USDJPY Slightly Rises, Supported by Upward Revision of U.S. Economic Indicators【August 30, 2024】

Fundamental Analysis

- U.S. GDP Revised Upward, Personal Consumption Remains Strong

- Focus on Changes in U.S. Fed’s Rate Cut Outlook, U.S. Price-Related Indicators to Be Released Today

USDJPY technical analysis

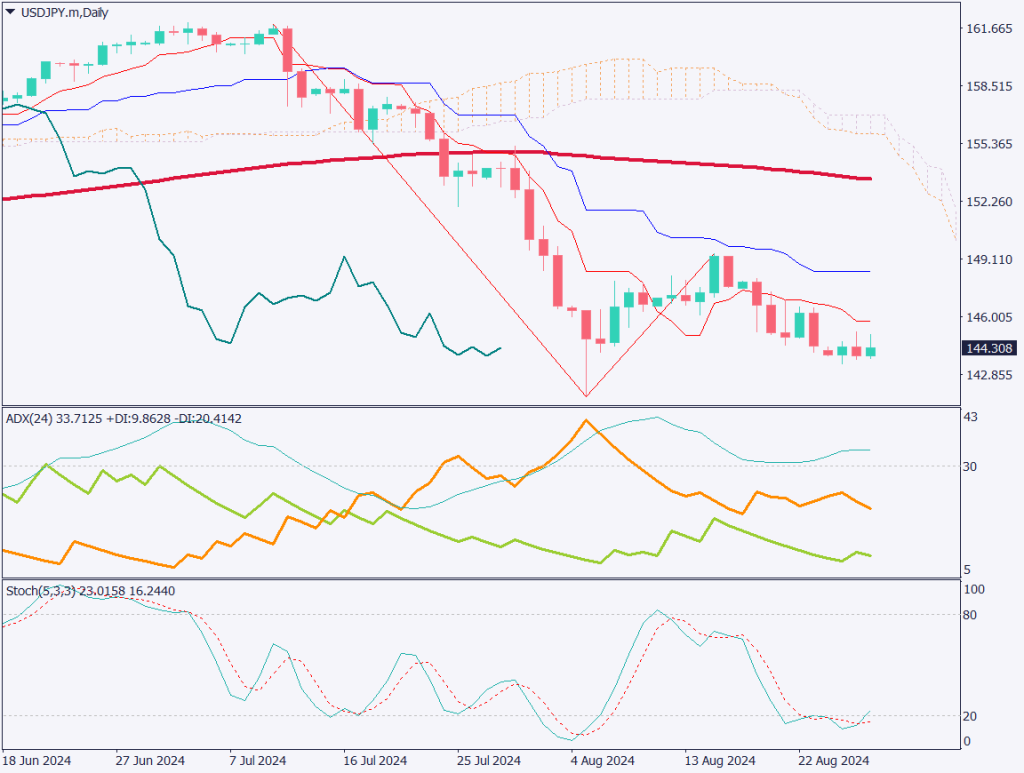

Analyzing the daily chart of USDJPY. The USDJPY is facing resistance at the conversion line. The U.S. GDP was revised upward to 3.0%, and U.S. personal consumption was also revised up to 2.9% from the preliminary figures. Additionally, NVIDIA’s earnings exceeded market expectations. Although NVIDIA’s stock price is currently declining, it is expected that buying will come in on dips.

However, the USDJPY is facing heavy resistance. Despite strong U.S. economic indicators, leading to increased buying of the USD, the USDJPY failed to maintain levels above 145JPY. The inability to surpass the conversion line is noteworthy. The key to confirming an uptrend will be whether USDJPY can break above the conversion line. If USDJPY breaks below 143.45JPY, it is likely that yen buying will strengthen, potentially aiming for the 140JPY level.

The Stochastic indicator has exited oversold territory, indicating a potential temporary rise as USDJPY forms a rebound high.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY. The 200-period moving average is acting as support for USDJPY. Additionally, the baseline of the Ichimoku Cloud is also functioning as a support line. A rising trendline can be drawn, with the 144.75JPY level serving as a key price range.

Today’s day trading strategy is challenging, but considering the strong performance of the U.S. stock market yesterday and the 1-hour chart’s movement, I prefer short-term buying on dips. However, I will remain cautious during the NY session when U.S. economic indicators are released, and will determine the direction after seeing the results.

Support/Resistance lines

The following support and resistance levels should be considered moving forward:

- 145.50JPY – Recent High on the 1-Hour Chart

- 145.17JPY – Conversion Line on the Daily Chart

- 143.45JPY – Recent Low on the Daily Chart

Market Sentiment

USDJPY Sell: 33% Buy: 67%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Japan Industrial Production | 8:50 |

| EU Consumer Price Index | 18:00 |

| U.S. Core PCE Price Index | 21:30 |

| Canada GDP | 21:30 |

| U.S. Michigan Consumer Sentiment Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.