USDJPY Rises to 146 JPY Level, End-of-Month Rebalancing Might Drive the Increase【September 2, 2024】

Fundamental Analysis

- The U.S. stock market closed the month with a bullish candlestick, shifting market focus to U.S. employment conditions.

- The Dollar Index has continued to rise for three consecutive days, though a temporary correction may occur before the employment data is released.

- Gold has been on a winning streak, marking six consecutive months of gains on the monthly chart.

USDJPY technical analysis

Analyzing the daily chart of USDJPY, the pair has broken above the conversion line and is attempting to surpass the base line. Volatility is gradually stabilizing, and expectations for a significant 0.50% rate cut have diminished. Instead, the forecast has shifted to a more moderate 0.25% rate cut, leading to a stronger USD and a weaker JPY. With the U.S. stock market closed today, significant movements are not expected.

The RSI indicates that the pair is hovering around the 46 level, suggesting that the upward trend may take a breather. If the pair continues to rise, the 148 JPY level might be the next target. This week, key indicators such as U.S. employment data, ISM, and ADP reports are scheduled for release. Volatility is expected to increase towards the end of the week, so it may be wise to wait for further developments.

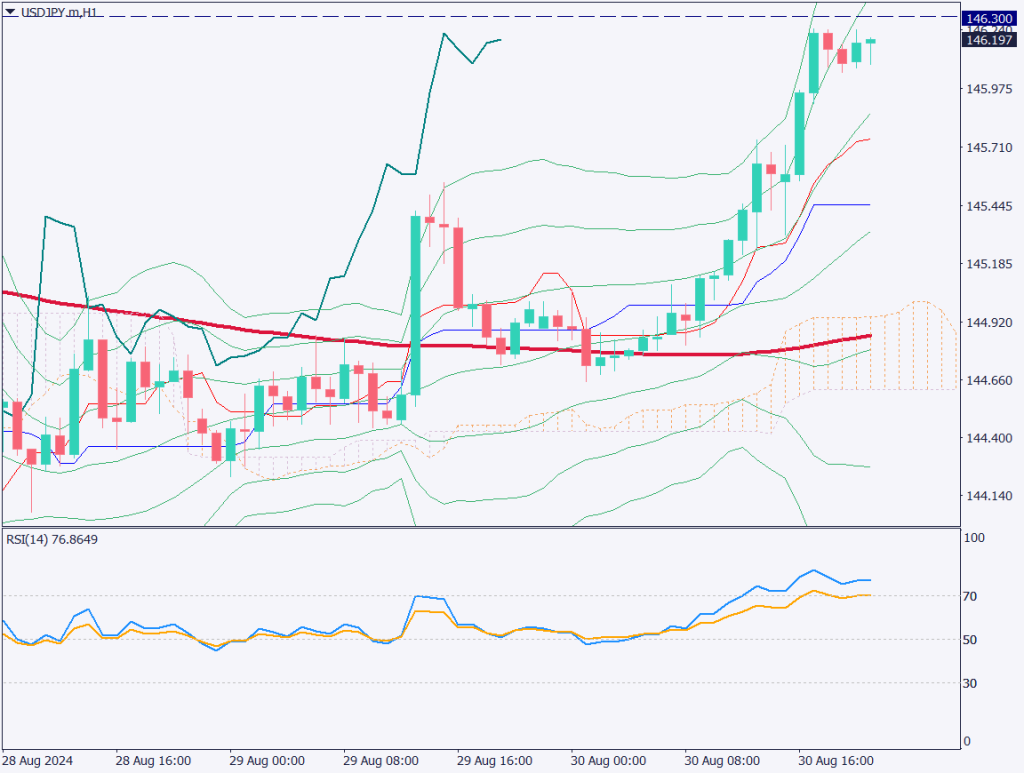

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, resistance is seen around the 146.30 JPY level. The 14-period RSI is at 76, indicating overbought conditions, suggesting a potential pullback. The primary strategy for day trading is to buy on dips. Consider entering a buy position around the 145.750 JPY level, near the base line, and aim for a target of 146.45 JPY. Set a stop at 145.40 JPY.

Support/Resistance lines

The following are the support and resistance levels to consider moving forward:

- 146.30 JPY: Significant historical support/resistance zone.

Market Sentiment

USDJPY Sell: 51% Buy: 49%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| U.S. and Canada Public Holiday | – |

| Germany Retail Sales | 15:00 |

| EU Manufacturing PMI | 17:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.