidation, and then another upward trend, which allows for a target price using N-calculation values. Applying the N-calculation values, 100% corresponds to 151.65 JPY.

Whether USDJPY can break above the 28-day moving average on the daily chart is a key focus. In the short term, a recovery to the 150 JPY range is possible. However, if the price reaches the 151 JPY range, selling pressure may increase.

Today’s day trading strategy is to sell on rebounds. Sell at 150.80 JPY, which has been a key level in the past, and set the take profit at 149.50 JPY. Set a stop loss if it breaks above 151.25 JPY.

Support/Resistance lines

The following are the support and resistance levels to consider moving forward:

- 151.65 JPY … N-calculation value

- 149.78 JPY … Daily Ichimoku base line

Market Sentiment

USDJPY: Sell: 55% / Buy: 45%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| UK Retail Sales | 15:00 |

| U.S. Housing Starts | 21:30 |

| University of Michigan Consumer Sentiment Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.