EURUSD Slightly Rises; ECB Official States Additional Measures Needed for September Rate Cut【August 28, 2024】

Fundamental Analysis

- Market Awaits NVIDIA Earnings; Stock Indices Slightly Rise

- ECB Official Comments that Additional Measures Are Needed for Rate Cuts

- EURUSD Forms a Gradual Uptrend

EURUSD technical analysis

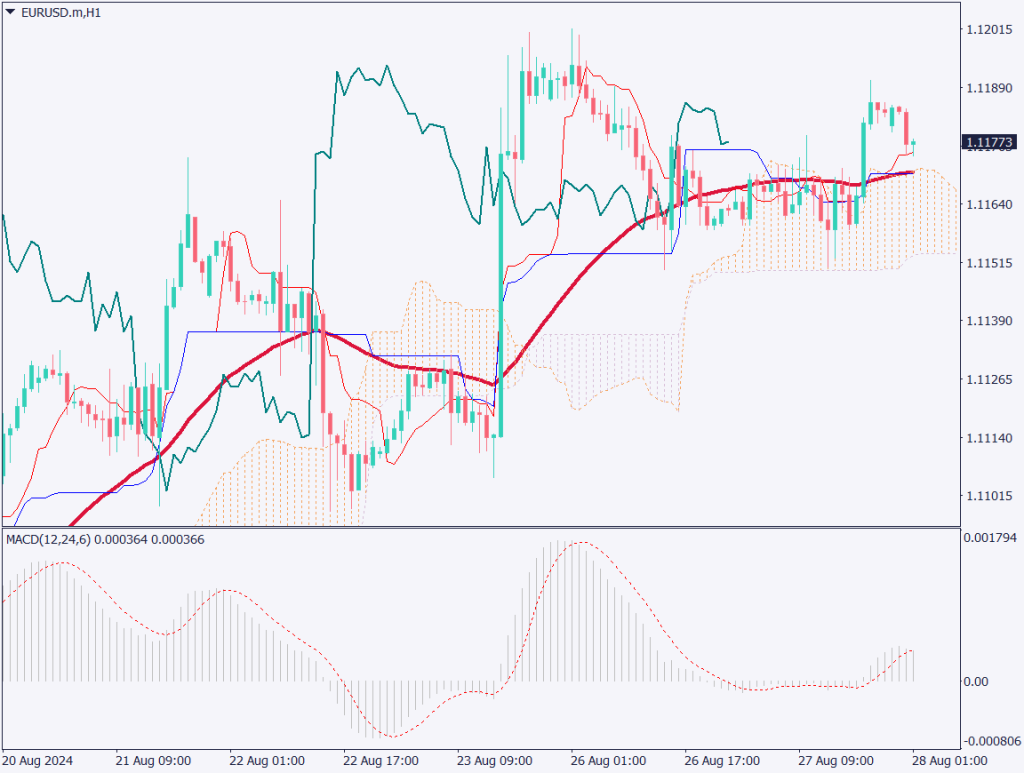

EURUSD is forming a gradual uptrend. Analyzing the Ichimoku Cloud, the price is above the Tenkan-sen, and the Chikou Span has crossed above the candlesticks, positioning above the cloud, indicating an upward bias.

Although there was some Euro buying sentiment following the ECB official’s comments, Germany, a key EU member, is experiencing economic stagnation, with GDP declining compared to the previous quarter. Economic sentiment remains low, and a rate cut by the ECB is gradually being priced in.

Drawing a Fibonacci Expansion on the daily chart, the 161.8% level corresponds to around 1.1230USD. After potentially reaching that price range, there could be profit-taking due to a sense of achievement.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for EURUSD, the highs are failing to break out, and the histogram peaks remain small, indicating a lack of upward momentum. The selling pressure around 1.12USD is quite strong, making it an important resistance zone that has been tested multiple times on the 1-hour chart. The market is likely to remain range-bound between 1.115USD and 1.12USD for a while.

If the price breaks below 1.115USD, it may target around 1.112USD. Conversely, if it breaks above 1.12USD, it could aim for around 1.124USD. It’s advisable to follow the breakout direction of the range.

Support/Resistance lines

The following support and resistance lines should be considered moving forward:

1.1150USD – Lower boundary of the Ichimoku Cloud

Market Sentiment

EURUSD Short: 89% Long: 11%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| AUD Construction Completed | 10:30 |

| NVIDIA Earnings | – |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.