USDJPY in Range, Volatility Expected at Month-End【August 29, 2024】

Fundamental Analysis

- NVIDIA’s earnings did not lead to a stock rally, and the indices declined.

- The market is likely waiting for the September US Employment Report, focusing on employment-related indicators.

- The Deputy Governor of the Bank of Japan commented on adjusting the degree of easing in line with inflation expectations.

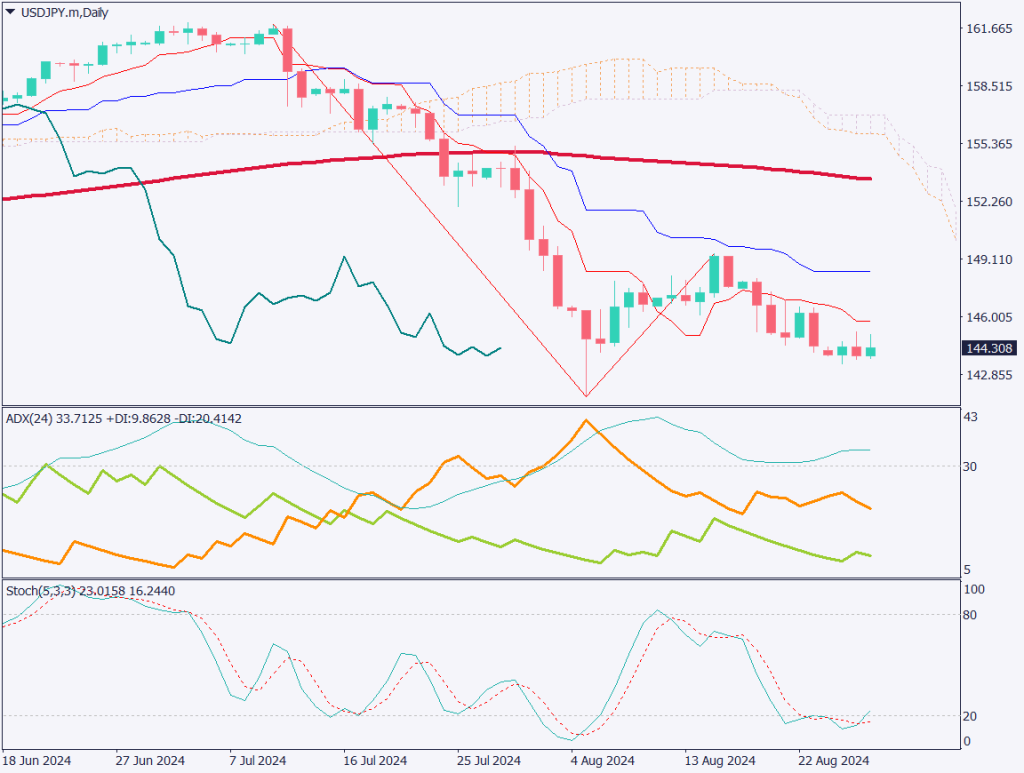

USDJPY technical analysis

Analyzing the daily chart of USDJPY. The pair is in a range, trading within a narrow range of 143 JPY to the upper 144 JPY. Although a downtrend is emerging, strong buying on dips is observed, preventing the pair from breaking below the low of 141.75 JPY.

The 200-day moving average is gradually turning downward. The ADX is at 33, indicating that while the market is in a range, it is within a downward trend. The stochastic is attempting to break out of the oversold level.

The focus is on whether the low will be breached, but until new developments arise, the market may continue to trade within the range.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the pair tends to rebound strongly on dips below 143.50 JPY. A strong monthly support zone exists at 142.75 JPY, creating a market that cannot break either upwards or downwards.

Primarily, it’s a sell on rallies strategy, but until new developments occur, it may be reasonable to expect range-bound trading. Selling opportunities are anticipated if the pair reaches the 145 JPY level.

The day trading strategy is to sell near the upper range limit. Specifically, consider selling at 145.56 JPY and 145.87 JPY. The take profit is set at 143.50 JPY, with a stop loss at 146.65 JPY.

Support/Resistance lines

The following support and resistance levels should be considered:

142.76 JPY – Monthly support line

Market Sentiment

USDJPY Sell: 48% | Buy: 52%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Germany Consumer Price Index | 21:00 |

| US Initial Jobless Claims | 21:30 |

| US Core Personal Consumption Expenditures Price Index | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.